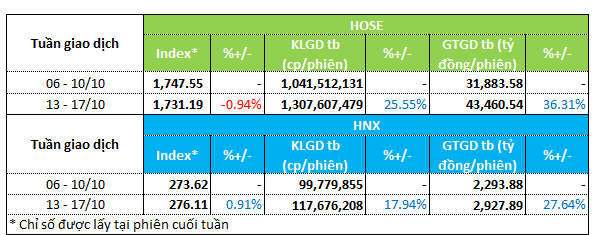

During the trading week of October 13-17, the market experienced a correction as the VN-Index dipped by nearly 1% to close at 1,731.19 points. Conversely, the HNX-Index saw a modest gain of almost 1%, reaching 276.11 points.

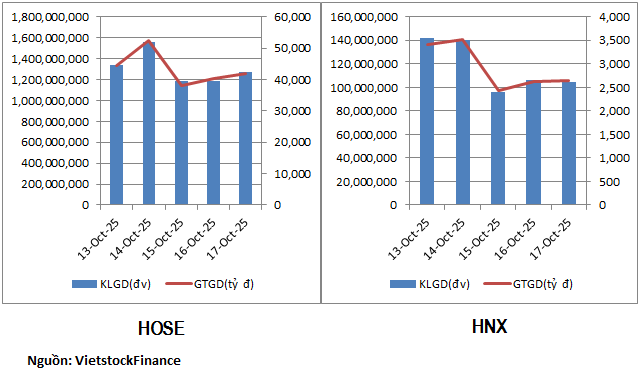

Despite the subdued index performance, trading activity remained vibrant. Liquidity surged on both major exchanges. On the HOSE, trading volume jumped 25% to 1.3 billion units per session, while trading value soared 36% to over VND 43.4 trillion per session. Similarly, the HNX recorded a nearly 18% increase in trading volume to 117.7 million units per session, with trading value climbing almost 28% to nearly VND 3 trillion.

|

Overview of Liquidity for the Week of October 13-17

|

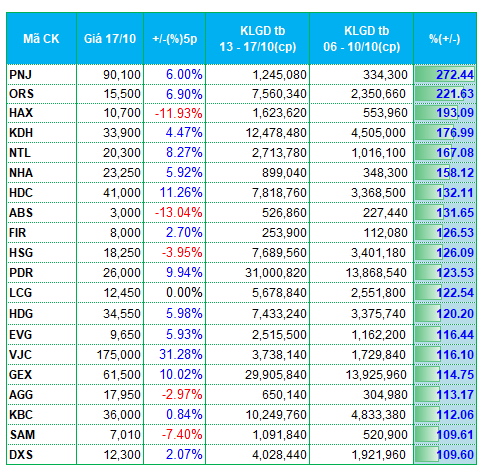

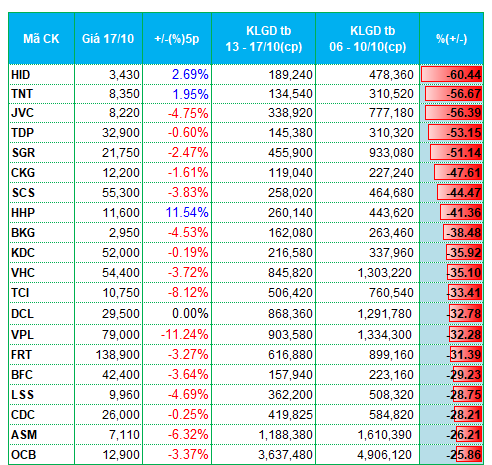

Strong inflows were concentrated in the real estate sector, with stocks from this group dominating the liquidity gainers on both exchanges. Notable performers on the HOSE included KDH, NTL, NHA, HDC, AGG, KBC, and DXS, all of which saw trading volume increases of over 100% compared to the previous week.

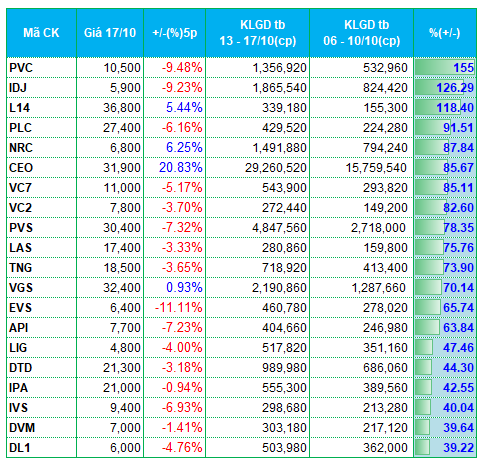

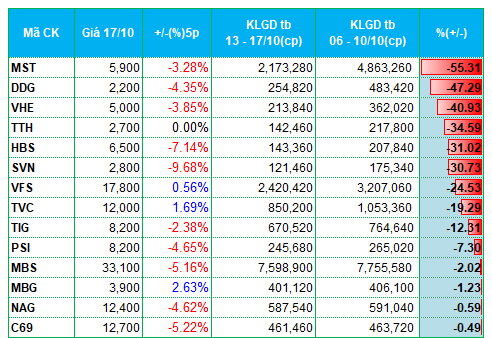

On the HNX, standout stocks included IDJ, L14, NRC, CEO, API, and DTD, with IDJ and L14 posting gains of more than 100%.

Amid the liquidity surge, outflows were sporadic and limited to specific sectors such as timber, seafood, and textiles. In the timber sector, HHP and BKG saw outflows. For seafood, VHC and ASM were notable. The securities sector experienced significant outflows, particularly on the HNX, with HBS, VFS, TVC, PSI, and MBS seeing sharp liquidity declines. On the HOSE, TCI recorded a drop of over 30%.

|

Top 20 Stocks with Highest Liquidity Gains/Losses on HOSE

|

|

Top 20 Stocks with Highest Liquidity Gains/Losses on HNX

|

The list of stocks with the highest liquidity gains/losses is based on average trading volumes exceeding 100,000 units per session.

– 19:28 20/10/2025

Insider Selling Surge: Executives’ Relatives Offload Shares in Corporate Rush

Mr. Tran Ngoc Dan’s brother-in-law, Chairman of the Board of Directors at City Auto Joint Stock Company, sold 217,145 shares of CTF. Ms. Huynh Hoang Hoai Han, Acting Chief Accountant at Chuong Duong Joint Stock Company, sold 218,000 shares of CDC, reducing her ownership to 0% of the company’s charter capital.

Expert Insight: The “Resting” Phase is Essential—VN-Index Gearing Up for the Next Bull Run

Most experts agree that last weekend’s correction was merely a “pit stop” for the upcoming bullish waves, with the immediate target set at 1,800 points.

Vietstock Weekly (Oct 20-24, 2025): Consolidating at the Peak

The VN-Index reversed its upward trend, closing lower as a Long Upper Shadow candlestick pattern emerged, accompanied by trading volume surpassing the 20-week average. This suggests intense profit-taking pressure as the index approached new historical highs. While the MACD has maintained a buy signal since May 2025, the weakening momentum of the Stochastic Oscillator in overbought territory indicates potential short-term volatility ahead.