|

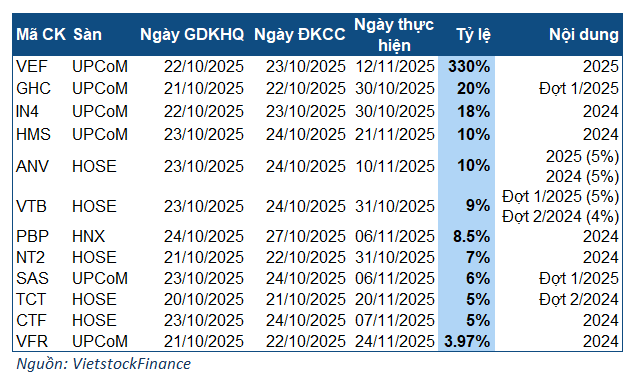

Companies Announcing Cash Dividends for the Week of October 20-24, 2025

|

VEF stands out as the most prominent name next week, announcing a cash dividend payout with a staggering 330% ratio. With over 166.6 million outstanding shares, the total payout reaches nearly VND 5.5 trillion. The ex-dividend date is October 22, and shareholders can expect to receive their dividends on November 12, 2025.

The majority of the payout will go to the parent company, Vingroup (HOSE: VIC), which holds over 83% of the shares. This translates to VIC receiving approximately VND 4.6 trillion. The Ministry of Culture, Sports, and Tourism, the second-largest shareholder with a 10% stake, will receive nearly VND 550 billion. The dividend is funded from the accumulated undistributed after-tax profit as of June 30, 2025, totaling over VND 10.35 trillion.

VEFAC is renowned for its generous cash dividend policy. In July 2025, the company completed two dividend payments with a combined ratio of 435%, equivalent to VND 43,500 per share, totaling over VND 7.2 trillion. This included a 135% dividend for 2024 and a 300% interim dividend for Q1/2025.

Next in line is GHC, announcing the first interim cash dividend for 2025 at a 20% ratio (VND 2,000 per share), totaling over VND 95 billion. The ex-dividend date is October 21, with payment scheduled for October 30. The largest beneficiary is Gia Lai Electricity Joint Stock Company (HOSE: GEG), the parent company holding 62.53% of GHC’s shares, expected to receive over VND 59 billion.

According to GHC’s plan, the 2025 dividend is projected to range between 15-25%. With a 20% interim payout, the company may execute an additional payment to reach the maximum target of 25%. In 2024, GHC paid a 20% dividend, down from 25% in 2023.

Next week, only one company, TT6, will announce a stock dividend with a 100:11 ratio (11%). The ex-dividend date is October 22, 2025.

– 1:58 PM, October 19, 2025

Vingroup Plans to Issue $325 Million in International Bonds

Vingroup’s upcoming international bond issuance offers a 5-year term with an attractive annual interest rate of 5.5%.

Market Pulse 14/10: Blue-Chip Stocks Bolster Against Intense Selling Pressure

In stark contrast to the morning’s optimism, the VN-Index closed in the red as selling pressure dominated towards the end of the session. The HOSE index settled at 1,761.06 points, marking a 4-point decline. Similarly, the HNX-Index dipped slightly below the reference level, shedding 0.02 points to close at 275.33.