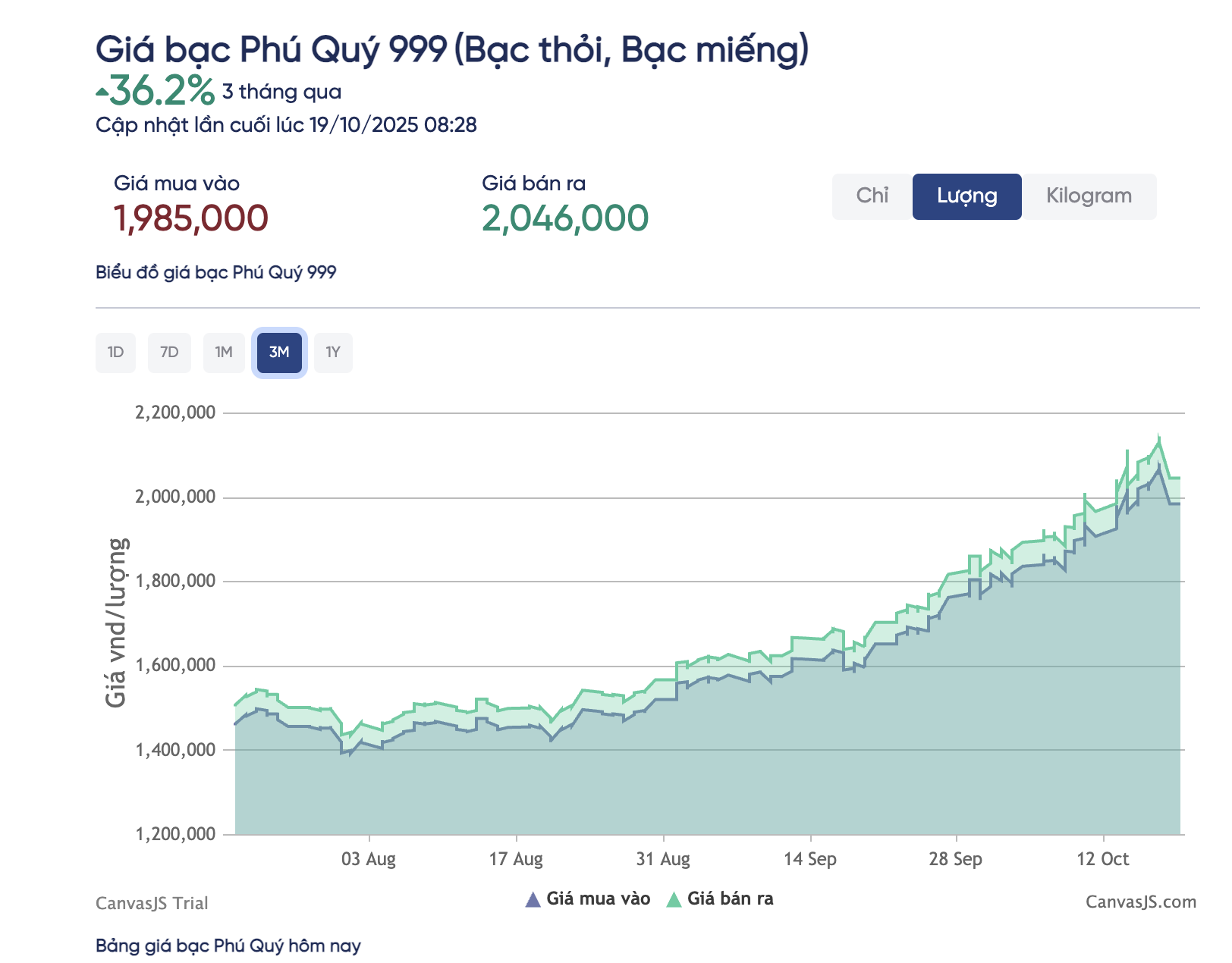

Over the weekend of October 19th, domestic silver prices were quoted by Vietnamese enterprises at approximately VND 1,985 million per tael for buying and VND 2,046 million per tael for selling, marking a 2.6% increase compared to the previous weekend. Over the past month, silver prices have surged by 22%, and over the last three months, they have risen by a total of 36%.

In the international market, silver prices concluded the weekend at $51.98 per ounce, despite retreating from the historical peak of over $54.3 per ounce. Nevertheless, they have still climbed by a total of 33% in just the last three months.

Reporter from Người Lao Động Newspaper interviewed Dr. Nguyễn Duy Quang from the University of Economics and Finance (UEF) in Ho Chi Minh City to discuss the factors driving the recent silver price surge.

Is the Silver Price Surge Driven by Electric Vehicles and Solar Panels?

– Reporter: Not only gold, but many investors are also surprised by the sharp rise in silver prices. What factors are causing this precious metal to “stir up” the market?

+ Dr. Nguyễn Duy Quang: The primary driver of the silver price surge is the booming industrial demand. According to Paul Williams, the volume of silver used in solar panels, electric vehicles, and electronic components reached a record high of 680.5 million ounces in 2024. The shift of capital into green technology and artificial intelligence (AI) is further fueling the demand for physical silver, propelling its price upward.

Dr. Nguyễn Duy Quang

The ripple effect from gold also plays a significant role. As gold surpassed the historical milestone of $4,000 per ounce, many investors view silver as a “high-beta version” of gold (as per Ole Hansen) and are buying it aggressively. The gold-to-silver ratio has dropped to 81—its lowest in a year—indicating that silver is more attractive as gold is considered overpriced.

Technical factors further reinforce the upward trend but also pose risks of correction. Spot prices hovering around $51-$52 per ounce—the highest since the 1980s—signal overbought conditions, and the $50 per ounce resistance level has become a critical warning point that could trigger a sell-off if not sustainably breached.

– In reality, silver prices hit a record high above $54 per ounce and then plummeted by about 4% in the final session of the week. Is there a risk for investors buying silver in Vietnam?

+ Silver in Vietnam is highly volatile, even more so than gold, leading to more significant price fluctuations. If global prices fall below $48 per ounce, the risk of triggering a sell-off increases, putting substantial downward pressure on domestic prices.

Additionally, the liquidity in Vietnam’s silver market is limited, and the bid-ask spread of approximately VND 40,000 – 43,000 per tael can result in considerable losses if prices reverse quickly.

Policy risks and USD/VND exchange rate fluctuations also directly impact silver import costs, narrowing profit margins. Any changes in tax regulations, licensing, or foreign exchange policies can significantly affect costs and silver’s appeal to domestic investors.

Domestic silver prices have risen by approximately 36% in just the last three months

Key Considerations During the Silver Price Surge

– What should investors keep in mind if investing in silver now?

+ In the baseline scenario, if gold stabilizes around $4,000 per ounce and industrial demand (solar panels, electric vehicles, electronic components) remains high, silver prices are likely to fluctuate between $48 and $55 per ounce. At this level, silver remains attractive for investors seeking portfolio diversification, reflecting a relatively balanced supply-demand dynamic in the short term.

Silver is a dual-purpose asset, serving both industrial and safe-haven functions. The current rally is supported by genuine industrial demand and a shift of capital from gold, but it is also intertwined with technical speculation—creating risks of sharp corrections.

Therefore, investors should manage risk by avoiding excessive leverage and diversifying their portfolios. Closely monitor the gold-silver relationship, global monetary policies, and the pace of the green energy transition.

Phú Quý silver prices have been rising continuously in recent times