Following a robust week of gains fueled by upgrade news and positive momentum in large-cap stocks, the stock market kicked off with two sessions of upward movement, reaching a short-term peak around 1,800 points. However, the benchmark index soon faced intense selling pressure. The VN-Index closed the week down by over 16 points (-0.94%), settling at 1,731.19 points, retesting the 1,700-point support level.

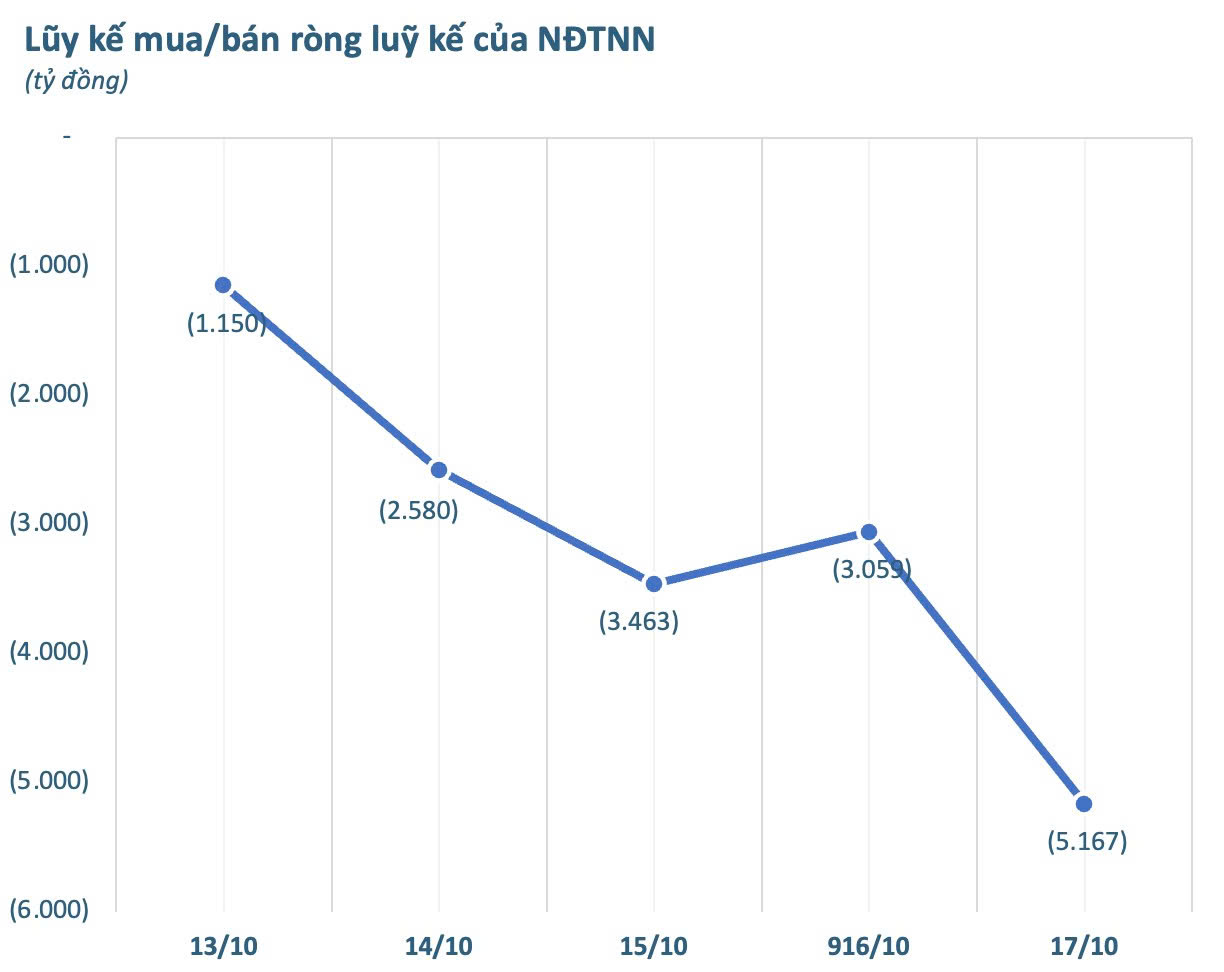

In terms of foreign trading activity, foreign investors maintained a net selling position, with values reaching trillions of dong per session. The exception was Thursday, October 16th, when foreign investors unexpectedly turned net buyers on the HoSE. Over the five sessions, foreign investors recorded a net sell of 5,167 billion dong across the market.

Breaking it down by exchange, foreign investors were net sellers of 4,906 billion dong on HoSE, 334 billion dong on HNX, and net buyers of 74 billion dong on UPCoM.

