|

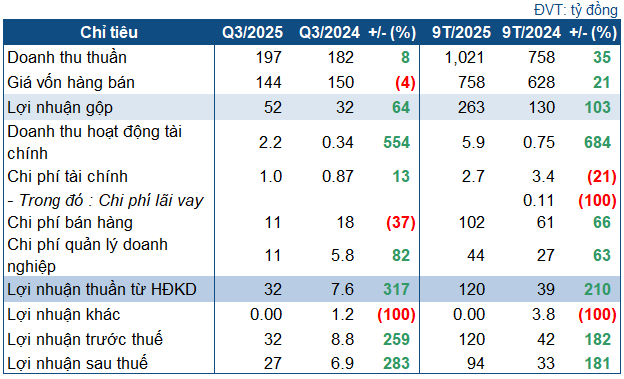

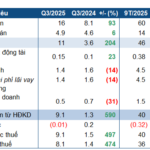

NFC’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, NFC achieved a net revenue of VND 197 billion, an increase of nearly 8% year-on-year. According to the company’s explanation, the revenue growth was driven by a 3.5% rise in sales volume and a 25% increase in powdered phosphate prices; NPK prices also rose by over 14%.

Meanwhile, the cost of goods sold decreased by more than 4%, to VND 144 billion. As a result, NFC‘s gross profit surged by 64% year-on-year, reaching over VND 52 billion.

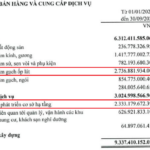

Financial income saw a significant increase, reaching over VND 2.2 billion, 6.5 times higher than the same period last year, thanks to a sharp rise in bank deposit interest. The company reported that deposits (with terms of 1-6 months and interest rates of 4.1%-5% per annum) in the first nine months increased by VND 159 billion (equivalent to 498%) compared to the same period last year. Financial expenses only slightly increased to VND 978 million.

Selling expenses were significantly reduced by 38%, to over VND 11 billion. However, administrative expenses rose by 84%, to VND 11 billion. After deducting expenses and taxes, NFC recorded an after-tax profit of nearly VND 27 billion, 3.8 times higher than the same period last year.

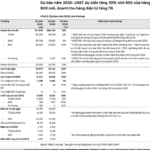

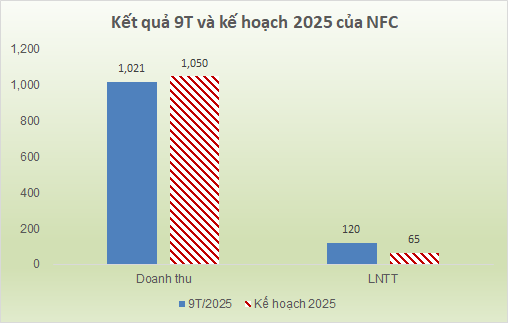

For the first nine months, NFC reported a net revenue of nearly VND 1,021 billion and an after-tax profit of VND 94 billion, up 35% and 181% year-on-year, respectively. Compared to the 2025 Annual General Meeting’s plan, the company has nearly completed its revenue target at 97% and exceeded its pre-tax profit goal by 84%.

Source: VietstockFinance

|

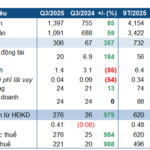

As of Q3-end, NFC‘s total assets reached VND 419 billion, a 20% increase from the beginning of the year. The majority were current assets, totaling VND 412 billion, up 21%. This growth was primarily driven by a 263% increase in cash and deposits to nearly VND 236 billion, accounting for 56% of total assets.

Conversely, inventory decreased significantly by 34% from the beginning of the year, to VND 127 billion.

On the capital side, total liabilities increased slightly by 10% to VND 140 billion, mainly short-term liabilities with no borrowings.

– 09:12 20/10/2025

F88 Surges Ahead in Q3, Achieving 90% of 2025 Annual Profit Target

F88 Investment Corporation (F88) has unveiled remarkable Q3/2025 financial results, reporting pre-tax profits of VND 282 billion, doubling the figure from the same period last year. In the first nine months of 2025, F88’s cumulative profit reached VND 603 billion, a 2.5-fold increase year-on-year.

Viglacera’s Q3 Profits Plummet 55% Amid Severe Storm Impact

Viglacera’s net profit in Q3 plummeted by over half due to adverse weather conditions and rising production costs. However, the nine-month results remain positive, with profits surging nearly 50%, driven by improved performance in industrial zone infrastructure leasing and construction materials segments compared to the same period last year.

Golden River Hydropower Profits Surge Sixfold in Q3 Compared to Last Year

Amidst favorable weather conditions, Song Vang Hydropower Joint Stock Company (UPCoM: SVH) has released its Q3/2025 financial report, showcasing a significant surge in revenue and a multi-fold increase in profits compared to the same period last year.