|

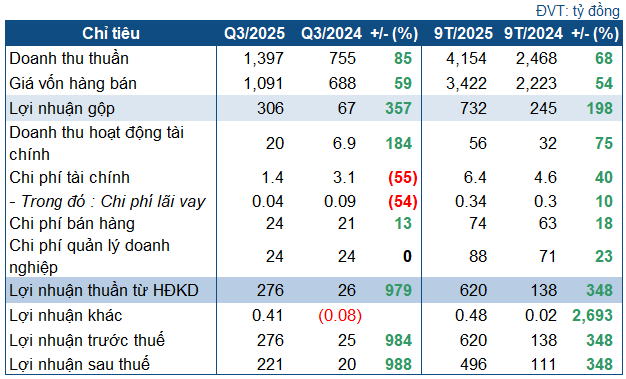

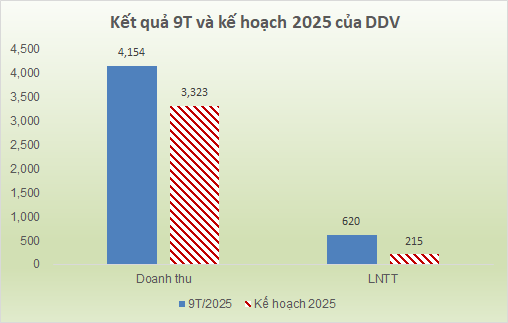

DDV’s Q3/2025 Business Targets

Source: VietstockFinance

|

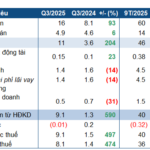

In Q3, DDV witnessed a remarkable 85% surge in revenue, reaching nearly VND 1.4 trillion, driven by increased production volume and higher DAP selling prices. Cost of goods sold rose by only 59% to approximately VND 1.1 trillion, primarily due to fluctuations in raw material prices and a significant increase in sales volume. Consequently, DDV’s gross profit soared to VND 305 billion, 4.6 times higher than the same period last year.

Financial activities also contributed positively to Q3 results, with financial revenue reaching nearly VND 20 billion, almost triple that of the same period last year, mainly due to higher interest income and exchange rate gains. Conversely, financial expenses plummeted by 55% to VND 1.4 billion, thanks to reduced exchange rate losses.

Selling expenses increased by 13% to VND 24 billion, while administrative expenses remained stable. As a result, DDV reported a net profit of VND 221 billion, 11 times higher than the VND 20 billion recorded in the same period last year. This marks the highest quarterly profit for DDV since its UPCoM listing in 2015.

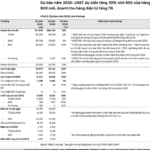

The explosive Q3 results significantly enhanced DDV’s year-to-date performance. In the first nine months, the company achieved a net revenue of nearly VND 4.2 trillion, up 68%; and post-tax profit of VND 496 billion, 4.5 times higher than the same period last year. Compared to the targets approved by the 2025 Annual General Meeting, DDV exceeded expectations, surpassing revenue by 25% and pre-tax profit by 188%.

Source: VietstockFinance

|

As of the end of Q3, DDV’s total assets reached nearly VND 2.8 trillion, a 24% increase from the beginning of the year, with current assets accounting for VND 2.3 trillion, up 28%. Term deposits surged to over VND 1.5 trillion, representing 54.4% of total assets, a 31% increase.

Inventory also rose by 10% to VND 454 billion. Short-term receivables increased by 24% to VND 211 billion.

On the capital side, total liabilities grew by 40% to VND 641.9 billion, primarily due to higher short-term payables. The company incurred an additional short-term loan of over VND 20 billion (no debt at the beginning of the year).

– 11:28 20/10/2025

Viglacera’s Q3 Profits Plummet 55% Amid Severe Storm Impact

Viglacera’s net profit in Q3 plummeted by over half due to adverse weather conditions and rising production costs. However, the nine-month results remain positive, with profits surging nearly 50%, driven by improved performance in industrial zone infrastructure leasing and construction materials segments compared to the same period last year.