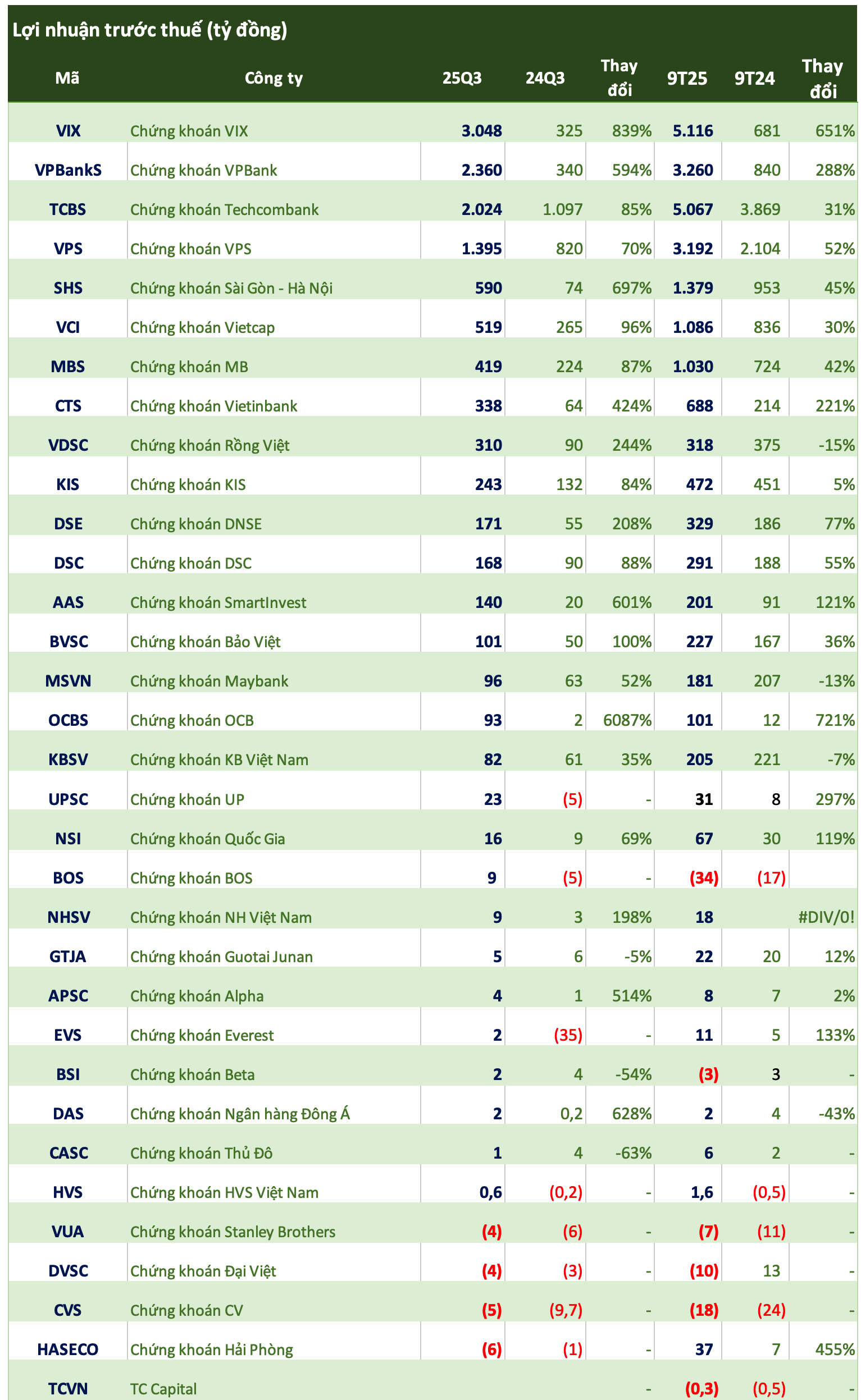

As of the morning of October 18, 2025, 33 securities companies have released their Q3 financial reports.

Vietinbank Securities (CTS) reported a remarkable 116% year-on-year growth in Q3 operating revenue, reaching 653 billion VND. The trading segment led the charge, with FVTPL asset profits soaring to 386 billion VND, nearly tripling the Q3 2024 figure. CTS also recorded 118 billion VND in lending and receivables interest income and nearly 64 billion VND in brokerage revenue.

Operating expenses rose in tandem with revenue, reaching 184 billion VND (+33%). Consequently, CTS’s pre-tax profit for Q3 surged 424% year-on-year to 338 billion VND. For the first nine months, the company’s pre-tax profit totaled 688 billion VND, a 221% increase.

Among foreign-owned securities firms, KIS Securities stood out with an 84% year-on-year rise in pre-tax profit to 243 billion VND. Q3 operating revenue hit 790 billion VND, driven by a 50% increase in lending and receivables interest to 248 billion VND. FVTPL asset profits edged up to 303 billion VND, while brokerage revenue surged 130% to 209 billion VND.

For the first nine months, KIS’s operating revenue reached 1,927 billion VND, up 8% year-on-year, with pre-tax profit rising 5% to 472 billion VND.

Baoviet Securities reported a doubling of Q3 pre-tax profit to 101 billion VND. For the first nine months, BVSC’s pre-tax profit climbed 36% year-on-year to 227 billion VND.

Conversely, Dai Viet Securities and Stanley Brothers Securities posted Q3 losses exceeding 4 billion VND each. Year-to-date, DVSC reported a pre-tax loss of 10 billion VND, while Stanley Brothers Securities lost over 7 billion VND.

October 17th Update: Securities Firms Report Earnings, with One Company Posting a Staggering 6,000% Growth

Several leading securities companies have unveiled their Q3 and 9-month 2025 business performance reports, offering valuable insights into their financial standing and operational achievements.

MBS Joins the “Billion-Dollar Club” for the First Time, Surging to Top 6 Market Share on HOSE

MBS Securities Corporation has unveiled its Q3 2025 financial results, reporting a remarkable profit of VND 418 billion, a 1.9-fold increase compared to the same period last year. With a cumulative nine-month profit of VND 1,030 billion, MBS has achieved a significant milestone by joining the prestigious “Thousand Billion Club” and securing a position among the top 6 brokerage firms on the Ho Chi Minh City Stock Exchange (HOSE).

Stock Market Shares: A Compelling Choice to Ride the Upgrade Wave

Vietnam’s official upgrade to secondary emerging market status by FTSE Russell unlocks significant opportunities for the securities sector, particularly for companies with strong fundamentals, robust growth potential, and the capability to attract foreign capital. Amid this backdrop, VPBankS launches its record-breaking IPO, offering an attractive opportunity for investors looking to capitalize on this market elevation.