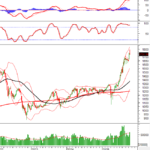

Heightened selling pressure during the final trading session of the week caused the VN-Index to close nearly 36 points lower, pulling the index back to 1,731 points. Similarly, the HNX-Index closed at 276 points, while the Upcom index hovered around 112 points.

A notable development is that, unlike previous weeks where the VN-Index surged primarily due to Vingroup-related stocks, this week’s profit-taking pressure from these stocks spilled over into other sectors, including banking, securities, and real estate. As a result, investors’ portfolios continued to erode.

Many investors reported that despite avoiding margin trading and the VN-Index’s upward trend in recent weeks, their portfolio values have been declining due to falling stock prices.

“Several stocks in my portfolio, spanning banking, securities, and real estate, are down 10-20% without margin trading. Many of my friends who use margin have even larger losses, despite the VN-Index remaining above 1,700 points and positive market sentiment following the recent upgrade and strong Q3/2025 earnings reports,” shared Hoang Thinh, an investor from Ho Chi Minh City.

The VN-Index’s sharp decline at week’s end further eroded many investors’ portfolios.

According to Dinh Viet Bach, an analyst at Pinetree Securities, after the selling pressure from Vingroup-related stocks, capital flowed into real estate stocks this week, helping the sector maintain a relatively positive performance even as the VN-Index plummeted nearly 40 points.

Looking ahead, experts predict the market will continue to “consolidate” before resuming its upward trend. The first support level is expected around 1,700 points, the most optimistic short-term scenario. However, if this level is breached, the index could retreat to the next support zone near 1,670 points.

“Recent weeks saw capital concentrated in Vingroup-related stocks and select VN30 constituents. With these stocks correcting, the market lacks a primary driver and needs time for other sectors to accumulate before regaining momentum. Capital is likely to shift toward the real estate sector, which is expected to lead the market in the coming period,” noted Dinh Viet Bach.

CSI Securities observed that the VN-Index closed the week lower after reaching a historic high of 1,794 points, with high trading volumes indicating diminished investor optimism. The short-term trend carries increased risks, though a reversal signal remains unconfirmed.

In this context, “investors may hold their portfolios and monitor support levels at 1,720 and 1,670 points next week to increase stock exposure,” the firm advised.

Despite the VN-Index remaining above 1,700 points, many stocks are still trading in the red.

Meanwhile, SHS Securities cautioned that the 1,700-point level is not an attractive entry point, especially for stocks that have experienced sharp recent gains. The firm recommends investors carefully evaluate positions based on reasonable valuations and Q3/2025 earnings to manage short-term risks.

Insider Selling Surge: Executives’ Relatives Offload Shares in Corporate Rush

Mr. Tran Ngoc Dan’s brother-in-law, Chairman of the Board of Directors at City Auto Joint Stock Company, sold 217,145 shares of CTF. Ms. Huynh Hoang Hoai Han, Acting Chief Accountant at Chuong Duong Joint Stock Company, sold 218,000 shares of CDC, reducing her ownership to 0% of the company’s charter capital.

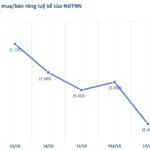

Foreign Blockades Unleash Massive Sell-Off: VN-Index Correction Sparks 5.2 Trillion VND Sell-Off – Which Stocks Are in the Crosshairs?

Foreign investors continued their net selling pressure, offloading thousands of billions worth of assets in each session. The sole exception was Thursday, October 16th, when foreign investors unexpectedly turned net buyers.

Vietstock Weekly (Oct 20-24, 2025): Consolidating at the Peak

The VN-Index reversed its upward trend, closing lower as a Long Upper Shadow candlestick pattern emerged, accompanied by trading volume surpassing the 20-week average. This suggests intense profit-taking pressure as the index approached new historical highs. While the MACD has maintained a buy signal since May 2025, the weakening momentum of the Stochastic Oscillator in overbought territory indicates potential short-term volatility ahead.