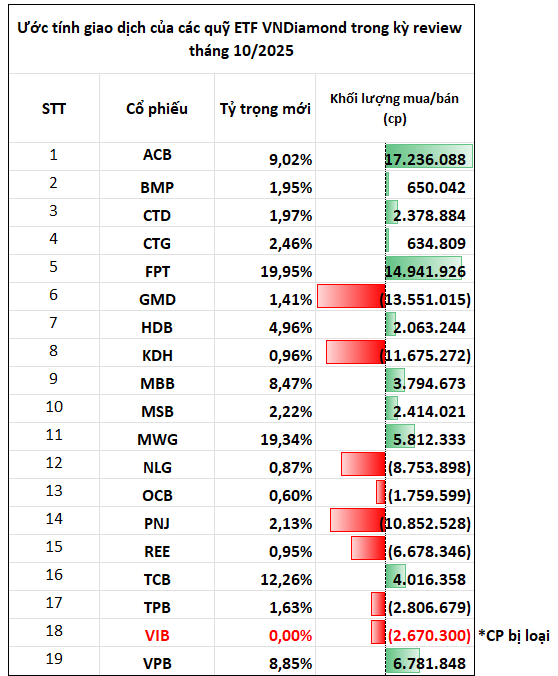

The Ho Chi Minh City Stock Exchange has announced the constituent stocks of the VN DIAMOND Index for October 2025.

The final date for funds to complete portfolio restructuring is October 31, 2025, with the new index basket taking effect on November 3, 2025.

As anticipated by several securities firms, VIB Bank’s stock has been removed from the portfolio. Conversely, no new stocks were added during this restructuring period.

Currently, six funds track the VN Diamond Index, including FUEVFVND, FUEMAVND, FUEBFVND, FUEKIVND, FUEABVND, and VFCVN DIAMOND, with a combined asset size of approximately 14,000 billion VND.

Projections indicate that these funds may increase holdings in stocks such as FPT (15 million shares), ACB (17 million shares), MWG (5.8 million shares), VPB (6.8 million shares), and TCB (4 million shares), among others.

Conversely, VIB may see nearly 3 million shares sold off as it exits the funds’ portfolios. Additionally, some stocks may experience reduced holdings, including GMD (-13.5 million shares) and KDH (-11.6 million shares), among others.

Nam Tân Uyên Set to Debut on HoSE with Reference Price of VND 161,470 per Share

Nearly 24 million NTC shares of Nam Tan Uyen will debut on the HoSE trading floor on October 28, 2025, with a reference price of VND 161,470 per share.

Thegioididong and Dien May Xanh Revenue Surges 21% in September

In September 2025, the mobile phone and electronics retail chains under the World Mobile Investment Corporation (HOSE: MWG) achieved a remarkable revenue of 9.4 trillion VND, marking a 21% year-on-year growth and the seventh consecutive month of expansion. These sectors now stand as the primary profit drivers for the diversified retail conglomerate.