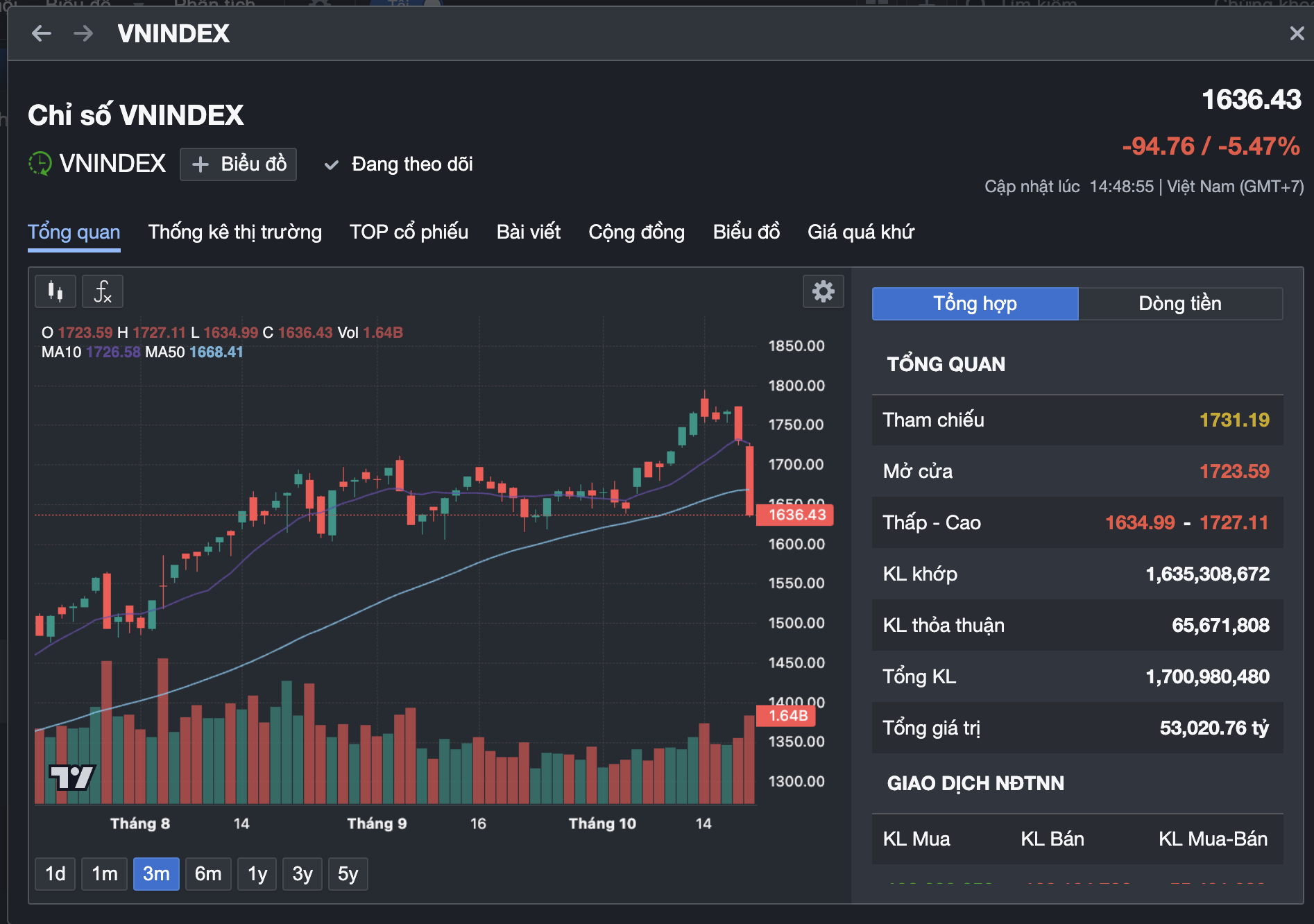

The VN-Index took a dramatic turn on October 20, closing at 1,636 points, a staggering loss of nearly 95 points (5.47%). Similarly, the HNX Index plummeted by over 13 points (4.74%), settling at 263 points.

