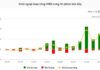

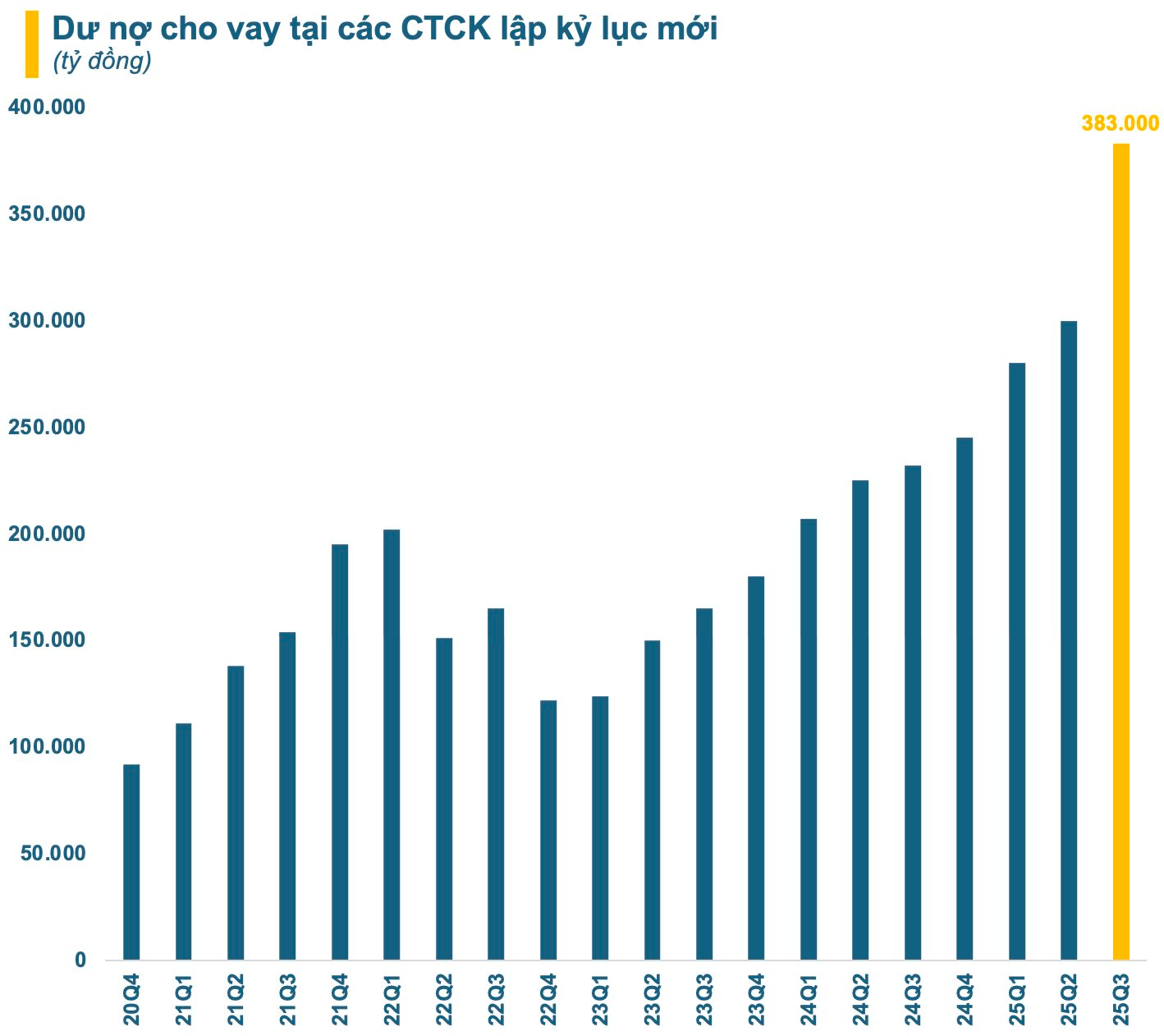

According to statistics, as of the end of Q3 2025, the outstanding loans (including margin and advance payments) at securities companies are estimated at approximately VND 383 trillion (~USD 14.5 billion), an increase of over VND 80 trillion compared to the end of Q2 and a record high.

