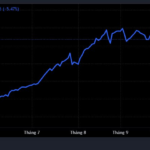

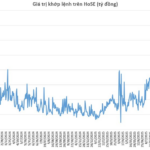

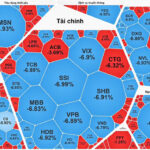

The market opened cautiously with narrow fluctuations in the morning session but unexpectedly plunged in the afternoon. By the close, the VN-Index dropped by 94.76 points, or 5.47%, to 1,636.43 points, setting a record for the largest single-day point decline in Vietnam’s stock market history over its 25-year existence. Selling pressure intensified in the afternoon, with 655 stocks declining, including 148 hitting their lower limit.

The nearly 5.5% drop also made Vietnam’s stock market one of the world’s worst performers on the first trading day of the week. The sharp decline erased over VND 412.3 trillion (~ USD 16 billion) in market capitalization on HoSE, leaving it at just over VND 7.1 quadrillion.

In their latest report, Yuanta Securities predicts the market may continue to decline in the next session, with the VN-Index potentially testing the 1,600-point support level. They note that the market remains in a short-term accumulation phase and could stabilize within 1-2 sessions. Yuanta’s statistics suggest the market will likely rebound after another sharp decline or quickly recover following a drop exceeding 5%. The firm advises investors to reduce margin levels or maintain safe ratios, avoiding panic selling at this stage.

Meanwhile, SHS Securities observes that the VN-Index, after reaching a short-term peak, is under pressure to retest the 1,700-point resistance level, which has now turned into a barrier. The index is expected to further test the 1,540–1,600 range. SHS maintains that the 1,700 level remains unattractive for new investments, especially for stocks that have seen abrupt price surges. However, the market’s sudden downturn suggests the VN-Index may be ending its strong uptrend since April 2025. In upcoming sessions, short-term buying interest could increase if the index falls to retest the 1,570–1,600 range.

Investors are advised to maintain balanced portfolios, focusing on fundamentally strong, leading stocks in strategic sectors with superior growth potential.

Adopting a cautious stance, Baoviet Securities (BVSC) anticipates the VN-Index will likely test the 1,600–1,610 support range as large-cap stocks, which heavily influence the index, remain under adjustment pressure. Post-adjustment, the market may stabilize and shift to a state of sector rotation. BVSC recommends that investors with high equity exposure or margin usage prioritize risk management by reducing portfolio equity levels. Conversely, cash-rich investors with high risk tolerance may consider opening trading positions if a sell-off persists.

Stock Market Plunges, Trading Volume on HoSE Hits Two-Month High

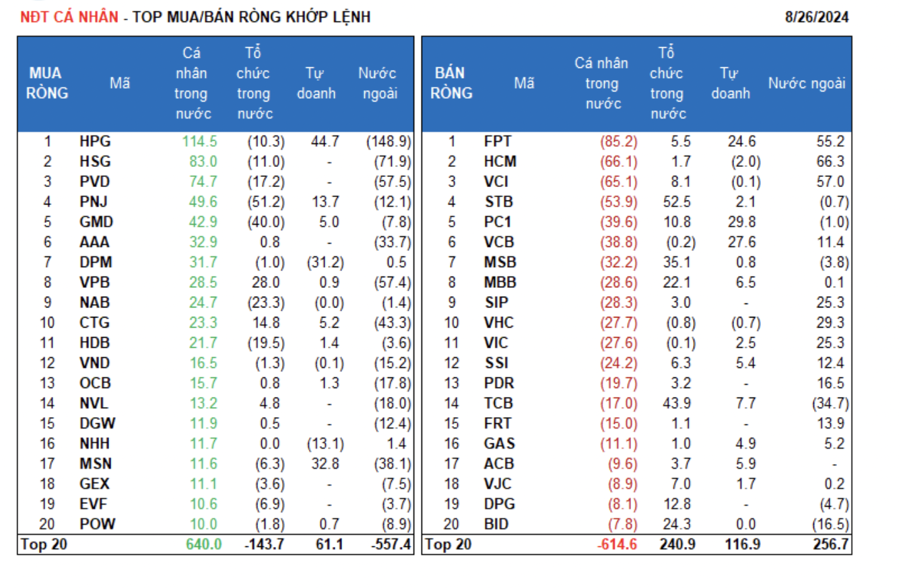

The VN-Index has plummeted for two consecutive sessions, shedding a total of 130 points from its peak, effectively erasing nearly all gains accumulated over the past month. This sharp decline has instilled a cautious sentiment among individual investors.

Surprise Power Unleashes $1 Trillion to Scoop Up Vietnamese Stocks as VN-Index Soars by Nearly 95 Points

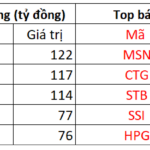

Proprietary trading firms made a surprising comeback, recording a net buying value of VND 999 billion on the Ho Chi Minh City Stock Exchange (HOSE).