Source: VietstockFinance

|

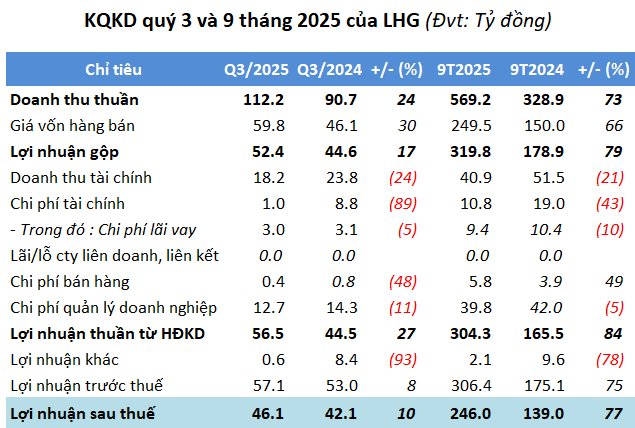

After nine months, LHG’s net revenue surpassed VND 569 billion, with post-tax profit reaching VND 246 billion—a 73% and 77% increase, respectively, compared to the same period last year.

| LHG’s 9-Month Financial Results from 2016–2025 |

In 2025, LHG set a target of over VND 657 billion in total revenue, a 24% increase; however, post-tax profit was conservatively projected at just over VND 145 billion, a 23% decrease compared to 2024. With this plan, Long Hậu has achieved 93% of its revenue target and exceeded its profit goal by 70%.

Long Hậu is the developer of the Long Hậu Industrial Park (IP) in Cần Giuộc Commune, Tây Ninh Province, spanning 500 hectares. The project is divided into multiple phases, including Long Hậu IP (137 hectares), Long Hậu IP Expansion (108.5 hectares), Long Hậu Residential and Resettlement Area (66 hectares), and the current Long Hậu IP 3 – Phase 1 (124 hectares).

Additionally, the company operates a high-tech factory complex in Đà Nẵng’s High-Tech Park, covering nearly 30 hectares.

Currently, LHC is processing legal procedures for the approval of investment policies and investor status for the Long Hậu IP Phase 2 Expansion (90 hectares) and Long Hậu – Tân Tập IP (150 hectares), both in Tây Ninh Province. Applications are expected to be submitted in Q4/2025 and Q1/2026, respectively.

The company is also constructing a 9-story, 30,000 m² multi-purpose factory for lease, the next phase of the Long Hậu multi-purpose factory complex. Completion and operation are scheduled for later this year.

As of Q1, LHG’s total assets stood at nearly VND 3,159 billion, a slight 1% decrease from the beginning of the year. Of this, over 31% (approximately VND 990 billion) is held in bank deposits, down 6%. Inventory reached nearly VND 803 billion, up 2%, primarily comprising construction costs for the Long Hậu IP (VND 658 billion) and residential areas (VND 144 billion).

Total liabilities decreased by 6% to over VND 1,368 billion, with financial debt rising 21% to VND 185 billion, accounting for 14% of total liabilities.

– 08:45 20/10/2025

Phước Đông New City: Secure Your Investment with Individual Pink Books Starting at 1.9 Billion VND!

In the midst of a recovering real estate market, where buyers are increasingly cautious and prioritize legal clarity, Phước Đông New City emerges as a standout choice. It boasts transparent legal frameworks, individual land titles for each unit, and same-day notarization for customers, making it a top contender in the market.