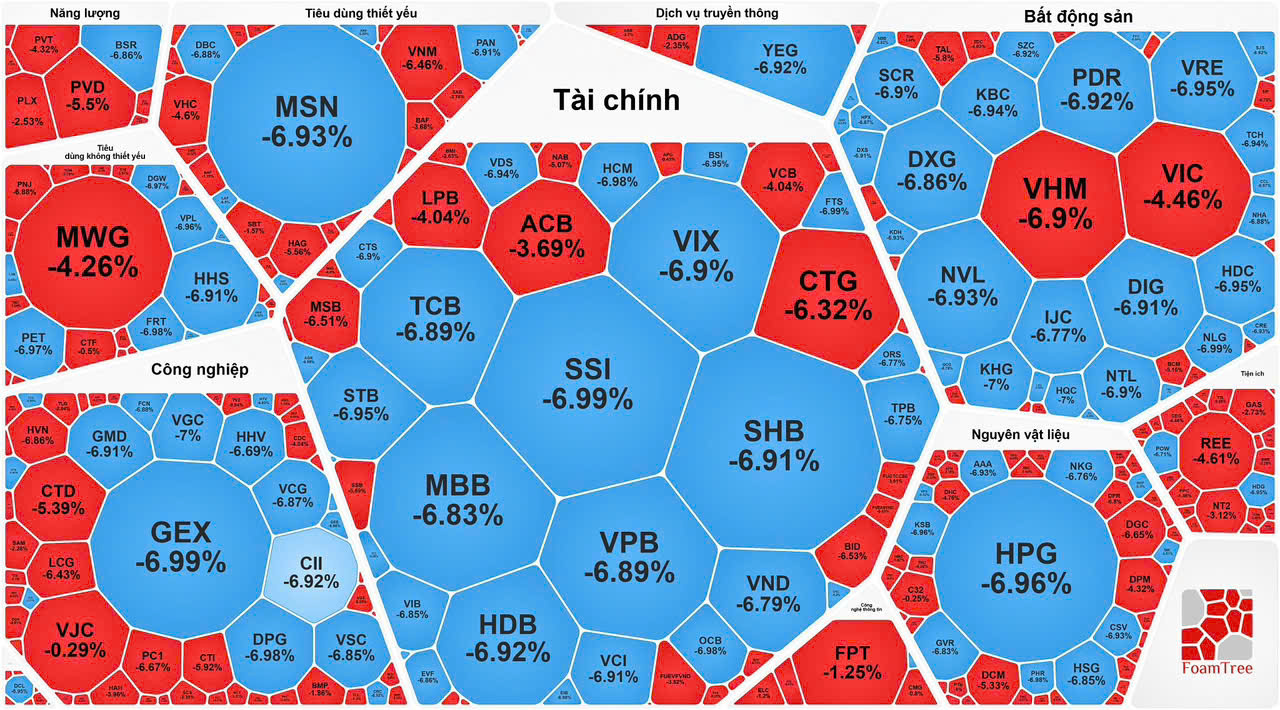

Market liquidity surged, with trading values on the HOSE exceeding 53 trillion VND. Widespread sell-offs, particularly among large-cap stocks, sent the VN30 index tumbling by more than 106 points to 1,870 points.

Over 770 stocks ended in the red, with 150 hitting their lower limit, as panic gripped the market in the final trading hours. Foreign investors continued their net selling spree, offloading over 2 trillion VND, further intensifying the downward pressure on indices.

The VN30 basket witnessed a massive sell-off in blue-chip stocks such as VIC, VHM, VCB, TCB, BID, and CTG, which significantly impacted the overall market. Numerous stocks hit their lower limits, leaving investors in a state of shock.

On various stock forums, investors were in a frenzy, struggling to comprehend the sudden drop in their portfolio values. Months of accumulated wealth evaporated within minutes.

Numerous stocks hit their lower limits.

In an interview with *Báo Người Lao Động*, financial expert Phan Dũng Khánh analyzed that the market had been reaching new highs for several days, peaking near 1,800 points. Despite positive news such as Vietnam’s stock market upgrade and robust economic growth, short-term factors like soaring gold prices and international market news took their toll.

“In reality, the VN-Index’s recent gains were supported by low liquidity, with the overall index driven primarily by VN30 stocks. Many other stocks remained below pre-upgrade levels. Thus, any market reversal prompted investors to lock in profits, exerting significant downward pressure,” explained Mr. Phan Dũng Khánh.

Investors were stunned by the market’s sharp decline.

According to VPS Securities, there were no significant developments, and global stock markets, particularly in Japan and India, were still trending upward.

“In theory, during highly volatile sessions, it’s best to avoid hasty decisions. Assess whether your portfolio is within safe limits and review the stocks you hold.

If your stock allocation or cash position is within safe thresholds, there’s no need to panic. The market’s short-term support zone lies between 1,610 and 1,630 points,” advised VPS Securities.

The VN-Index experienced a historic decline.

Market Pulse 21/10: Foreign Investors Shift to Net Buying

As the morning session drew to a close, sellers took control, with nearly 500 stocks declining, dwarfing the roughly 240 that managed to rise. By the end of the session, the VN-Index had fallen 6 points to 1,630.47, while the HNX-Index shed over 2 points, closing at 260.85.

Market Pulse October 20: Capital Flight from Financial and Real Estate Sectors Sends VN-Index Plummeting Nearly 95 Points

At the close of trading, the VN-Index plummeted 94.76 points (-5.47%), settling at 1,636.43 points, while the HNX-Index dropped 13.09 points (-4.74%), closing at 263.02 points. Market breadth was overwhelmingly negative, with 686 decliners (including 150 at the lower limit) versus just 140 advancers. Similarly, all constituents of the VN30 basket ended the session in the red.

Vietstock Daily 21/10/2025: Panic Selling Surges, Short-Term Risks Escalate

The VN-Index plummeted sharply, marked by a long red candle accompanied by a surge in trading volume and a significantly higher number of declining stocks compared to advancing ones, reflecting overwhelming selling pressure across the board. The index breached the 1,700-point threshold, slicing through the Middle Bollinger Band and poised to retest the August 2025 lows (ranging between 1,605–1,630 points). Further compounding concerns, the MACD indicator triggered a sell signal as it crossed below the Signal line, signaling heightened short-term risks.

Technical Analysis Afternoon Session 20/10: Re-testing Critical Support Levels

The VN-Index underwent a significant correction, retesting the critical support zone of 1,700-1,711 points. The Middle line of the Bollinger Bands, positioned closely to this area, is anticipated to provide robust support. Meanwhile, the HNX-Index experienced a modest rebound, continuing its short-term sideways consolidation phase.