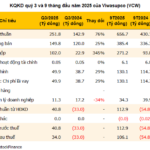

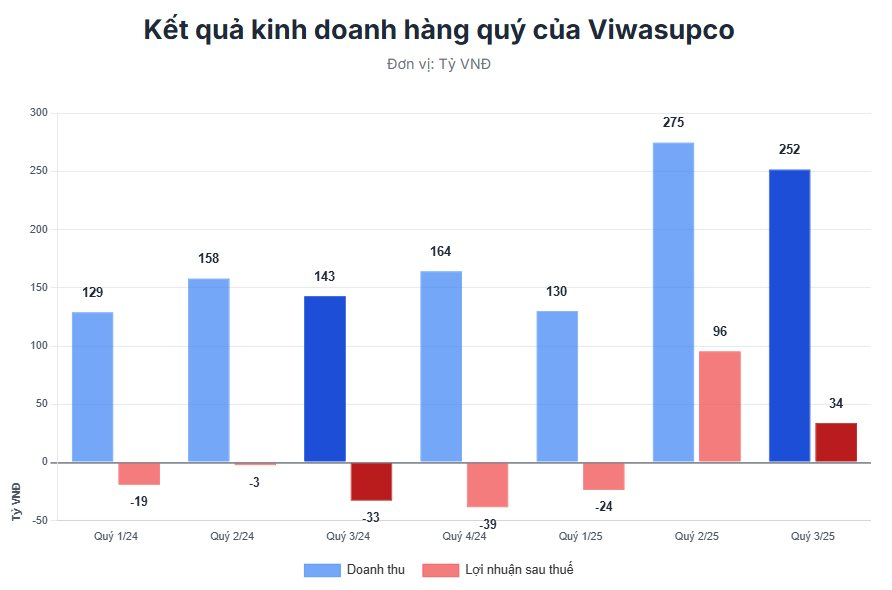

After seven consecutive quarters of losses, Viwasupco (stock code: VCW) demonstrated a notable recovery in Q3/2025. The company’s financial report revealed a net revenue of nearly VND 252 billion, marking a 76% increase compared to the same period last year. This growth is attributed to higher consumption of clean water and a price adjustment implemented during the year.

More significantly, the cost of goods sold increased by only 25%, improving the gross profit margin from 16% in Q3/2024 to 40.5% this quarter. As a result, Viwasupco reported an after-tax profit of nearly VND 34 billion, a substantial turnaround from the VND 33 billion loss in the same period last year.

For the first nine months of 2025, the company achieved a revenue of nearly VND 657 billion and an after-tax profit of VND 106 billion. With these results, Viwasupco has surpassed its annual profit target by nearly three times, despite completing only 79% of its revenue plan.

However, this positive business news coincides with the company’s leadership seeking written shareholder approval to revoke its public company status. The reason cited is that Viwasupco’s shareholder structure no longer meets the requirements of the Securities Law.

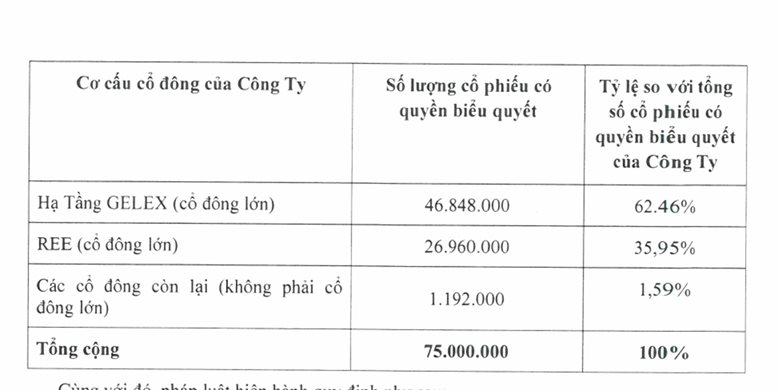

Specifically, the shares held by investors who are not major shareholders account for only 1.59%, significantly below the 10% minimum required by law. Currently, the two largest shareholders of Viwasupco are GELEX Infrastructure JSC (a member of GELEX) and REE Clean Water LLC, holding 62.46% and 35.95% of the charter capital, respectively.

According to the documents sent to shareholders, the Board of Directors believes that proactively revoking the public company status before the January 1, 2026 deadline is necessary to ensure legal compliance and allow the company to focus on its core business operations. Shareholder rights will remain protected under the Enterprise Law and the company’s charter.

Financially, despite the return to profitability, Viwasupco faces pressure from its debt obligations. As of September 30, 2025, the company’s total financial debt stood at VND 3,508 billion, an increase of over VND 1,000 billion since the beginning of the year. Interest expenses for the first nine months totaled VND 130 billion, accounting for approximately 20% of revenue.

