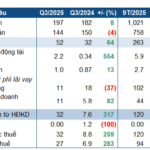

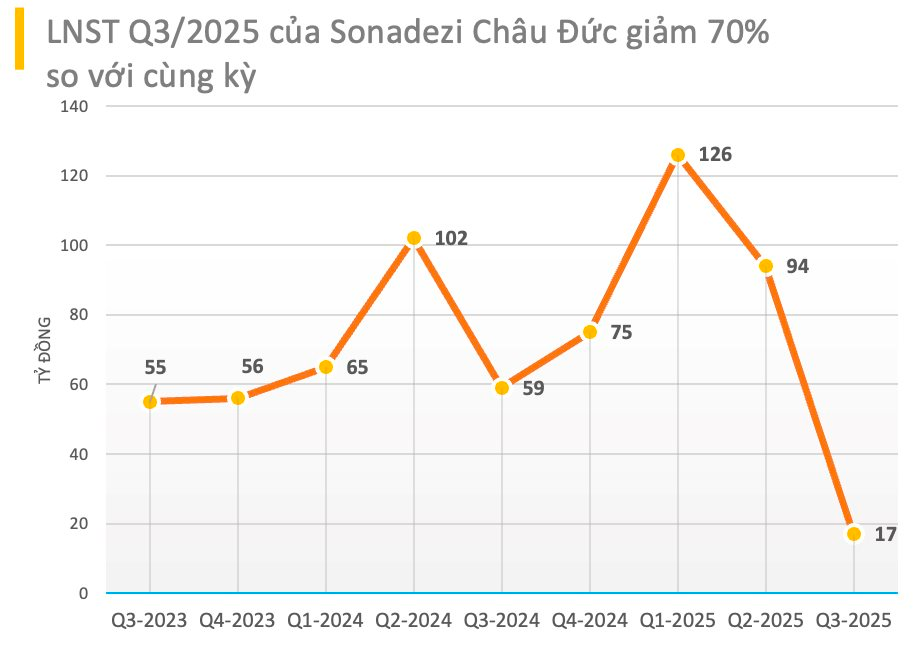

Sonadezi Chau Duc JSC (stock code: SZC) has announced its Q3/2025 business results, revealing a significant decline compared to the same period last year.

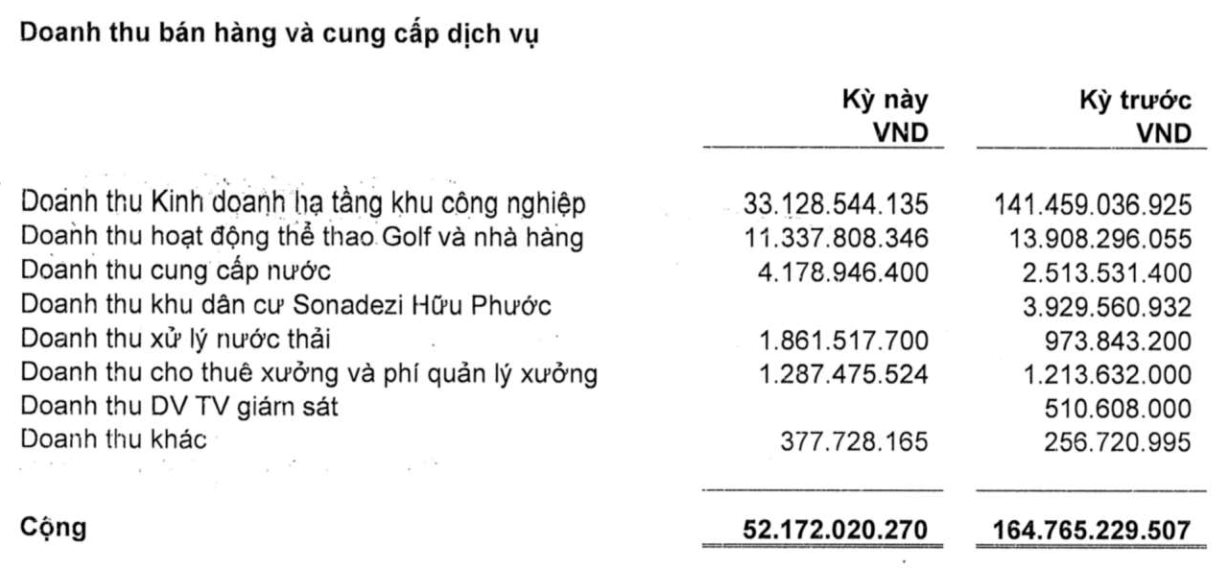

Revenue from sales and services reached over 52 billion VND, a 65% decrease compared to Q3/2024.

The primary reason for this decline is the 76% drop in revenue from the company’s core business segment, industrial zone infrastructure leasing, which now stands at 33 billion VND.

Cost of goods sold decreased by 57% compared to the same period in 2024. Financial revenue dropped by 26%, while financial expenses decreased by a corresponding 26% compared to Q3/2024. Selling expenses plummeted by 97%, and administrative expenses fell by 71% year-over-year.

As a result, net profit after tax reached over 17.4 billion VND, a 70% decrease compared to the same period last year.

In the first nine months of 2025, Sonadezi Chau Duc recorded a revenue of 652 billion VND and a net profit after tax of 227 billion VND, remaining relatively stable compared to the same period last year.

Sonadezi Chau Duc, established in 2007, is a key subsidiary of Sonadezi Industrial Zone Development Corporation (SNZ). The company is the developer of Chau Duc Industrial and Urban Zone, a large-scale project in Ho Chi Minh City, spanning over 2,300 hectares.

On the stock market, as of the close of trading on October 20th, SZC shares were priced at 30,250 VND per share, a nearly 7% decrease from the previous session.

Hue Garment Sets 9-Month Profit Record, Yet Faces Hefty Penalty from Tax Authority

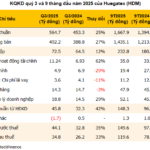

Fueled by rising yarn prices and lower input costs, Hue Textile Joint Stock Company (Huegatex, UPCoM: HDM) reported a net profit of VND 120 billion in the first nine months of 2025, surpassing its full-year 2024 profit of VND 109 billion. However, during the same period, the company was fined and required to pay nearly VND 1 billion in back taxes by the Hue Tax Department.

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

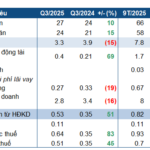

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.

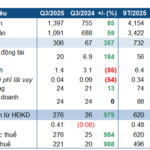

Record-Breaking Profits for DDV, Surpassing Annual Targets

DAP – VINACHEM Corporation (UPCoM: DDV) soared to new heights in Q3 2025, achieving a record-breaking quarterly profit. This remarkable performance was driven by a significant surge in both revenue and selling prices of its flagship product, DAP, compared to the same period last year.