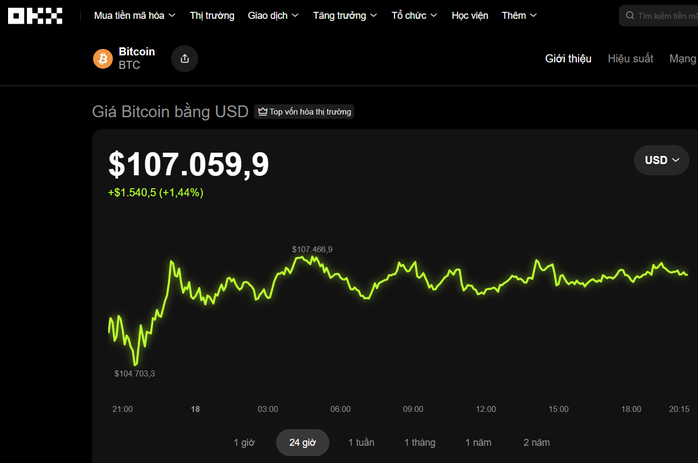

On the evening of October 18th, the cryptocurrency market showed positive momentum following a previous decline. Data from the OKX exchange revealed that Bitcoin (BTC) surged by over 1% in the past 24 hours, surpassing the $107,000 mark.

Several other cryptocurrencies also experienced significant gains. Ethereum (ETH) rose by more than 2%, reaching $3,870; BNB climbed 2.5% to $1,095; and Solana (SOL) increased by nearly 3%, hitting $185. Notably, XRP led the rally with a 4.6% jump, reaching $2.30.

According to Coingecko, Bitcoin’s price continues to trade sideways within a downtrend after losing its peak of $126,272.

Currently, Bitcoin’s price hovers around the support range of $103,500–$106,000, following a slight recovery signal in the latest session.

In the short term, Bitcoin is trapped between $106,000 and $108,000. If the price breaks above $108,500 with substantial volume, the upward momentum could push Bitcoin to the $110,000–$112,000 range, and potentially further to $114,000. Conversely, if it falls below $103,500, Bitcoin’s price could drop significantly to the psychological threshold of $100,000.

Bitcoin is currently trading around $107,000. Source: OKX

With prices remaining below key moving averages, Bitcoin’s primary trend remains bearish. Investors should closely monitor price reactions around the $103,500–$108,500 range to determine the next direction.

Observations from local cryptocurrency communities indicate that caution still prevails after the recent sharp decline.

Mr. Trần Minh Hoàng (Ho Chi Minh City) shared that his investment portfolio has only recovered slightly, by 3–4%, after losing up to 40% of its value. He is currently opting to observe further to safeguard his assets.

Echoing this cautious sentiment, Ms. Ngô Hải Yến (Ho Chi Minh City) mentioned that she, like many small investors, remains in a “wait-and-see” mode.

Analysts note that despite emerging recovery signals, hesitation dominates the market, as many investors have yet to recoup losses from the previous downturn.

Money Laundering in the Digital Asset Era: Acquiring Clean Projects with Dirty Money, Then Crashing Them to Erase Traces

Unveiling a sophisticated money laundering scheme, bad actors create seemingly legitimate crypto projects, only to purchase them with illicit cryptocurrency assets. They then transfer the funds back to themselves before ultimately collapsing the project, effectively erasing any trace of their malicious activities.

Over 4 Million Trillion Dong in Real Estate Credit: What Could Happen Next?

As of the end of August 2025, real estate credit outstanding debt has surpassed 4 million trillion VND, accounting for nearly a quarter of the total debt in the economy. This substantial capital inflow is anticipated to stimulate market recovery, yet it also raises concerns regarding capital efficiency and the potential risk of an asset bubble.