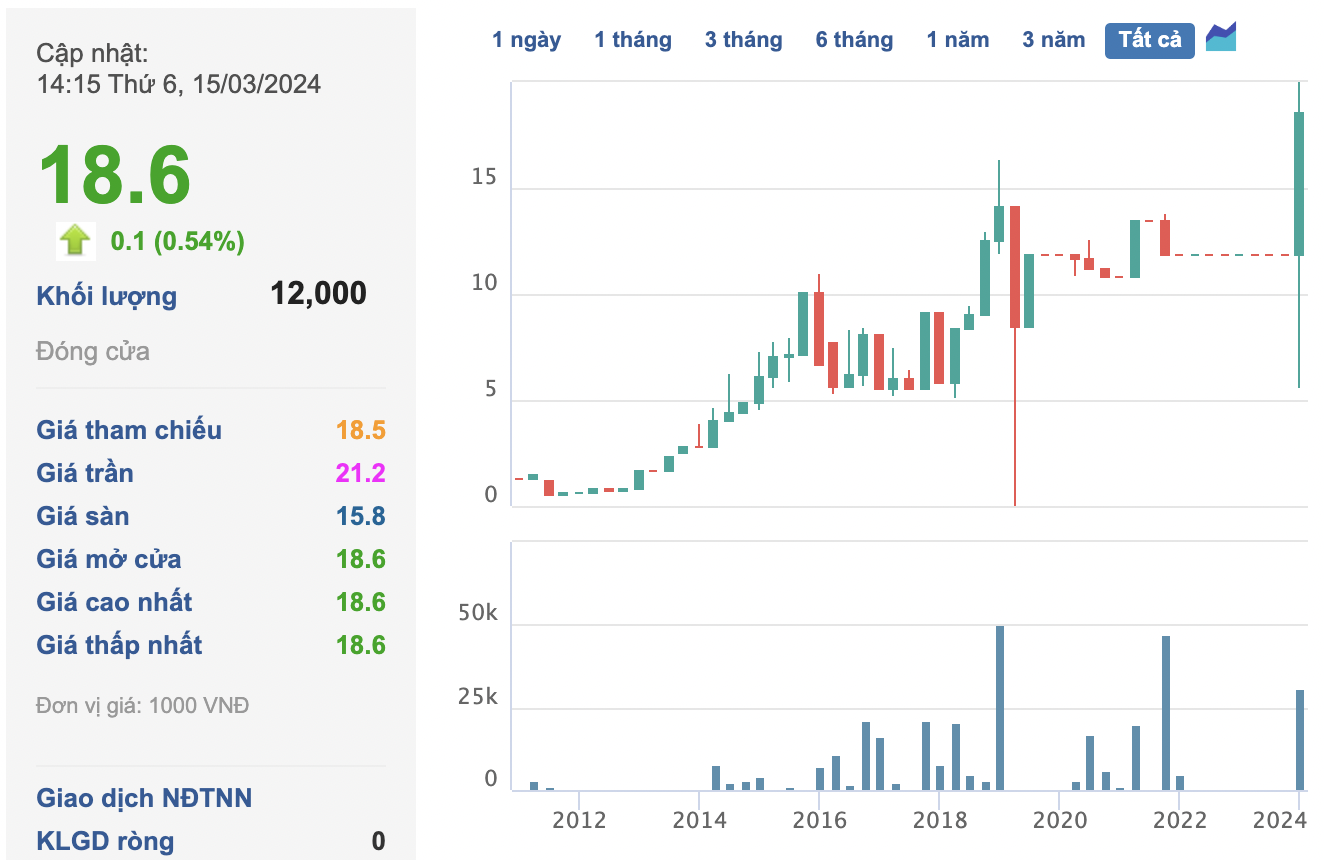

On the stock market, VCW shares are traded on the UPCoM platform. The stock’s liquidity remains low, with an average trading volume of just over 1,700 units per session, reflecting the company’s concentrated shareholder structure.

Viwasupco Posts Massive Profits, Seeks Delisting Amid Soaring Debt of Over VND 3,500 Billion

Viwasupco (UPCoM: VCW) reported a remarkable turnaround in Q3 2025, posting a net profit of VND 34 billion, a stark contrast to the VND 33 billion loss incurred in the same period last year. Amidst this robust business recovery, the company is seeking shareholder approval to delist and revoke its public company status.

Vietnam Airlines Successfully Raises Nearly VND 9,000 Billion, Ministry of Finance No Longer the Largest Shareholder

Vietnam Airlines (HOSE: HVN), the national flag carrier of Vietnam, has successfully raised nearly VND 9,000 billion through a public offering of 900 million shares.