|

Source: VietstockFinance

|

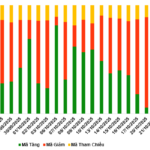

The rebound in blue-chip stocks has become the driving force behind the market’s recovery. Vingroup led the positive impact on the index with a 4% increase today. VHM was the second most influential stock. Notably, the market was also significantly boosted by a key stock, FPT, which hit its ceiling price during the session with strong foreign buying.

Across various sectors, many stocks showed positive movements. In the banking sector, HDB surged to its ceiling price. Similarly, GEE in the electrical equipment sector and BMP also hit their ceiling prices. Alongside FPT, FRT saw a strong rally, reaching its ceiling price by the end of the session.

After a period of tug-of-war, blue-chip stocks regained their strength at the start of the session. The VN30 basket saw 26 out of 30 stocks rise.

Beyond real estate and information technology, the insurance sector saw widespread gains. BVH and MIG both increased by 4%. BIC, VNR, PTI, and PGI rose by 1-2%.

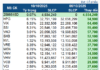

Foreign capital was activated as the market adjusted. Foreign investors turned net buyers with over 2.4 trillion VND. The focus of net buying was FPT and SSI. Other stocks in the top 10 net-bought list also recorded net purchases exceeding hundreds of billions of VND.

| Top 10 Stocks with Strong Foreign Net Buying and Selling |

Morning Session: Foreign Investors Reverse to Net Buying

Towards the end of the morning session, sellers gained the upper hand, with the number of declining stocks surging to nearly 500. Meanwhile, only about 240 stocks rose. At the close of the morning session, the VN-Index fell by 6 points to 1,630.47, and the HNX-Index dropped by over 2 points to 260.85.

Most sectors were dominated by declines. Only a few sectors saw gains, including information technology, insurance, pharmaceuticals, and transportation. Among these, the information technology sector stood out due to the positive performance of FPT.

Meanwhile, the securities sector was among the top decliners. Many stocks in this sector saw significant drops, such as VIX and VND falling by 6%, and VCI, SHS, MBS, and CTS declining by 3%. A rare bright spot was the newcomer TCX, which, despite the overall pressure, managed a nearly 6% increase on its debut.

Many blue-chip stocks showed lackluster performance. MSN and GEX both fell by over 6%.

A positive note from the morning session was the robust liquidity and foreign investors’ reversal to net buying. The trading value reached 30.5 trillion VND, nearly double that of the previous session. Foreign investors turned net buyers with over 1.7 trillion VND.

| Foreign Investors Reverse to Net Buying in the Morning Session of 21/10/2025 |

10:30 AM: Heavy Pressure from Financial and Real Estate Sectors

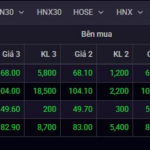

By mid-morning, buying and selling forces were balanced. The market breadth showed nearly 330 gainers and over 330 decliners. However, strong pulling power from blue-chip stocks helped the VN-Index rise to around 1,650 points.

The top 10 stocks contributing the most to the VN-Index pulled the index up by nearly 14 points. These included stocks from various sectors: VIC from real estate, VCB, BID, and LPB from banking, TCX from securities, HVN and VJC from aviation, and VNM from consumer goods.

On the flip side, MSN, VPL, and NVL weighed on the index, though their declines were not overly negative.

The pulling power of large-cap stocks was also evident in the VN30 group, with 22 out of 30 stocks rising. This lifted the VN30-Index by over 26 points.

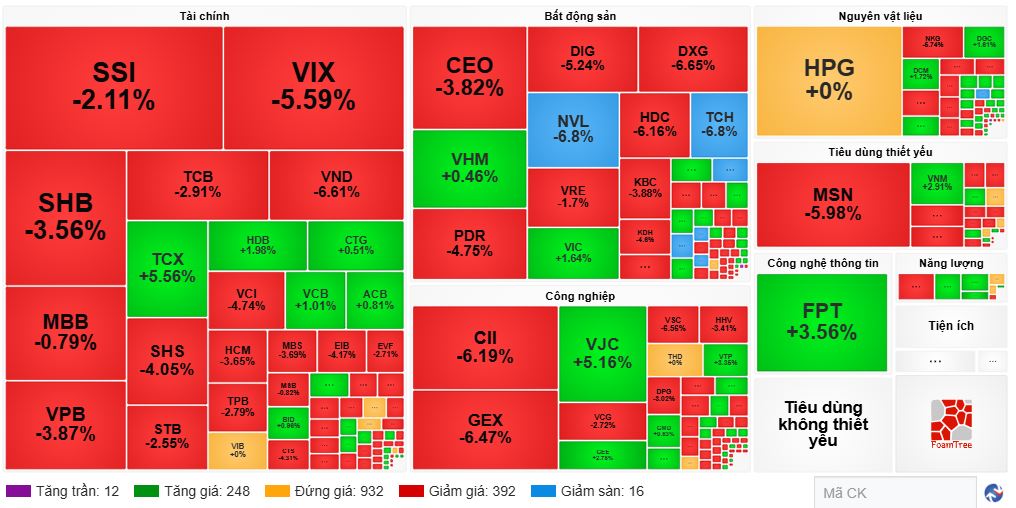

Despite the presence of many blue-chip stocks among the top contributors, banking and securities stocks showed a rather negative performance. Red dominated the financial sector, with VIX, VND, SHB, and VCI declining by 2-5%.

The real estate sector remained negative. NVL, TCH, DXG, and DXS were at their lower limits. Red spread widely across this sector. The real estate and financial sectors maintained pressure, preventing the index from breaking free from the tug-of-war to surge.

Trading activity was vibrant, with the trading value exceeding 22.6 trillion VND in the first half of the morning session (as of 10:40 AM).

Market heatmap as of 10:40 AM. Source: VietstockFinance

|

Opening: Early Session Tug-of-War

Following the sharp decline in the previous session, the market still showed hesitation.

The market opened the 21/10 session with both the VN-Index and HNX-Index in the green. Leading large-cap stocks across sectors supported this upward momentum. Green dominated financial, essential consumer, and information technology stocks, driving the index higher at the start. At this point, the real estate sector remained in the red.

NVL performed negatively in the early minutes, quickly hitting its lower limit as the market opened.

Market breadth at the start was relatively balanced between buyers and sellers, with 260 gainers and nearly 260 decliners. This reflected investors’ hesitant sentiment.

During the opening phase, VIC rejoined the race, contributing nearly 3 points to the VN-Index. Newcomer TCX from TCBS Securities officially listed on HOSE. Its debut with a nearly 5% increase placed it among the top 10 stocks contributing the most to the VN-Index.

– 15:45 21/10/2025

Vietnamese Real Estate Stock Surges Amid Record 95-Point Market Plunge

NTC shares of Nam Tan Uyen Industrial Park Joint Stock Company emerge as a rare bright spot, defying the trend ahead of its upcoming market transfer.

What Should Stock Investors Do After a Record-Breaking Market Decline?

According to the expert, this phase will serve as a necessary “reset” step before the market can return to its upward trajectory.