Last week, the VN-Index dropped by 14.37 points to close at 1,733.18. The total trading value across the market reached 217.302 trillion VND, a 36% increase compared to the previous week. The HNX-Index ended the week at 276.11, up by 2.49 points. Liquidity on the HNX also surged, with a total trading value of 14.64 trillion VND.

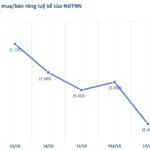

On the HoSE, foreign investors net sold 163 million units, with a net value of over 4.869 trillion VND. On the HNX, foreign investors net sold over 10 million units, with a net value of more than 340 billion VND.

On the Upcom market, foreign investors net bought for five consecutive sessions, acquiring nearly 0.2 million units with a net value of over 73 billion VND. Overall, during the trading week from October 13 to 17, foreign investors net sold 172.9 million units, with a net value of 5.136 trillion VND.

Capital Withdrawal

Mr. Nguyễn Văn Thành, the brother-in-law of Mr. Trần Ngọc Dân – Chairman of the Board of City Auto Joint Stock Company (stock code: CTF) – sold 217,145 shares out of the registered 300,000 shares, reducing his ownership to 2.45% of the charter capital.

The brother-in-law of the Chairman of City Auto Joint Stock Company sold 217,145 CTF shares.

Previously, from August 28 to September 26, Tan Thanh Do Group Joint Stock Company – an organization related to Mr. Trần Ngọc Dân – did not purchase any shares out of the registered 3 million shares, maintaining its ownership at 15.21% of the charter capital. The reason for not purchasing the registered shares was due to a change in plans.

Similarly, from September 5 to October 3, Mr. Trần Lâm – a member of the Board of Directors and Mr. Dân’s son – also did not purchase the registered 2.4 million shares, retaining his ownership at 8.4% of the charter capital.

Ms. Huỳnh Hoàng Hoài Hân, Acting Chief Accountant of Chuong Duong Joint Stock Company (stock code: CDC), sold 218,000 CDC shares, reducing her ownership to 0% of the charter capital.

Earlier, from July 21 to July 23, Construction Corporation No. 1 (stock code: CC1) sold 10,453,374 CDC shares, reducing its ownership to 0% of the charter capital in CDC. Conversely, Ms. Nguyễn Thị Trang purchased 2.5 million CDC shares, increasing her ownership to 5.68% of the charter capital.

National Securities Joint Stock Company registered to purchase 10 million SAM shares of SAM Holdings Joint Stock Company, increasing its ownership to 4.31% of the charter capital. The transaction is expected to take place from October 21 to November 19. It is estimated that National Securities will spend approximately 70 billion VND to acquire an additional 10 million SAM shares.

Notably, Mr. Trần Việt Anh, Chairman of the Board of SAM Holdings, is a major shareholder owning over 10% of the capital in National Securities. Additionally, Mr. Bùi Quang Bách, a member of the Board of Directors of National Securities, serves as an independent member of the Board of Directors at SAM Holdings.

NTC Shares Move to HoSE

The Ho Chi Minh City Stock Exchange (HoSE) announced the listing of Nam Tan Uyen Industrial Park Joint Stock Company’s shares (stock code: NTC) on October 28. The initial trading price of NTC shares on HoSE is 161,470 VND per share, with a 20% fluctuation range.

With nearly 24 million listed shares, NTC’s estimated market capitalization on its debut day is approximately 3,875 billion VND. Previously, NTC shares had their final trading session on Upcom on October 15, closing at 165,000 VND per share.

The initial trading price of NTC shares on HoSE is 161,470 VND per share.

Construction and Investment Joint Stock Company 40 (stock code: L40) approved a plan to issue shares for dividend payment in 2025. Specifically, L40 will issue 10.8 million shares for dividend payment at a 100% ratio, meaning shareholders holding 1 share will receive 1 new share. The total issuance value at par is 108 billion VND.

After the issuance, L40’s charter capital will increase from 108 billion VND to 216 billion VND. In addition to the share dividend, L40 also approved a plan for an interim cash dividend payment in 2025 at a 5% rate.

On October 29, Lizen Joint Stock Company (stock code: LCG) will finalize the shareholder list for the issuance of over 13.5 million shares for dividend payment in 2024, at a 7% ratio. The total issuance value at par is over 135 billion VND.

After completing the dividend payment, LCG will issue 100 million private placement shares, offered to a maximum of 50 professional securities investors at a price of 10,000 VND per share.

All private placement shares will be restricted from transfer for 1 year. If successful, the charter capital will increase to nearly 2,951 billion VND. The total amount LCG expects to raise is 1,000 billion VND. Of this, Lizen plans to allocate 700 billion VND to repay debts and 300 billion VND to invest in machinery and equipment for construction purposes.

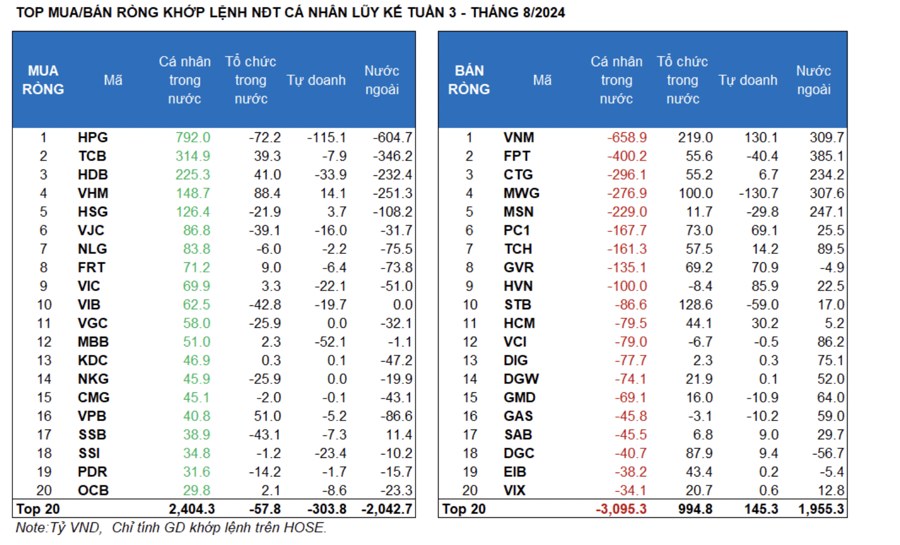

Unveiling the Catalyst Behind Foreign Investors’ Massive Sell-Off of Trillions of Dong in Vietnam’s Stock Market

Unlocking foreign investment in Vietnam requires a robust framework: stabilizing exchange rates, dismantling capital and tax barriers, and fostering an enabling environment for open-ended funds to thrive.

Foreign Blockades Unleash Massive Sell-Off: VN-Index Correction Sparks 5.2 Trillion VND Sell-Off – Which Stocks Are in the Crosshairs?

Foreign investors continued their net selling pressure, offloading thousands of billions worth of assets in each session. The sole exception was Thursday, October 16th, when foreign investors unexpectedly turned net buyers.

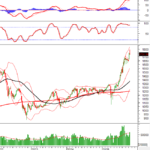

Vietstock Weekly (Oct 20-24, 2025): Consolidating at the Peak

The VN-Index reversed its upward trend, closing lower as a Long Upper Shadow candlestick pattern emerged, accompanied by trading volume surpassing the 20-week average. This suggests intense profit-taking pressure as the index approached new historical highs. While the MACD has maintained a buy signal since May 2025, the weakening momentum of the Stochastic Oscillator in overbought territory indicates potential short-term volatility ahead.