On November 6th, An Truong An Joint Stock Company (UPCoM: ATG) will convene an extraordinary shareholders’ meeting for the year 2025. The agenda includes capital increase through private placement, company name change, business expansion, strategic plans until 2030, investment in a Blockchain and AI technology company, and other key matters.

Rebranding for a New Era

Specifically, An Truong An proposes renaming itself to ATG Planet JSC. This rebranding reflects the company’s new strategic focus on blockchain technology, artificial intelligence (AI), digital assets, and advanced construction materials, aiming to enhance brand recognition and attract strategic investors.

Additionally, the company seeks to diversify its business portfolio by adding digital technology and construction materials to its operations. This move aligns with its strategy to capitalize on market opportunities, support the Cam Son Industrial Park project, and ensure compliance with business registration regulations.

According to the meeting documents, ATG plans to issue 10 million shares privately at VND 20,000 per share, raising VND 200 billion. The offering targets professional investors, including both domestic and international entities such as IDG, Korean partners, and APG Securities. Upon completion, ATG’s chartered capital will increase to VND 252.2 billion.

The proceeds of VND 200 billion, combined with an additional VND 100 billion in loans, will fund the establishment of ATG Planet Stone LLC in Thanh Hoa, specializing in high-end construction materials. This initiative aims to strengthen financial capacity, expand production, and lay the groundwork for future growth.

The new plant is scheduled to break ground in Q4/2025 and commence operations in Q2/2026, targeting annual revenue of VND 171 billion and profits ranging from VND 127 to 132 billion, with a payback period of 14-18 months.

Ambitious Goals: VND 1,000 Billion Revenue by 2030

As per the Q2/2025 financial report, ATG recorded a pre-tax profit of VND 345 million for the first six months. However, accumulated losses exceed VND 157 billion as of June 30, 2025, reducing equity to just over VND 400 million—a fallout from the VND 122 billion loss in 2022. The company currently employs only two staff members, unchanged from the previous year.

By 2026, ATG aims to eliminate negative equity and establish ABI Planet in Da Nang’s technology hub, focusing on Blockchain and AI. The company plans to partner with foreign investors experienced in blockchain and digital assets (BTC, ETH, etc.) as strategic shareholders and continue capital raising to invest in digital asset portfolios once legal frameworks permit.

ATG also targets listing its shares for daily trading by January 2026.

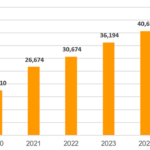

Looking ahead to 2030, ATG aims to invest heavily in Blockchain and AI research, development, and applications across manufacturing, finance, and governance, with a goal of achieving VND 1,000 billion in annual revenue and VND 150 billion in profit.

Currently, ATG shares (ticker: ATG) are under trading restrictions due to negative equity, closing at VND 8,300 per share on October 17th.

SBSI Extraordinary Shareholders’ Meeting: Capital Increase Plan Approved

Stanley Brothers Securities Corporation (SBSI) successfully held its Extraordinary General Meeting of Shareholders (EGM) on the morning of October 14th. The assembly unanimously approved critical resolutions, including the election of additional members to the Board of Directors and the Supervisory Board for the 2024–2029 term, the plan to increase the charter capital, and several other key matters.

SBSI Extraordinary Shareholders’ Meeting: Capital Increase Plan Approved

Stanley Brothers Securities Corporation (SBSI) successfully held its Extraordinary General Meeting of Shareholders (EGM) on the morning of October 14th. The assembly unanimously approved critical resolutions, including the election of additional members to the Board of Directors and the Supervisory Board for the 2024–2029 term, the plan to increase the charter capital, and several other key matters.

SHB Boosts Capital to Strengthen Financial Resilience and Drive Growth in the New Era

SHB is set to seek shareholder approval via written consent for its 2025 charter capital increase plan. This strategic move aims to solidify its position as Vietnam’s leading private commercial bank, enhance its capacity to meet growing credit demands, and facilitate business expansion. By investing in digital transformation, SHB seeks to elevate customer experiences and strengthen its competitive edge in the next phase of growth.

Vietnamese Billionaire Pham Nhat Vuong’s Wealth Surges by $1 Billion to $18.1 Billion, Ranking Among Top 3 Global Gainers on October 10th

According to Forbes’ latest update on October 10th, billionaire Pham Nhat Vuong’s net worth has surged to $18.1 billion, marking a $1.1 billion increase from the previous day. This impressive growth places him at the 131st position among the world’s wealthiest individuals.