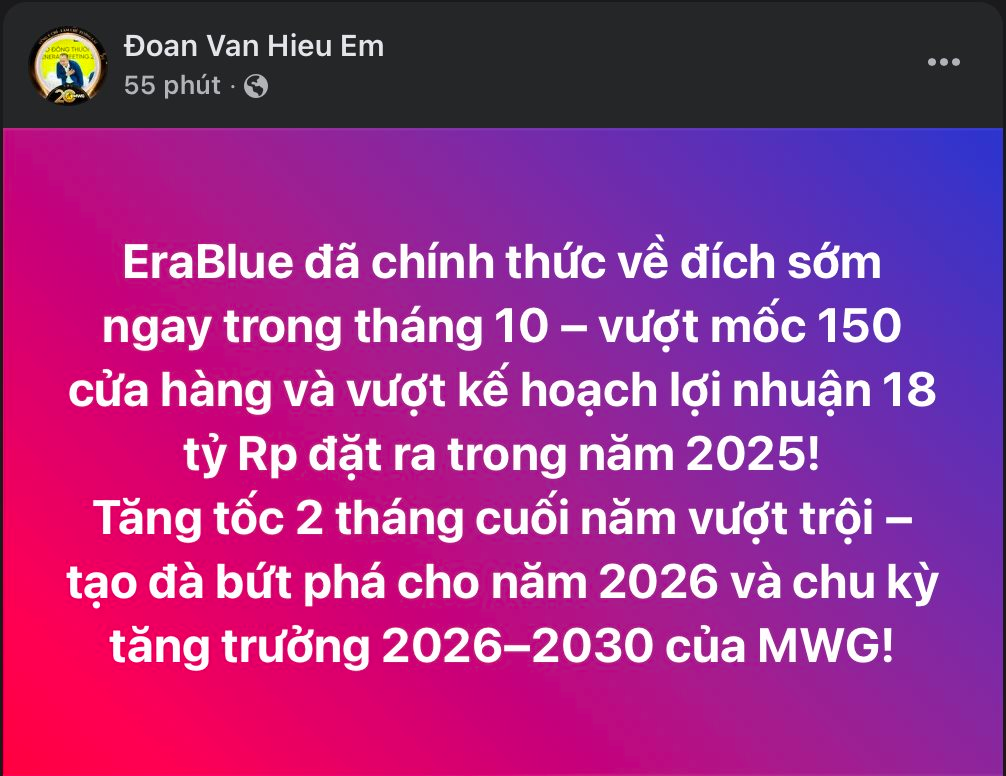

On his personal Facebook page, Mr. Doan Van Hieu Em, a Board Member of Mobile World Investment Corporation (stock code: MWG) and CEO of The Gioi Di Dong Corporation, recently shared notable insights regarding EraBlue – an electronics retail chain in Indonesia.

“EraBlue has officially reached its target ahead of schedule in October, surpassing 150 stores and exceeding the 18 billion Rp profit plan set for 2025! Accelerating in the last two months of the year will create a breakthrough momentum for 2026 and MWG’s growth cycle from 2026 to 2030!”, stated Mr. Doan Van Hieu Em.

With EraBlue achieving its target early, investors are optimistic that MWG will also surpass its annual plan without waiting until year-end. During the group’s 21st anniversary celebration in mid-July, Mr. Hieu Em expressed a similar determination.

“October marks the finish line – End the year with excellence – Moving closer to the 2030 vision of becoming a great retailer, capturing 70–80% market share, and creating sustainable value for customers and the community”, shared Mr. Hieu Em.

