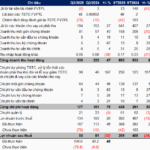

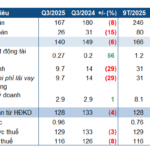

Hoang Anh Gia Lai Joint Stock Company (HAG) has released its Q3 2025 report, revealing a net revenue of VND 1,895 billion, marking a 32% increase compared to the same period in 2024.

The fruit segment remains HAG’s primary revenue driver, contributing significantly to the overall sales. In Q3, the net revenue from this segment reached VND 1,419 billion, showcasing an impressive 61% growth year-over-year. Additionally, revenue from other products and goods sales also saw a notable increase, reaching VND 428 billion, up by 49%.

Conversely, the pig sales segment experienced a sharp decline, with Q3 net revenue dropping to nearly VND 40 billion, an 83% decrease compared to the same quarter last year. For the first nine months of the year, pig sales revenue plummeted by over 79%, totaling nearly VND 174 billion.

Slower growth in production costs has led to a 25% increase in gross profit, reaching VND 762 billion. The gross profit surge of VND 153 billion compared to Q3 2024 is primarily attributed to the improved gross profit from banana sales.

HAG reported a VND 28 billion increase in other losses during the period, mainly due to the liquidation of several underperforming assets.

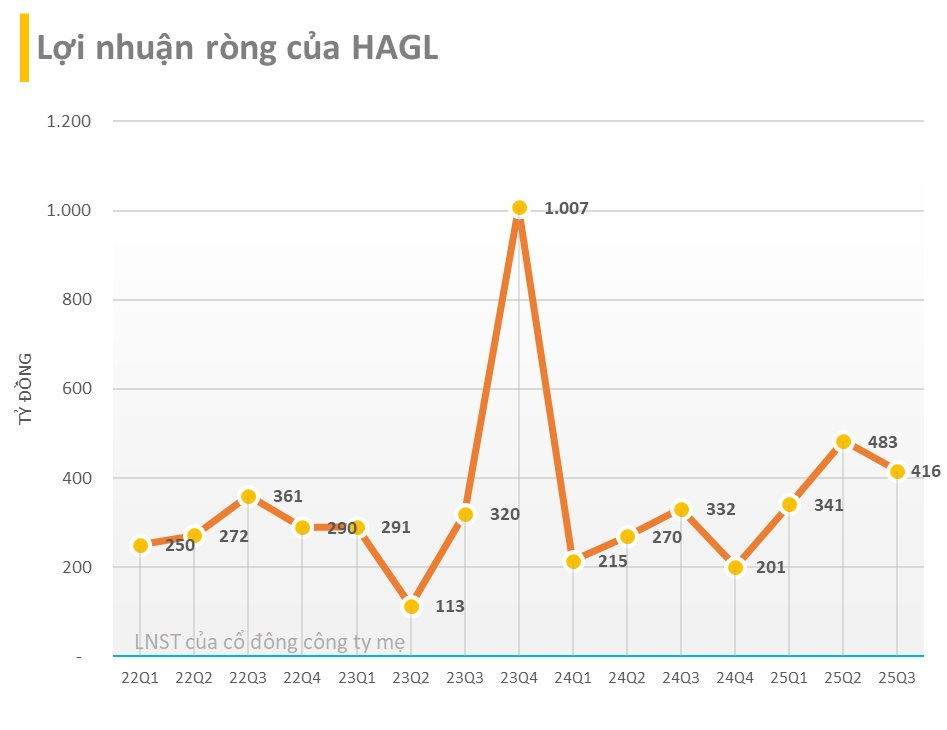

After deducting expenses, the consolidated after-tax profit for Q3 stood at VND 432 billion, a 23% increase year-over-year. The parent company’s after-tax profit for Q3 reached VND 416 billion, up by 25% compared to Q3 2024.

For the first nine months of 2025, the cumulative net revenue exceeded VND 5,600 billion, a 34% increase compared to the same period in 2024. After-tax profit reached VND 1,312 billion, a substantial 54% growth year-over-year. The parent company’s after-tax profit stood at VND 1,250 billion, up by 55%.

As of September 2025, the company’s total assets reached VND 27,744 billion, a 25% increase since the beginning of the year.

