|

According to the Consolidated Financial Report for Q3/2025, KienlongBank’s pre-tax profit reached VND 1.537 trillion in the first nine months, doubling the same period last year and achieving 112% of the annual plan. This marks the highest profit in the bank’s 30-year history, surpassing the previous record of VND 1.112 trillion set last year. This remarkable growth underscores the bank’s robust expansion and operational efficiency. With this momentum, KienlongBank is projected to complete 150% of its 2025 profit target.

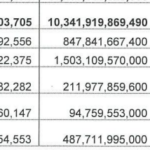

Over the nine months, the bank’s total assets increased by VND 5.540 trillion to VND 97.716 trillion; mobilized capital rose by VND 7.377 trillion to VND 87.491 trillion; and credit outstanding expanded by VND 9.490 trillion to VND 70.922 trillion. These figures not only highlight the leadership’s agile and effective management but also demonstrate KienlongBank’s sustainable growth amidst a volatile financial market.

Alongside scaling operations and boosting profits, KienlongBank continues to restructure its revenue streams toward sustainability, leveraging services as a new growth driver. Service revenue in Q3 reached VND 165 billion, bringing the nine-month total to VND 515 billion, a 29% year-on-year increase. The service revenue-to-net interest income ratio stands at 19%.

Non-interest income also accelerated in foreign exchange, securities trading, and other activities, contributing over VND 85 billion in Q3 and VND 379 billion year-to-date, nearly triple the same period last year. This growth in non-credit revenue not only reflects the bank’s ability to seize market opportunities and optimize its investment portfolio but also reduces reliance on net interest margins. This strengthens KienlongBank’s resilience to interest rate cycles, positioning it as a balanced, sustainable, and multi-functional financial institution.

Despite robust growth, KienlongBank maintains a cautious risk management approach. The non-performing loan (NPL) ratio in Q3 remained below 2%, in strict compliance with the State Bank of Vietnam’s regulations. The NPL coverage ratio averaged over 80% in the last three quarters, showcasing proactive provisioning and adaptability to market fluctuations. Notably, KienlongBank is among the first banks to adopt Circular 14 on capital adequacy ratios, turning compliance into a competitive advantage in its sustainable development strategy.

The integration of advanced machine learning models via Kiloba AI has significantly enhanced KienlongBank’s operational efficiency. By accurately assessing customer needs and capabilities, Kiloba AI enables tailored product and service design. It also automates numerous business processes, reduces time-to-market, and ensures stringent credit quality control.

The report also highlights the bank’s streamlined workforce, with average labor productivity significantly increasing year-on-year. This is a direct outcome of comprehensive digital transformation, where technology serves as both a business enabler and a catalyst for optimizing resources, enhancing productivity, and improving customer service quality.

Building on its strong financial performance and sustainable foundation, KienlongBank is implementing strategic initiatives to bolster capital capacity, support credit growth from 2026 to 2030, and maximize shareholder value. Following approval at the 2025 Extraordinary General Meeting, the bank issued a 60% stock dividend, increasing its charter capital to VND 5.822 trillion. This move propelled KienlongBank’s market capitalization past VND 11,000 billion, driven by the KLB share price reaching VND 19,700, its highest quarterly level. This milestone reflects growing market confidence in the bank’s capital base, governance, and growth narrative.

The increased charter capital, safe risk management, and sustainable revenue restructuring have strengthened expectations of stable profitability and expanded credit capacity. The planned HoSE listing in Q4/2025 is anticipated to further elevate KienlongBank’s market capitalization.

As KienlongBank marks its 30th anniversary (1995–2025), it embarks on a new journey where technology and human touch converge. Each product and service is designed to resonate emotionally and deliver lasting value. KienlongBank is poised to “transcend digitalization, create differentiation, and build trust through emotional connections.”

Services

– 08:30 20/10/2025

Government Sets Ambitious 10%+ GDP Growth Target for 2026

On the morning of October 15th, the 50th Session of the National Assembly Standing Committee continued with discussions on the Government’s reports. These reports detailed the outcomes of the 2025 socio-economic development plan, the proposed 2026 socio-economic development plan, and the implementation results of the National Assembly’s resolutions on the 2021-2025 five-year plan for socio-economic development and economic restructuring. Vice Chairman of the National Assembly Vũ Hồng Thanh chaired the discussion session.

Secretary-General: Rejecting ‘Term-Based Thinking’ and ‘Clinging to Local Interests’

Emphasizing the rejection of ‘term-limited thinking,’ ‘clinging to parochial interests,’ and the lack of courage to think, act, or innovate, General Secretary Tô Lâm stated: “Those who fall into these conditions without rectifying them must be promptly replaced.”