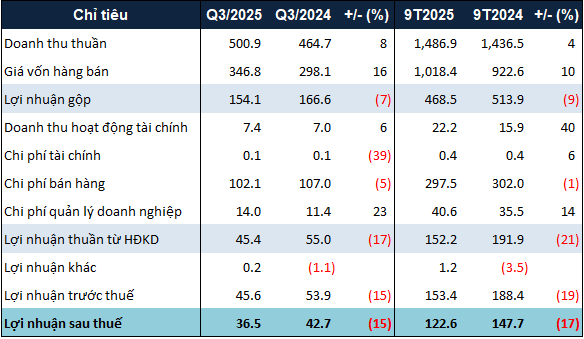

Specifically, IFS’s Q3 net revenue increased by 8% year-over-year, reaching nearly VND 501 billion. Notably, revenue from canned food surged by over 69%, hitting almost VND 150 billion. Conversely, beverage sales declined by more than 7%, settling at over VND 377 billion. The company attributed the revenue growth to the success of intensified sales programs, advertising, and promotions aimed at sustaining the year’s sales targets.

However, a 16% rise in the cost of goods sold led to a 7% dip in gross profit, which stood at over VND 154 billion. This was driven by fluctuating prices of key raw materials and a decrease in production volume, ultimately elevating product costs.

Administrative expenses also climbed by 23%, reaching VND 14 billion. Despite this, IFS maintained its administrative expense-to-net revenue ratio at 3%, consistent with the previous year. After deducting expenses, IFS reported an after-tax profit of nearly VND 37 billion, a 15% decrease year-over-year.

For the first nine months of the year, the company’s after-tax profit totaled nearly VND 123 billion, a 17% decline. Compared to the 2025 target of VND 204 billion, IFS’s nine-month after-tax profit represents 60% of the annual goal.

|

IFS’s 9-month business results for 2025. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, IFS’s total assets reached nearly VND 1.4 trillion, a slight 6% decrease from the beginning of the year. Short-term cash holdings fell by 15% to over VND 821 billion, while short-term receivables doubled to more than VND 102 billion. Inventory levels remained stable at nearly VND 305 billion.

Total liabilities decreased by 18% to nearly VND 212 billion, primarily due to a 15% reduction in short-term payables to sellers, which stood at VND 126 billion.

– 10:31 20/10/2025