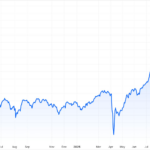

The VN-Index closed the third quarter at 1,661.7 points, marking a 21% increase from the beginning of the quarter and a 31% surge year-to-date. This upward trend was accompanied by an average daily trading value of nearly VND 39.5 trillion, a significant improvement from the VND 22 trillion in Q2 and VND 16.4 trillion in Q1.

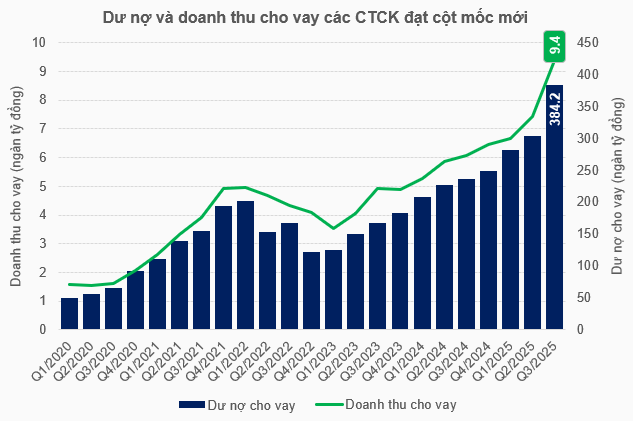

Amid this backdrop, outstanding loans (primarily margin lending) from securities companies continued to reach new heights. As of the end of Q3, the total lending volume soared to approximately VND 384.2 trillion, a 54% increase since the start of the year. Over a longer cycle, the market’s total outstanding loans have seen an 11-quarter consecutive growth streak, beginning in Q1 2023.

This surge in outstanding loans propelled lending revenue to nearly VND 9.4 trillion in Q3, a 54% jump compared to the same period last year.

Source: VietstockFinance

|

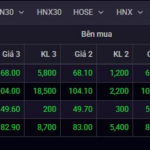

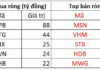

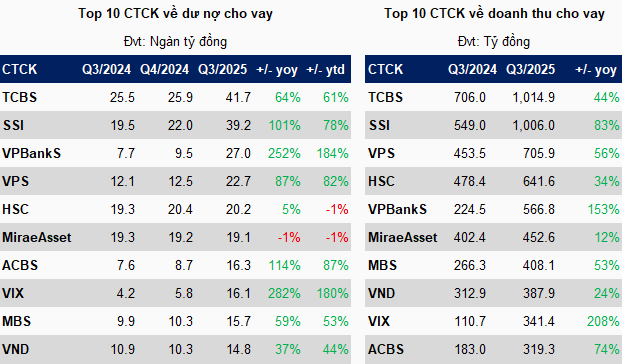

According to VietstockFinance data as of October 20, the top 10 securities companies with the largest margin debt in Q3 recorded a combined total of nearly VND 233 trillion, accounting for 61% of the market.

TCBS and SSI led the industry with outstanding debts of VND 41.7 trillion and VND 39.2 trillion, respectively. Following closely were VPBankS (VND 27 trillion), VPS (VND 22.7 trillion), and HSC (VND 20.2 trillion).

In terms of revenue, TCBS and SSI maintained their top positions, generating over VND 1 trillion in Q3, thanks to their substantial outstanding debts.

Regarding growth rates, VPBankS and VIX showcased impressive performances, both doubling their figures. VPBankS saw a 184% increase in outstanding debt since the beginning of the year and a 252% rise year-on-year, with revenue climbing 153% year-on-year. VIX’s outstanding debt at the end of Q3 surged 180% since the start of the year and 282% year-on-year, while revenue jumped 208%.

Source: VietstockFinance

|

Ample Lending Headroom Remains

In addition to borrowed capital, securities companies’ lending capacity is bolstered by their equity capital—a metric that has been a focal point of competition among firms in recent years.

Among recent capital increase initiatives, VPBankS stood out with its IPO plan of up to 375 million shares (25% of its capital), potentially raising its charter capital from VND 15 trillion to VND 18.75 trillion upon success.

During the IPO Roadshow on October 15, Mr. Vu Huu Dien, Board Member and CEO of VPBankS, emphasized the urgency of capital increase at this juncture.

He attributed this to the rapid business growth and anticipated continued expansion, which, despite placing VPBankS among the top 4 in the industry in terms of capital, still faces constraints due to safety regulations and state mandates. Failure to increase capital within the next six months would hinder the growth pace and strategic direction of both the VPBank ecosystem and the company itself.

VPBankS leadership also highlighted the current market conditions as highly favorable for capital raising, citing FTSE Russell’s upgrade of Vietnam’s market status to Secondary Emerging, which is expected to attract more robust capital inflows.

Regulations cap total lending limits at twice the equity capital. With consecutive capital increase transactions, the industry’s total equity capital has surpassed VND 331 trillion, a 17% increase since the start of the year and a 23% rise year-on-year. This scale enables a margin lending capacity of over VND 663 trillion, 1.7 times the outstanding debt at the end of Q3, indicating significant headroom for lending in the market.

However, several securities companies, including PSI, MBS, FPTS, and VCBS, have already maxed out their lending limits, even exceeding them by the end of Q3. Many others, such as KIS, Mirae Asset, PHS, and HSC, are nearing their limits.

Despite this, Mr. Truong Hien Phuong, Senior Director at KIS, shared with the author that the substantial headroom among most securities companies in the top 10 brokerage market share indicates that the current margin market is far from “tight,” but rather, quite abundant.

– 13:52 21/10/2025

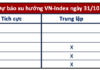

Viettel Stocks Surge Against Market Trends

Closing the session on October 20th, the stock prices of Viettel Global (VGI), Viettel Construction (CTR), Viettel Post (VTP), and Viettel Consulting & Design (VTK) collectively surged, with gains ranging from 3.9% to 4.8%.