Intense selling pressure weighed heavily on Vietnam’s stock market, leading to a historic trading session with multiple records set. The VN-Index closed with a staggering 95-point drop (-5.47%), settling below 1,636 points. This marks the most significant absolute decline in the VN-Index’s history.

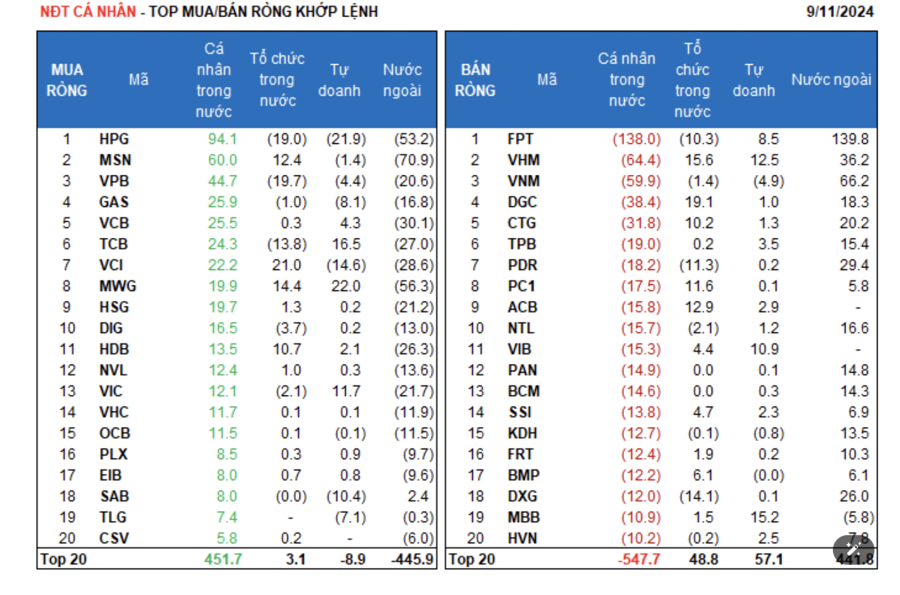

Foreign trading activity further exacerbated the situation, with net selling reaching VND 2,042 billion across the market.

On HOSE, foreign investors net sold VND 1,962 billion

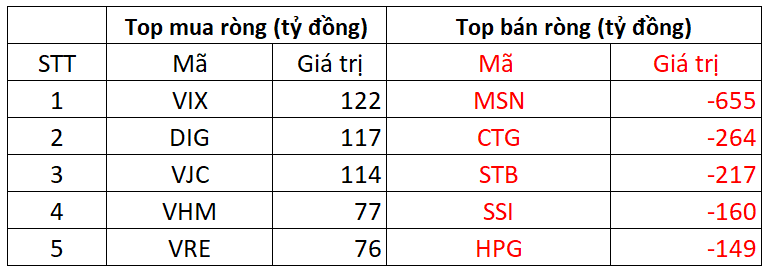

On the buying side, VIX emerged as the most purchased stock by foreign investors on HOSE, with a value exceeding VND 122 billion. DIG followed closely, attracting VND 117 billion in foreign investment. Additionally, VJC and VHM saw significant buying interest, with VND 114 billion and VND 77 billion, respectively.

Conversely, MSN led the selling spree with VND 655 billion in net sales. CTG and STB also faced substantial selling pressure, with VND 264 billion and VND 217 billion, respectively.

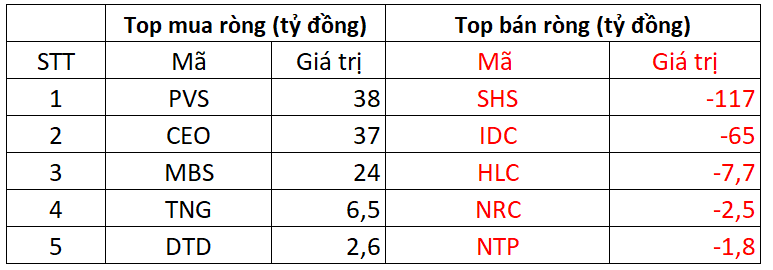

On HNX, foreign investors net sold VND 86 billion

PVS topped the buying list on HNX, with a net purchase value of VND 38 billion. CEO followed suit, attracting VND 37 billion in foreign investment. Other stocks like MBS, TNG, and DTD also saw modest net buying activity.

On the selling side, SHS faced the most significant foreign selling pressure, with nearly VND 117 billion in net sales. IDC followed with VND 65 billion, while HLC and NRC saw net sales ranging from VND 2 billion to VND 8 billion.

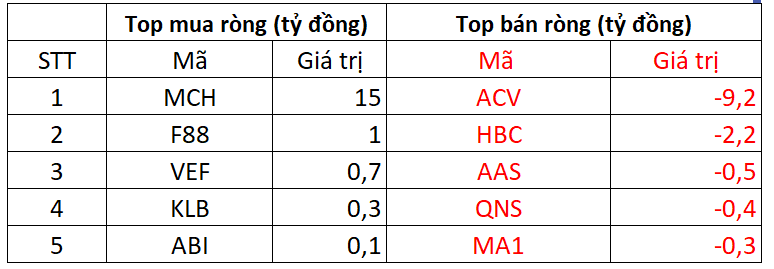

On UPCOM, foreign investors net bought VND 5 billion

MCH led the buying activity on UPCOM, with foreign investors purchasing VND 15 billion worth of shares. F88 and VEF also saw modest net buying, with a few billion dong each.

Capture3.PNG

In contrast, ACV experienced net selling of VND 10 billion by foreign investors. Other stocks like HBC and AAS also faced net selling pressure.

Market Pulse 21/10: Foreign Investors Shift to Net Buying

As the morning session drew to a close, sellers took control, with nearly 500 stocks declining, dwarfing the roughly 240 that managed to rise. By the end of the session, the VN-Index had fallen 6 points to 1,630.47, while the HNX-Index shed over 2 points, closing at 260.85.

Market Pulse October 20: Capital Flight from Financial and Real Estate Sectors Sends VN-Index Plummeting Nearly 95 Points

At the close of trading, the VN-Index plummeted 94.76 points (-5.47%), settling at 1,636.43 points, while the HNX-Index dropped 13.09 points (-4.74%), closing at 263.02 points. Market breadth was overwhelmingly negative, with 686 decliners (including 150 at the lower limit) versus just 140 advancers. Similarly, all constituents of the VN30 basket ended the session in the red.

Vietstock Daily 21/10/2025: Panic Selling Surges, Short-Term Risks Escalate

The VN-Index plummeted sharply, marked by a long red candle accompanied by a surge in trading volume and a significantly higher number of declining stocks compared to advancing ones, reflecting overwhelming selling pressure across the board. The index breached the 1,700-point threshold, slicing through the Middle Bollinger Band and poised to retest the August 2025 lows (ranging between 1,605–1,630 points). Further compounding concerns, the MACD indicator triggered a sell signal as it crossed below the Signal line, signaling heightened short-term risks.