In terms of capital structure, total liabilities at the end of Q3 were VND 14,460 billion, a 12% increase year-to-date. Total loans amounted to VND 8,371 billion. Shareholders’ equity also saw a significant 42% rise, reaching VND 13,284 billion.

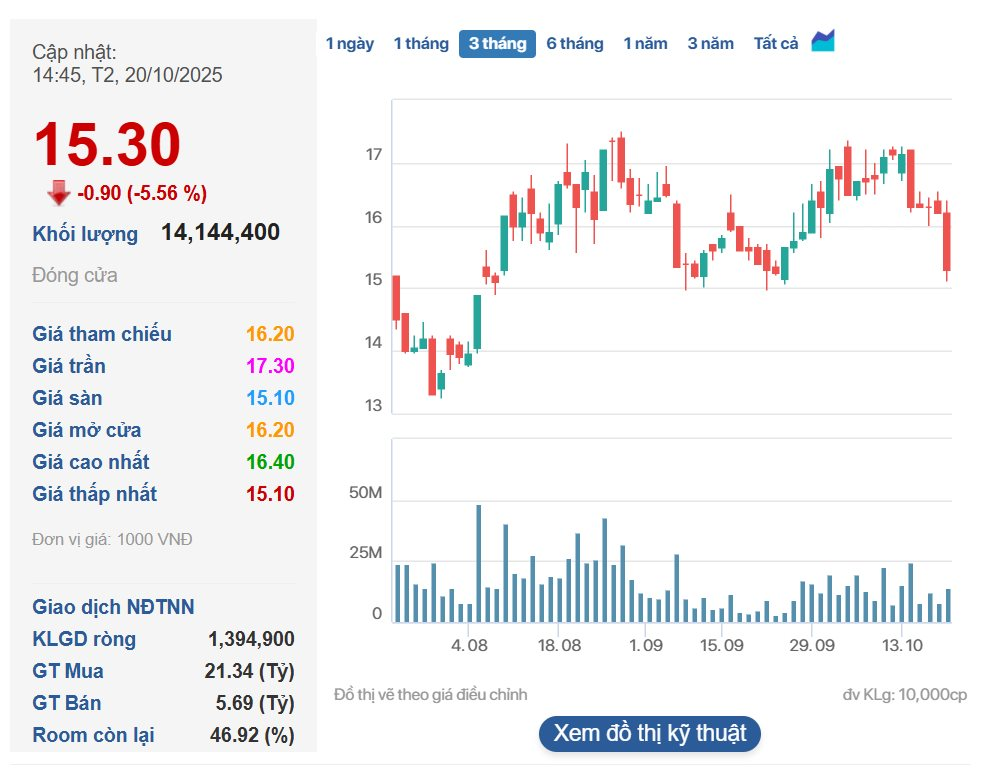

At the close of trading on October 20th, HAG’s stock price was VND 15,300 per share, down by 5.56%.

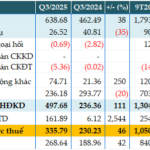

VRG Returns to Profitability in Q3, Driven by New Land Lease Contracts

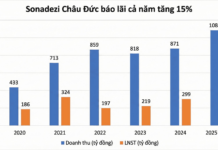

Industrial real estate firms marked their first profitable quarter in 2025, driven by new land lease agreements that significantly boosted earnings. However, the path to achieving the ambitious target of over 130 billion VND in pre-tax profit remains fraught with challenges.

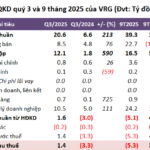

Vietcap Securities Doubles Q3 Net Profit on Strong Brokerage and Lending Performance

Vietcap Securities Corporation (HOSE: VCI) has released its Q3/2025 financial report, revealing a remarkable net profit of over 420 billion VND, doubling the figure from the same period last year. This impressive growth is primarily driven by robust brokerage and lending activities. Consequently, the company’s cumulative profit for the first nine months of the year has surged to nearly 900 billion VND, marking a 30% increase year-on-year.

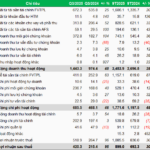

North Ha Hydro Power Rebounds Strongly in Q3

North Ha Hydropower JSC (HNX: BHA) reported a decline in post-tax profit for Q3/2025 compared to the same period last year, primarily due to lower water levels in the reservoir, which impacted revenue. However, this quarter marks a significant recovery for the hydropower company when compared to the previous two quarters.