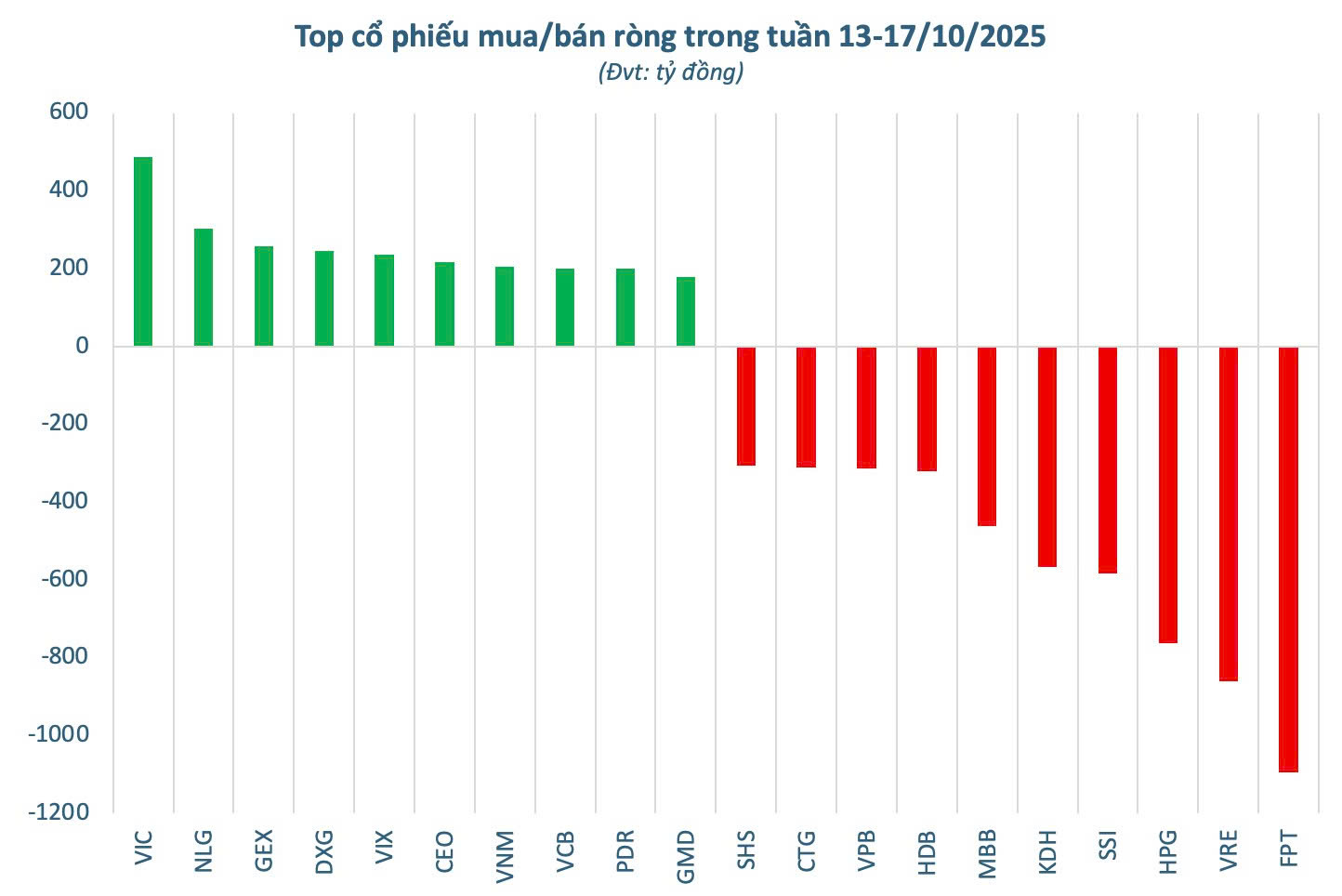

Analyzing individual stocks, FPT emerged as the most heavily sold stock of the week, with a net sell value of 1,095 billion dong, significantly outpacing other stocks. VRE followed with a net sell of 859.6 billion dong, trailed by HPG (761.9 billion dong) and SSI (582.3 billion dong). Other large-cap stocks also faced capital outflows, including KDH (565.7 billion dong), MBB (461.7 billion dong), HDB (319.8 billion dong), and VPB (313.4 billion dong). CTG, SHS, KBC, and VCI recorded net sells ranging from 280 to over 310 billion dong each.

On the buying side, VIC led with a net buy of 486.9 billion dong. NLG followed with 303.7 billion dong, GEX with 257.9 billion dong, and DXG with 246.4 billion dong. VIX (235.5 billion dong), CEO (218.1 billion dong), VNM (204.8 billion dong), and VCB (201.1 billion dong) also attracted significant foreign interest. Additionally, PDR, GMD, DIG, and VJC recorded net buys ranging from 150 to over 200 billion dong.

Vietstock Weekly (Oct 20-24, 2025): Consolidating at the Peak

The VN-Index reversed its upward trend, closing lower as a Long Upper Shadow candlestick pattern emerged, accompanied by trading volume surpassing the 20-week average. This suggests intense profit-taking pressure as the index approached new historical highs. While the MACD has maintained a buy signal since May 2025, the weakening momentum of the Stochastic Oscillator in overbought territory indicates potential short-term volatility ahead.

DIC Corp Yet to Disburse Full Proceeds from 2021 Share Offering

As of October 7, 2025, DIC Corp has disbursed approximately VND 1,422.8 billion out of the total VND 1,499.9 billion raised from its 2021 share offering, leaving nearly VND 77.1 billion yet to be allocated.