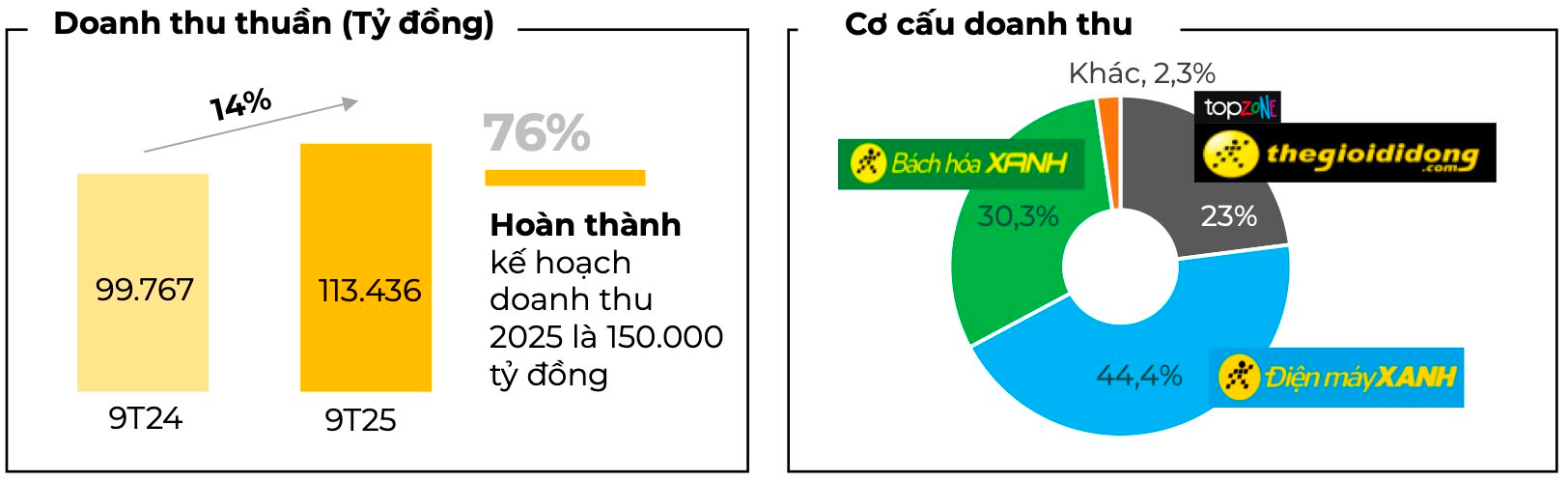

MWG has not yet released its Q3 financial report but has disclosed preliminary business results. In the first nine months, MWG recorded revenue of 113.436 trillion VND, a 14% increase year-on-year, achieving 76% of the annual plan. In Q3 alone, MWG’s revenue reached nearly 40 trillion VND, the highest since its inception.

After nine months, the The Gioi Di Dong/Dien May Xanh (TGDĐ/ĐMX) chains, managed by MWG’s subsidiary The Gioi Di Dong Corporation (MW), reported positive business results. This success is attributed to a growth strategy focused on quality, exceptional lifelong services, and comprehensive financial solutions.

Specifically, MWG’s mobile phone and electronics sectors achieved revenue of 76.5 trillion VND, a nearly 15% increase year-on-year, despite a slow market recovery and a decrease in the average number of stores. The positive results are primarily due to revenue growth in existing stores, driven by a focus on services and comprehensive financial solutions for customers.

Regarding Bach Hoa Xanh (BHX), the grocery chain achieved 34.4 trillion VND in cumulative revenue for the first nine months, a 14% increase year-on-year. However, its growth rate has slowed in recent months. According to MWG, by optimizing costs and controlling shrinkage, BHX’s business efficiency in Q3/2025 continued to improve compared to Q2/2025.

As of September, the chain opened 520 new stores this year, bringing the total to 2,290, with over 50% of new stores located in the Central region. These new stores recorded positive profits at the store level after deducting all direct operating and warehousing costs. In Q4/2025, BHX plans to continue selective expansion in new provinces and regions where it already has a presence.

Notably, Mr. Nguyen Duc Tai’s supermarket chain has begun recruiting personnel to expand into the Northern market. At the Q2 Investor Meeting, Mr. Vu Dang Linh, CEO of MWG, stated that 2026 will be a pivotal year when BHX officially enters the North. He also revealed an ambitious plan to open 1,000 new Bach Hoa Xanh stores annually starting next year.

In addition to EraBlue, the An Khang pharmacy chain also showed positive developments, with an average monthly revenue per store of 540 million VND, maintaining three consecutive months of growth. Compared to the same period last year, the chain will continue to improve in-store business efficiency, aiming to contribute profits to the group.

AvaKids recorded double-digit revenue growth in the first nine months compared to the same period last year, with an average monthly revenue per store of 1.8 billion VND. Total revenue in Q3/2025 increased by 10% compared to the previous quarter and over 30% year-on-year. The chain has achieved profitability at the company level and continues to improve its financial results month by month.

In other developments, MWG recently approved a detailed share repurchase plan, as endorsed by the Annual General Meeting of Shareholders (AGM) 2025. Specifically, the maximum registered repurchase volume is 10 million shares, equivalent to nearly 0.7% of the total outstanding shares.

The purpose of the repurchase is to reduce the charter capital. The funding will come from existing resources and undistributed after-tax profits based on the audited 2024 financial statements. The remaining undistributed after-tax profit at the end of the year is 12,582 billion VND.

Notably, the minimum repurchase price is 10,000 VND per share, and the maximum is 200,000 VND per share, based on market prices at the time of transaction, ensuring compliance with regulations. Thus, the maximum expected expenditure is 2,000 billion VND.

The transaction method is order matching. The expected transaction period is within two months from the date the State Securities Commission confirms receipt of complete share repurchase report documents to reduce charter capital, and the company announces the information as required. The transaction period will not exceed 30 days from the start date.

Thegioididong and Dien May Xanh Revenue Surges 21% in September

In September 2025, the mobile phone and electronics retail chains under the World Mobile Investment Corporation (HOSE: MWG) achieved a remarkable revenue of 9.4 trillion VND, marking a 21% year-on-year growth and the seventh consecutive month of expansion. These sectors now stand as the primary profit drivers for the diversified retail conglomerate.

Securities Firms Forecast MWG’s 2026 Profit at VND 8.5 Trillion, Anticipating Bach Hoa Xanh to Accelerate Opening of 6,000 Stores

Vietcap forecasts a remarkable 77% surge in post-tax profit for 2025, reaching an estimated VND 6,559 billion, significantly outpacing the previous year’s performance.

The Wager of Nguyen Duc Tai: Transforming a Math-IT Master’s Graduate into a ‘Zero-Salary’ CEO of Bach Hoa Xanh and the Data Secret Behind Its Miraculous Turnaround

Looking back to April 2023, MWG’s appointment of Mr. Phạm Văn Trọng, a Master of Mathematics and Computer Science, as Acting CEO of Bách Hóa Xanh signaled a strategic shift. This move marked a pivotal step in the restructuring initiated in late 2021, cementing the retailer’s future as one driven by algorithms and data.