Of this, the margin loan balance is estimated at around VND 370 trillion as of the end of Q3, up VND 78 trillion from Q2, also the highest figure in the history of Vietnam’s stock market.

The VND 78 trillion increase (approximately 27%) is also a record high for margin debt in a single quarter. This was one of the capital flows that drove the market up strongly in Q3, with the VN-Index rising over 280 points (around 21%). Alongside this, trading was highly active, with liquidity even surging to over USD 3 billion in some sessions.

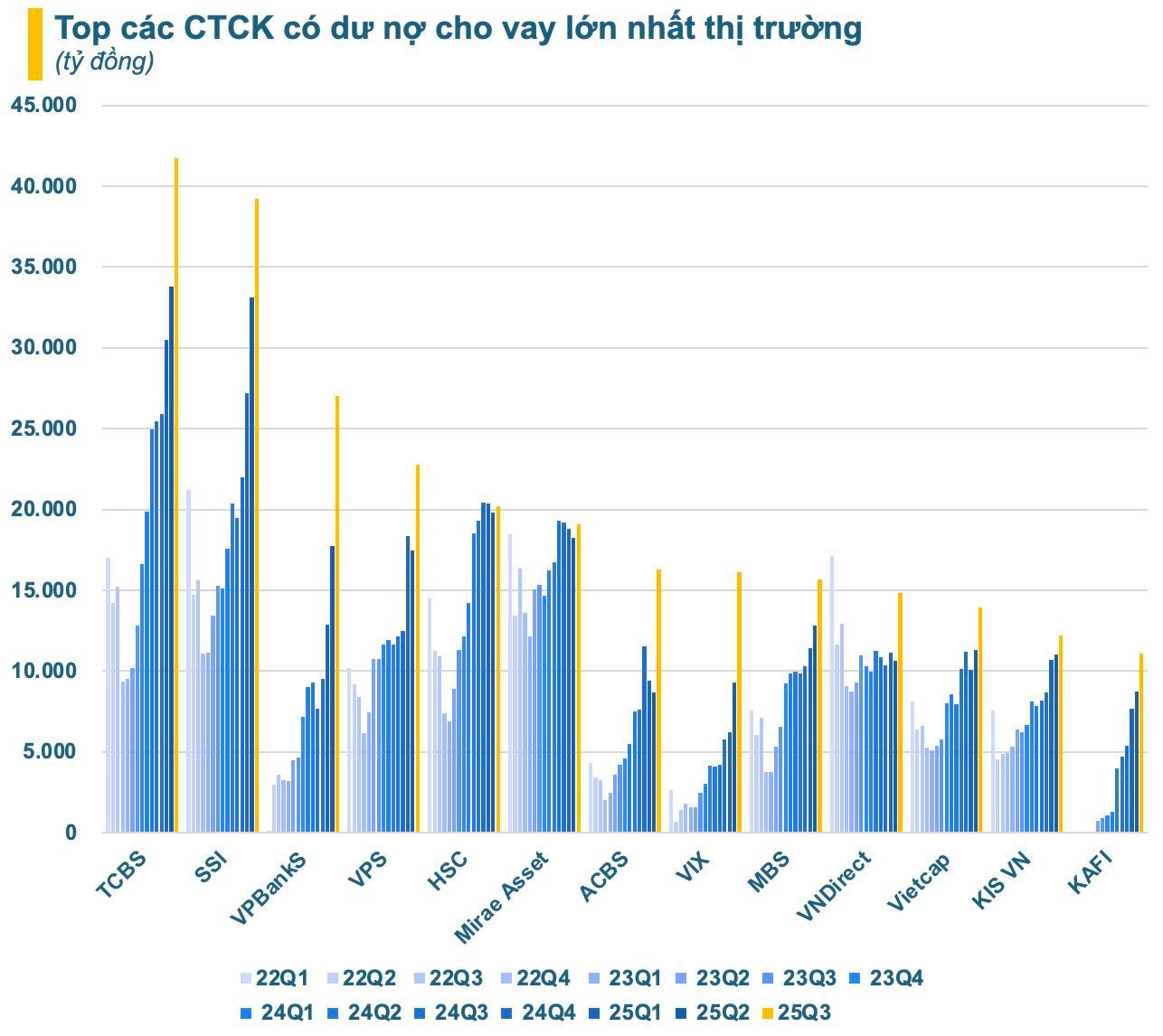

In Q3, most of the leading securities companies in lending activities recorded an increase in outstanding loans compared to the same period last year and the previous quarter. An increase of over VND 5 trillion was quite common, notably with TCBS, SSI, VPBankS, VPS, ACBS, and VIX. Among these, VPBankS expanded its lending scale the fastest, with outstanding loans increasing by nearly VND 9.3 trillion, rising to third place, just behind TCBS and SSI.

As of the end of Q3, the entire market had 13 securities companies with outstanding loans exceeding VND 10 trillion, a record high. TCBS became the first securities company in history to have outstanding loans surpass VND 40 trillion, up nearly VND 8 trillion from the end of Q2. SSI also significantly expanded its lending activities, raising its outstanding loans to over VND 39 trillion, closely following TCBS. Additionally, ACBS and VIX were notable names with soaring outstanding loans, entering the top 10.

Conversely, some top names like HSC and Mirae Asset have slowed down in recent quarters and are gradually falling behind in the lending race. The issue for HSC and Mirae Asset stems from lending limits, as the Margin/Equity ratio is nearing the 2x threshold. The slow capital increase in recent times is partly to blame.

