Mr. Le Ngoc Lam, CEO of BIDV. Photo: Forbes.

Speaking at the 2025 Business Forum: Pivoting for Growth, organized by Forbes Vietnam, Mr. Le Ngoc Lam, CEO of BIDV, emphasized that banks are actively seeking viable projects and businesses to disburse funds. The government and the State Bank have also relaxed credit limits, facilitating capital flow into production.

Regarding current interest rates, Mr. Lam noted that Vietnam’s rates are significantly lower than those in the region and globally. This creates a favorable environment for businesses to increase investment.

As a leading state-owned financial institution with the largest credit market share, BIDV consistently allocates capital to support business investment, particularly for companies involved in global supply chains. The bank offers various short-, medium-, and long-term credit packages to encourage innovation, technology adoption, and enhanced production capabilities, enabling businesses to integrate into global value chains.

However, Mr. Lam highlighted a challenge akin to the “chicken or egg” dilemma. Businesses aiming to join global supply chains often must invest upfront to demonstrate their capabilities and products before securing output contracts. Banks, meanwhile, are hesitant to lend without clear output agreements. A potential solution involves government-backed guarantee funds or support mechanisms to encourage businesses to invest boldly in global supply chains.

“Regarding how businesses can access capital, I emphasize that banks are eager to lend and provide financing,” Mr. Lam stated.

He explained that, following government and State Bank directives, businesses must meet the following criteria to access bank capital: strengthen financial capacity with transparent financial systems, improve corporate governance by adopting international standards, align with ESG criteria in their business strategies, and present clear, viable business plans to build bank confidence.

“If a business is transparent and has a concrete plan, banks can confidently provide financing,” he stressed.

BIDV is also a seasoned lender for infrastructure and construction projects. According to the bank, BOT projects in transportation, energy, and other sectors often require long-term financing, which BIDV can provide for up to 15–20 years.

The bank raises capital through various channels, including bond issuance, foreign loans, and other long-term sources. However, operating under market mechanisms and relying on public deposits for business loans makes offering preferential loans as expected by investors challenging. Mr. Lam believes that encouraging infrastructure investment requires additional government support and partnership mechanisms.

“PPP mechanisms are now much clearer. In a project, the government contributes budget capital, the business provides equity (around 15%), and the remainder is sourced from banks. Banks participate in project appraisal, calculate effectiveness, and can recommend adjustments to increase government support if needed to ensure debt repayment balance.

Some transportation BOT projects now benefit from government revenue guarantees: if revenue falls short of financial plans, the government covers the deficit to ensure bank debt repayment. This mechanism reassures investors and banks when extending credit,” Mr. Lam analyzed.

Vietnam’s Untapped Potential: 42,000 KM of Rivers, 3,260 KM of Coastline, Yet Waterway Transport Remains Underinvested

On the afternoon of October 9th, the 7th discussion session of the FIATA World Congress 2025 took place at the National Convention Center in Hanoi. The vibrant session focused on the theme “Promoting Inland Waterway and Rail Transport for Sustainable Supply Chain Development.”

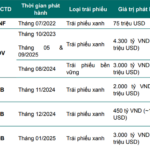

Green Bonds Struggle to Gain Traction Amid High Issuance Costs, Experts Warn

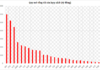

Vietnam’s sustainable bond market remains nascent, accounting for a mere 1.6% of total corporate bond debt—significantly lagging behind the global average of 4% and Asia’s 8%. Experts attribute this sluggish growth to prohibitive issuance costs, a lack of incentives, and an underdeveloped, fragmented support ecosystem.