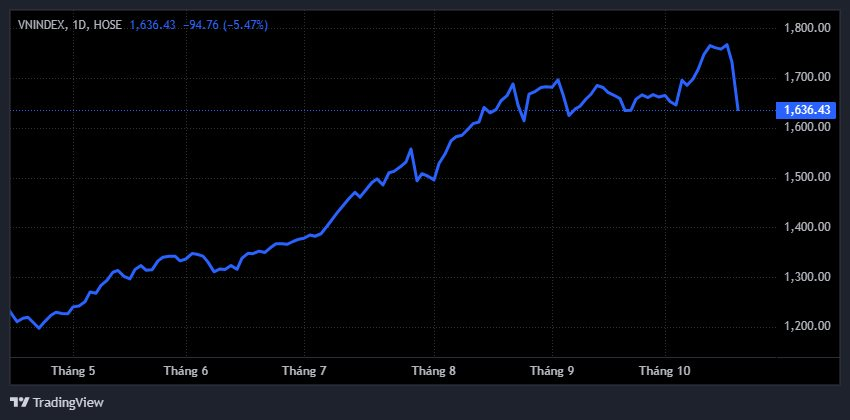

The Vietnamese stock market witnessed a shocking start to the week on October 20th, as the VN-Index plummeted nearly 95 points—an unprecedented decline. This abrupt shift caught investors off guard, especially after the index had recently reached consecutive record highs.

Mr. Bui Van Huy, Vice Chairman of FIDT, attributed this dramatic drop to a confluence of factors.

Firstly, the market had been experiencing a “green shell, red core” phenomenon over the past month, with blue-chip stocks like Vingroup and Gelex surging while the majority of other stocks underperformed, leaving many investors in the red. When these blue chips reversed course, the accumulated frustration among investors triggered a wave of sell-offs.

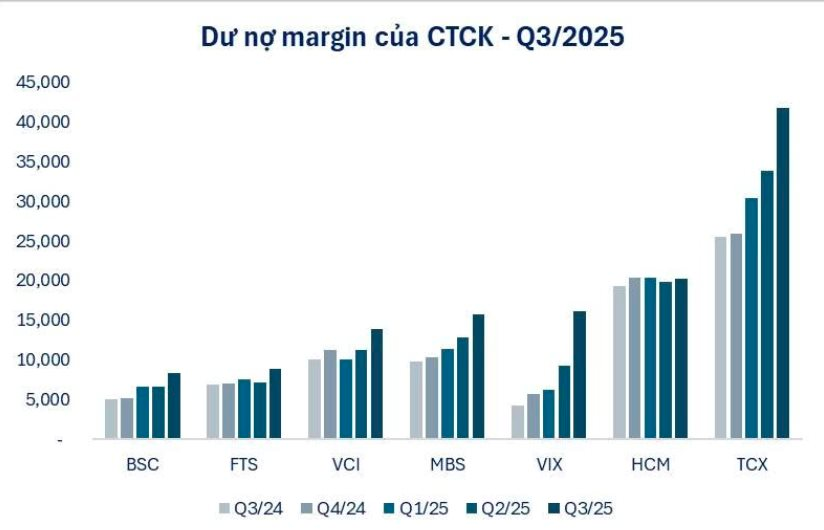

Secondly, margin debt had risen significantly, forcing investors to restructure their portfolios as the market showed signs of correction. Financial reports from several securities companies revealed a notable increase in margin lending compared to the previous quarter.

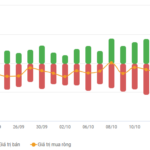

Thirdly, foreign investors continued their strong net selling, offloading nearly VND 2 trillion during the session, primarily due to concerns over exchange rate fluctuations, further exacerbating the selling pressure.

Market liquidity surpassed VND 53 trillion—the highest in a month—concentrated in the afternoon session as selling pressure intensified. Mr. Huy interpreted this as a clear sign of “unloading,” driven by investor pessimism and high margin levels forcing rapid account adjustments.

He also highlighted the cyclical nature of the market: “Typically, in October and November, the Vietnamese market experiences strong profit-taking pressure to discount prices, preparing for the year-end rally—a phenomenon often referred to as the Halloween effect.”

Strong support at 1,500–1,550 points

Regarding the trend, Mr. Huy noted that the market had risen over 30% since the beginning of the year, making a correction reasonable, especially since most supportive news, such as upgrades and Q3 earnings, had already been priced in.

However, the expert believed the sell-off might have gone too far for some fundamentally strong stocks. This year’s VN-Index rally was primarily driven by a few sectors, such as Finance and large conglomerates like VinGroup and GELEX. Meanwhile, manufacturing, export, industrial zone, and commodity stocks remain at their 2023 lows, offering more attractive valuations compared to the broader market.

Mr. Huy warned that a wave of margin calls is entirely possible. According to Q3 financial reports from major securities firms like TCX (TCBS), HCM, VCI, FTS, MBS, and VIX, margin lending increased compared to Q2/2024 and the same period in 2024.

Estimates suggest that around 80% of stocks have underperformed recently, weakening investors’ account buffers. “If the market continues to decline for one or two more sessions with the same intensity as October 20th, widespread margin calls could occur, pushing the index even lower,” he predicted.

With the VN-Index breaching the 1,700-point mark, Mr. Huy identified the next strong support level at 1,500–1,550 points, especially if margin calls add further pressure.

Several stock groups poised for rebound after correction

Nonetheless, the expert remains optimistic about the stock market’s medium- to long-term prospects. He explained that the government’s accommodative policies aim to achieve high growth targets. Low interest rates, record-high gold prices, and a sluggish real estate market make equities a more attractive investment option.

“Market valuations are currently reasonable, presenting an opportunity for patient, long-term investors. However, close monitoring of exchange rate risks and geopolitical developments is essential for informed investment strategies,” Mr. Huy advised.

According to the expert, two stock groups stand out during this correction.

The first is companies with strong Q3 earnings, including securities, construction materials, and fertilizers. As positive financial results emerge, these stocks are likely to attract early attention post-correction.

The second group comprises sectors directly benefiting from macroeconomic policies, such as construction, construction materials, real estate, and banking. With the government’s focus on high economic growth, supportive measures like credit expansion (benefiting banks), increased public investment (aiding construction and materials), and relaxed land management regulations (boosting real estate) are expected.

The expert believes these sectors’ prospects are not only promising in the short term but could extend into 2026 as these policies take effect and yield results.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.

Daily Stock Purchase: Astonishing Returns from FPT Holdings by Chairman Truong Gia Binh

Investing in FPT Corporation by purchasing one share daily resulted in an 80% loss after two years, requiring an additional five years to break even. However, since 2014, the investment value has consistently risen, delivering a remarkable return of nearly 1,500% to date.