Vietnamese stocks concluded the week on a subdued note, with selling pressure intensifying towards the close of Friday’s session. The VN-Index dropped nearly 36 points to settle at 1,731 points.

Amid this backdrop, shares of KSV, issued by Vietnam National Coal and Mineral Industries Group (Vimico), surged to their upper limit. The stock closed the October 17 session at 172,700 VND per share, marking a three-month high. Consequently, its market capitalization rose to 34.5 trillion VND (~1.3 billion USD).

Trading activity in KSV shares also picked up, with matched volume reaching nearly 200,000 units—a significant increase compared to recent sessions.

Vimico, a subsidiary of the Vietnam National Coal and Mineral Industries Corporation (Vinacomin), is a domestic leader in the extraction, processing, and refining of non-ferrous and precious metals such as copper, zinc, lead, gold, and silver.

Compared to industry peers, Vimico distinguishes itself through its advanced processing capabilities (e.g., copper, zinc, tin metals) at a large scale, while most competitors focus on concentrate production or lack significant deep-processing capacity.

In related developments, China’s recent announcement of tighter rare earth export controls—the second such move this year—has fueled investor interest in mineral stocks, including KSV.

The Chinese Ministry of Commerce stated that the measures, effective October 9, aim to refine export control systems.

Beijing cited national security concerns amid global instability and frequent conflicts as justification for the restrictions.

The updated regulations expand controls to include not only raw rare earth materials but also associated intellectual property and technologies.

Foreign companies must obtain permits if their products contain over 0.1% rare earths sourced from China or utilize Chinese extraction, refining, magnet manufacturing, or recycling technologies. Orders with potential military applications will be denied.

For 2025, Vimico has set conservative targets of 12,619 billion VND in revenue and 1,000 billion VND in pre-tax profit. This follows a record-breaking 2024, where consolidated revenue reached 13,277 billion VND and pre-tax profit hit 1,566 billion VND. In the first half of 2025, the company achieved 55% of its revenue target and 99% of its profit goal.

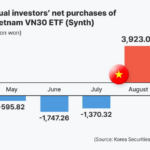

Korean Investors Flock to Vietnamese Stock Market

Amidst the sluggish growth of South Korea’s domestic stock market, retail investors are increasingly channeling capital into Vietnam’s equity market, drawn by the country’s promising economic indicators and robust growth prospects. This influx of Korean retail investment underscores Vietnam’s emerging appeal as a lucrative destination for international capital.

What’s Next for the VN-Index After Reaching All-Time Highs?

“With a harmonious blend of robust profit growth and a still-reasonable price-to-earnings ratio, the VN-Index has the potential to soar beyond the 1,700-1,800 level,” asserted the expert.