The decline occurred as the new international terminal T3 at Tan Son Nhat Airport began operations, intensifying competition in non-aviation services at Vietnam’s largest airport.

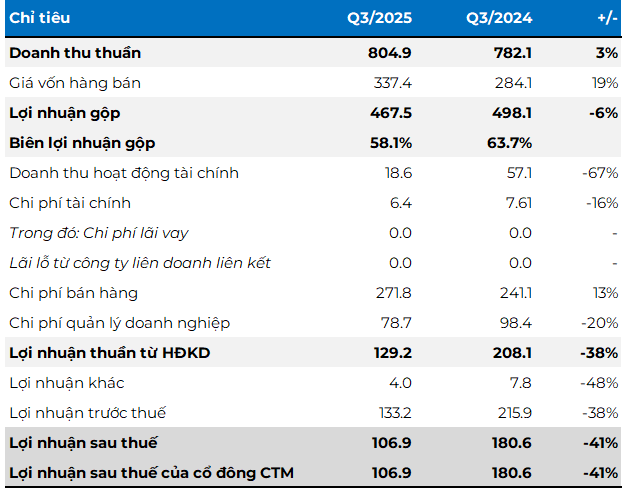

While SASCO’s net revenue rose slightly by 3% in Q3, gross profit margin dropped significantly from 64% to 58%. Financial revenue plummeted by 67% to nearly VND 19 billion, primarily due to reduced dividends from investment contributions. Other income also halved to VND 4 billion.

These factors led to a 40% year-on-year drop in SASCO’s net profit, totaling VND 107 billion.

SASCO’s Q3/2025 Business Results

Unit: Billion VND

Source: VietstockFinance

|

According to SASCO’s explanation, the primary reason for the profit decline is the unrecorded profit compensation from duty-free operations. This profit will be settled and recognized in Q4/2025 as per regulations.

Earlier, at the 2025 Annual General Meeting in June, SASCO Chairman Hanh Nguyen forecasted increasing competition: “With airport expansions and the growth of non-aviation services, ACV aims to involve more partners in airport business. This will impact SASCO’s future market share.”

However, he remains optimistic about SASCO’s growth potential, stating: “In rough seas, a strong ship prevails. If previously VND 100 yielded VND 40-50, that was significant; now, with VND 1,000, even a 30% return is substantial.”

To address these challenges, Hanh Nguyen directed SASCO to focus on developing high-quality services and products, ensuring continued partnership with ACV. Opportunities at Terminal T3 and Long Thanh Airport will be openly tendered by ACV.

Overall, in the first nine months of 2025, SASCO achieved net revenue of nearly VND 2,340 billion and a net profit of VND 328 billion, up 10% and 12% year-on-year, respectively. This fulfills 78% of the annual revenue target and 74% of the pre-tax profit goal.

– 11:06 20/10/2025

Airport Business Booms: Taseco Airs Announces Highest Dividend Payout in Years

Taseco Airs (HOSE: AST) has announced a 25% cash dividend for 2025, equivalent to VND 2,500 per share. The ex-dividend date is set for October 16, with payment scheduled for October 24.

Unlocking Potential: Vietnam’s Ministry of Construction Highlights $450 Million Long Thanh Airport Project

The Ministry of Construction commends ACV’s visionary proposal for a $450 million project at Long Thanh Airport, yet seeks further clarification on key aspects to ensure its feasibility.