For the first nine months of the year, F88 achieved a cumulative profit of 603 billion VND, 2.5 times higher than the same period last year.

As of September 30, 2025, F88’s outstanding loan balance reached 6,413 billion VND, a robust 40% increase compared to the beginning of the year. Disbursements in Q3-2025 alone totaled 4,339 billion VND, up 33% from Q3-2024 and surpassing Q2-2025 figures. Q3-2025 marked another record-breaking quarter for F88 in the past three years. Cumulative disbursements for the first nine months of 2025 grew by 35% year-on-year, reaching 11,485 billion VND.

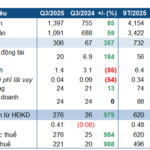

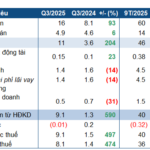

F88’s business expansion continued to yield remarkable results in Q3-2025. Total revenue for the quarter reached nearly 1,075 billion VND, a 49% increase compared to the same period in 2024. Lending activities contributed approximately 925 billion VND (86% of total revenue), while insurance services added 134 billion VND (12.5%), growing by 47% and 52% respectively compared to Q3-2024.

F88 also prioritized risk management and loan quality, maintaining an on-time repayment rate of around 85%. The net write-off rate for the period remained at 2.4% per month of the average outstanding balance. The company effectively controlled operational costs, with a cost-to-income ratio (CIR) of 49% (down from 52.7% in Q3-2024).

Through its efforts in business expansion, risk management, and cost optimization, F88 generated 282 billion VND in pre-tax profit for Q3-2025, doubling the figure from the same period last year. For the first nine months, pre-tax profit reached 603 billion VND, double the previous year’s result and equivalent to 90% of the annual target (673 billion VND).

The significant growth in Q3-2025 was driven by an expanded customer base and heightened business activity during the peak season. F88 welcomed nearly 70,700 new borrowers and issued over 246,700 new contracts, representing 16% and 82% year-on-year increases, respectively. The repeat customer rate surged from 58% in Q1-2025 to 68% in Q3-2025, reflecting the success of tailored product initiatives.

In Q3-2025, F88 launched its Revolving Credit Line product, offering pre-approved credit limits for customers to withdraw funds as needed, with interest and fees applied only to the amount used. This product caters to customers requiring frequent, small emergency loans for everyday needs.

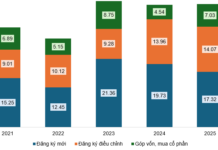

F88’s business expansion strategy focuses on three key pillars: physical transaction offices, partnerships, and digital channels (via the My F88 app). By Q3-2025, the company operated 896 transaction offices nationwide, exceeding the 2025 target of 888 offices.

F88 has partnered with CIMB Bank Vietnam, Military Commercial Joint Stock Bank (MB), The Gioi Di Dong (MWG), and recently, ZaloPay. The My F88 app has successfully transitioned a significant number of contracts from offline to online, enhancing service flexibility and customer experience.

Phùng Anh Tuấn, Chairman and CEO of F88, commented: “We’ve invested heavily in technology to build a robust foundation for future business expansion. The launch of our Revolving Credit Line product underscores our commitment to enhancing financial accessibility for underbanked populations and promoting inclusive finance.”

“We anticipate Q4-2025 profits to mirror Q3-2025 performance, driven by seasonal demand and strong consumer spending in the latter half of the year, positioning F88 to significantly exceed the targets set at the 2025 Annual General Meeting,” added Mr. Tuấn.

Today, FinnRatings upgraded F88’s credit rating to “BBB” with a “Stable” outlook, up from the previous “BBB-” rating with a “Positive” outlook.

FinnRatings attributed the upgrade to F88’s improved capital and liquidity position, noting, “F88’s capital and liquidity have strengthened since the last rating, thanks to diversified funding sources, plans to issue public bonds in 2026, and reduced average funding costs.”

The rating also reflects F88’s leadership in alternative lending, robust profitability, and high asset quality.

F88 Surges Ahead in Q3, Achieving 90% of 2025 Annual Profit Target

F88 Investment Corporation (F88) has unveiled remarkable Q3/2025 financial results, reporting pre-tax profits of VND 282 billion, doubling the figure from the same period last year. In the first nine months of 2025, F88’s cumulative profit reached VND 603 billion, a 2.5-fold increase year-on-year.

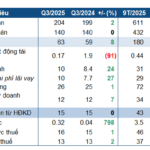

Q3 Profits Flatline: Agimexpharm Achieves Nearly 68% of Annual Target

Agimexpharm Pharmaceutical JSC (UPCoM: AGP) has released its Q3/2025 financial report, showcasing a modest growth compared to the same period last year.