It’s evident that with the market’s development, particularly in lending activities, the capital increase race among securities companies is expected to intensify. Just before the market upgrade, several major securities companies like SSI, TCBS, VPBankS, and VPS have planned capital increases for the upcoming boom phase.

In early September, SSI announced a plan to sell 415.5 million shares to existing shareholders, raising capital from VND 20.779 trillion to nearly VND 25 trillion, leading the industry. At a selling price of VND 15,000 per share, SSI will raise approximately VND 6.2 trillion. This amount will be used to supplement margin lending capital, invest in bonds, and deposit certificates.

Previously, TCBS completed an initial public offering (IPO) of 231.1 million shares at VND 46,800 per unit. The chartered capital after the transaction will increase to VND 23.133 trillion. The company expects to raise VND 10.817 trillion post-IPO. Approximately 70% of the proceeds will be used for proprietary trading (stocks, bonds), and 30% for margin lending.

VPBankS also plans an IPO, offering 375 million shares, equivalent to 25% of its current capital, at a minimum price of VND 12,130 per unit. The company’s chartered capital is expected to increase from VND 15 trillion to VND 18.75 trillion. Besides these names, VPS, HSC, Kafi, TPS, MBS, and TVS also plan to issue hundreds of millions of shares in the near future.

Stock Market Plunges, Trading Volume on HoSE Hits Two-Month High

The VN-Index has plummeted for two consecutive sessions, shedding a total of 130 points from its peak, effectively erasing nearly all gains accumulated over the past month. This sharp decline has instilled a cautious sentiment among individual investors.

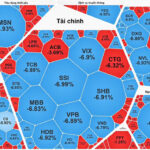

Surprise Power Unleashes $1 Trillion to Scoop Up Vietnamese Stocks as VN-Index Soars by Nearly 95 Points

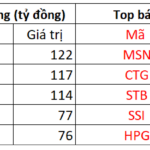

Proprietary trading firms made a surprising comeback, recording a net buying value of VND 999 billion on the Ho Chi Minh City Stock Exchange (HOSE).