International Turmoil Puts Pressure on Bank Stocks

Cautious sentiment towards financial stocks isn’t limited to domestic markets. Last week, the U.S. stock market witnessed significant volatility among regional banks following negative news about asset quality.

Specifically, Zions Bancorporation announced a $50 million write-off due to “contract discrepancies and violations” in commercial loans through its California Bank & Trust unit. Meanwhile, Western Alliance Bancorporation revealed legal action against a borrower over fraudulent collateral.

These developments regarding the health of U.S. banks have heightened global investor caution, especially amid ongoing geopolitical and political uncertainties.

While not directly impacted, Vietnamese bank stocks—highly sensitive to risk sentiment—have seen some underperforming tickers emerge.

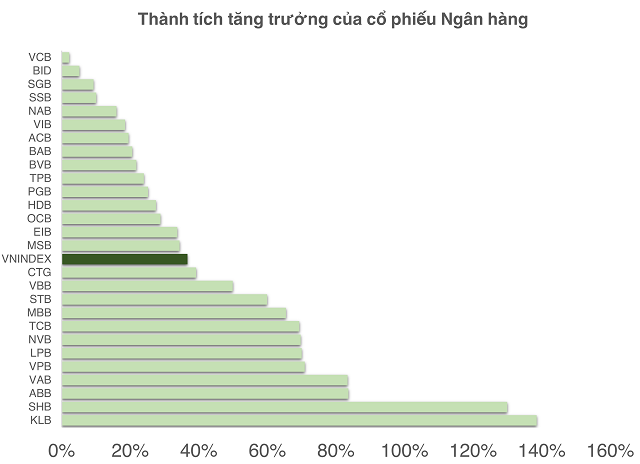

Statistics show that less than 50% of bank stocks maintained short-term uptrends (above the 20-session moving average) last week, indicating weakening momentum. Notably, SSB and BVB lost their long-term uptrends (200-session moving average).

Even among top players, VCB (+2.2%) and BID (+5.2%) have shown modest gains over the past 10 months, failing to lead the current rally. In contrast, TCB, STB, HDB, CTG, SHB, MBB, and LPB remain near historical highs.

Compared to Q3—when 100% of bank stocks maintained long-term uptrends—the group’s strength has somewhat weakened. However, 96% still holding long-term uptrends remains impressive in the current context.

The last cycle where 100% of bank stocks held long-term uptrends was 2020-2022.

|

Cautious investors may monitor underperformers like SSB and BVB for a clearer sector outlook.

As of the October 17th session.

|

Despite short-term corrections, SSB is up over 10% year-to-date, while BVB has surged 22%.

Expert Perspective: Healthy Cooling-Off, Capital Reallocation Underway

Analysts view this as a natural development. Nguyễn Anh Khoa, Head of Research at Agriseco Securities, believes the pullback in bank stocks and VIC isn’t negative but creates opportunities for healthier capital allocation.

“I see the correction in VIC and bank stocks as a chance for capital reallocation. The VN-Index’s uptrend remains intact. Rotation into sectors with strong Q4 earnings will stabilize the market in the medium term,” Khoa stated.

On global factors, Khoa noted that U.S.-China trade tensions and U.S. banking sector volatility primarily impact short-term sentiment, without directly affecting Vietnam’s economy or banking system.

“Markets like South Korea, Japan, and Thailand continue rising. Vietnam is unlikely to face significant negative impact. Q4’s key drivers remain domestic—GDP growth, monetary policy, and corporate earnings,” he added.

Bùi Văn Huy, Deputy Chairman and Head of Research at FIDT, echoed this view, highlighting banks as an attractive group alongside securities, industrial real estate, construction materials, consumer, and retail sectors.

“Banks remain index heavyweights, benefiting from stabilizing net interest margins, improving fee income, and recovering credit growth. However, investors should focus on banks with strong CASA ratios, proactive provisioning, and robust capital adequacy,” Huy advised.

– 12:00 20/10/2025

Market Reversal: Surge in Investment Flows

The market rallied impressively in today’s afternoon session (24/9), with a significant return of capital inflows, particularly favoring banking and securities stocks. The VN-Index reversed course, surging by over 22 points.

Will Bank Stocks Continue to Rise?

The banking sector’s rally may continue in the short term, but caution is warranted at this juncture, especially for novice investors. This is according to Mirae Asset Securities’ research, which suggests that while the industry’s uptrend might persist, the risks associated with entering the market at the present stage are considerable.