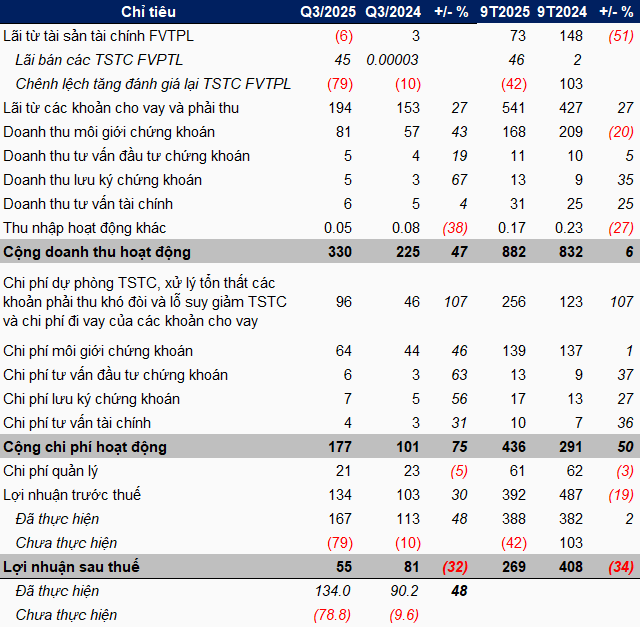

Specifically, the unrealized post-tax loss reached nearly VND 79 billion, significantly higher than the VND 10 billion loss in the same period last year. This fluctuation is primarily attributed to the revaluation of listed stocks.

Conversely, the company recorded a realized post-tax profit of nearly VND 134 billion, a 48% increase. In Q3, the company recognized over VND 45 billion in profit from the sale of FVTPL financial assets, a substantial surge compared to the same period last year. This revenue is primarily explained by the sale of approximately 1.2 million units of stocks and fund certificates during the quarter.

This volume is nearly equivalent to the total number of MSH (May Sông Hồng) shares sold by the company, with 672,000 shares and 520,000 shares sold in July 2025, respectively. By the end of September, FPTS attempted to sell an additional 1.2 million MSH shares but was unsuccessful due to unfavorable market prices.

Revenue for the period also grew by 55%, which FPTS attributes to the strong liquidity in Q3, driving a 43% increase in brokerage revenue to over VND 81 billion and a 27% rise in lending revenue to nearly VND 194 billion.

However, the push to expand lending activities also led to a doubling of costs associated with financial asset provisions, handling losses from bad debts, and financial asset impairments, with borrowing costs for loans reaching nearly VND 96 billion.

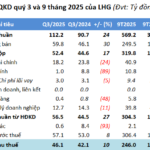

With the Q3 results, the company could only increase its post-tax profit for the first nine months to nearly VND 269 billion, a 34% decrease compared to the same period last year.

For 2025, FPTS aims to achieve VND 500 billion in realized pre-tax profit. Thus, with over VND 388 billion earned in the first nine months, the company has completed 78% of its annual target.

|

FPTS’s Q3 and 9-month cumulative business results for 2025

Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, FPTS’s total assets reached nearly VND 13.7 trillion, a 40% increase from the beginning of the year. The two largest components, outstanding loans and FVTPL financial assets, both saw significant growth compared to the start of the year.

Specifically, outstanding loans reached nearly VND 8.9 trillion, a 26% increase, primarily from margin lending. This was also a key factor in FPTS’s lending revenue growth during the period.

The fair value of FVTPL financial assets exceeded VND 4 trillion, double that of the beginning of the year, mainly invested in bonds (over VND 2.2 trillion) and fixed-term deposits and deposit certificates (nearly VND 1.4 trillion). Investments in listed and traded stocks recorded nearly VND 457 billion, with the value of MSH stock investments exceeding VND 455 billion, 38 times the purchase price.

Regarding capital sources, FPTS’s debt reached nearly VND 8.1 trillion, a 48% increase from the beginning of the year, accounting for 59% of the total. The company also saw a significant surge in short-term payables and other liabilities, increasing 177 times to over VND 1.1 trillion.

– 13:47 20/10/2025

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.

Long Hậu Surpasses 70% of Annual Profit Target in Just 9 Months

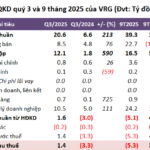

In Q3, Long Hau Corporation (HOSE: LHG) reported net revenue exceeding VND 112 billion, a 24% year-on-year increase, with nearly half attributed to a 19% rise in leasing revenue from industrial workshops, accommodation areas, and commercial centers. Net profit reached over VND 46 billion, marking a 10% growth.