Vingroup Joint Stock Company (Stock Code: VIC) has recently announced to the State Securities Commission (SSC), Ho Chi Minh City Stock Exchange (HoSE), and Hanoi Stock Exchange (HNX) its plan to establish a new subsidiary.

On October 17, 2025, the Board of Directors of Vingroup approved a resolution to invest in the establishment of Vin New Horizon Joint Stock Company (Vin New Horizon).

Vin New Horizon will be headquartered at Symphony Office Building, Chu Huy Man Street, Vinhomes Riverside Urban Area, Phuc Loi Ward, Hanoi.

The company’s chartered capital is set at VND 1,000 billion, with Vingroup contributing 65% of the total. Vin New Horizon will primarily focus on investing in and managing senior healthcare centers.

In other developments, Vingroup’s Board of Directors also approved adjustments to the Ha Long Xanh Complex Urban Area project in Tuan Chau and Ha An wards, Quang Ninh Province.

The adjustments, as per Resolution No. 14/2020/NQ-HĐQT-VINGROUP dated July 8, 2020, include updates to reflect current conditions and project requirements:

The project location has been revised to Tuan Chau and Ha An wards, Quang Ninh Province, due to administrative boundary changes.

The project spans approximately 4,119.23 hectares, with 933.23 hectares in Tuan Chau Ward and 3,186 hectares in Ha An Ward. The total investment is VND 456,639 billion.

The Board of Directors has authorized the CEO or a legally appointed representative to handle investor-related matters and complete necessary legal procedures for the project adjustments.

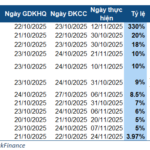

Additionally, Vingroup has announced the third shareholder opinion survey for 2025.

The final registration date for shareholders to participate is October 30, 2025, with the ex-rights date set for October 29, 2025.

Each common share entitles the holder to one voting right. The survey is scheduled for November 2025 at Vingroup’s headquarters.

The proposed agenda includes issuing shares to increase capital from equity and other matters within the Board’s authority. Detailed content will be finalized by the Board at the time of implementation.

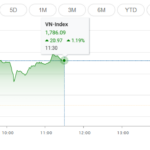

Expert Insight: The “Resting” Phase is Essential—VN-Index Gearing Up for the Next Bull Run

Most experts agree that last weekend’s correction was merely a “pit stop” for the upcoming bullish waves, with the immediate target set at 1,800 points.

The Female Powerhouses Steering Vingroup Empire Alongside Billionaire Pham Nhat Vuong

Meet the formidable women leaders whose vision, talent, and unwavering determination have been instrumental in building and expanding Vingroup’s ecosystem alongside billionaire Phạm Nhật Vượng. Their exceptional leadership and strategic acumen have shaped the conglomerate’s success, leaving an indelible mark on Vietnam’s business landscape.

Vingroup Plans to Issue $325 Million in International Bonds

Vingroup’s upcoming international bond issuance offers a 5-year term with an attractive annual interest rate of 5.5%.

Market Pulse 14/10: Blue-Chip Stocks Bolster Against Intense Selling Pressure

In stark contrast to the morning’s optimism, the VN-Index closed in the red as selling pressure dominated towards the end of the session. The HOSE index settled at 1,761.06 points, marking a 4-point decline. Similarly, the HNX-Index dipped slightly below the reference level, shedding 0.02 points to close at 275.33.