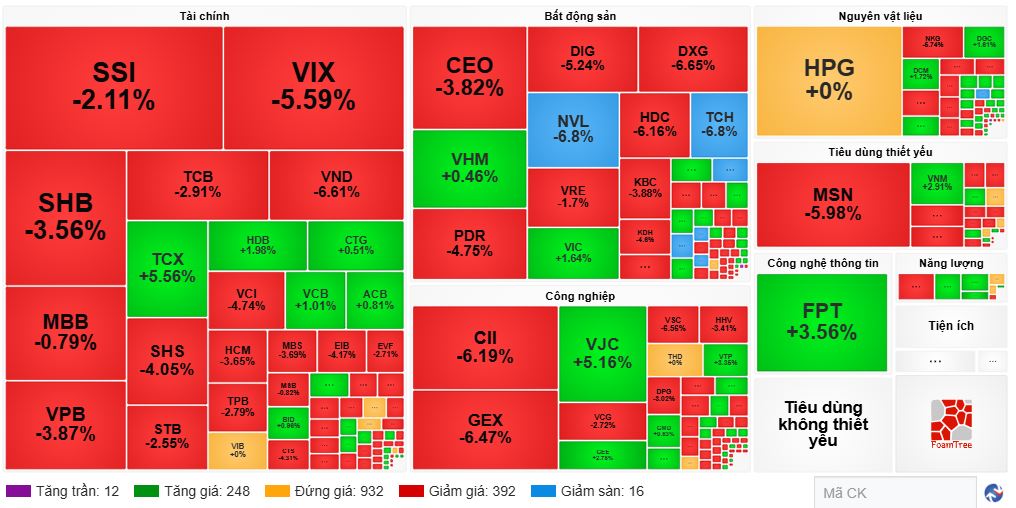

Sector dominance has shifted dramatically, leaving only a handful of industries in the green, including information technology, insurance, pharmaceuticals, and transportation. Among these, the information technology sector stands out, driven by the positive performance of FPT.

Conversely, the securities sector is among the hardest hit. Several stocks within this group have experienced significant declines, such as VIX and VND, both down 6%, and VCI, SHS, MBS, and CTS, all down 3%. The lone bright spot is the newcomer TCX, which, despite the overall pressure, managed a near 6% increase on its debut.

Many blue-chip stocks are underperforming. MSN and GEX have both dropped by over 6%.

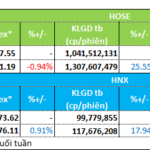

A positive note from today’s morning session is the robust liquidity and foreign investors’ net buying. Trading value reached 30.5 trillion VND, nearly double that of the previous session. Foreign investors net bought over 1.7 trillion VND.

| Foreign investors net bought in the morning session of 21/10/2025 |

10:30 AM: Heavy pressure from financial and real estate sectors

By mid-morning, buying and selling forces were evenly matched. Market breadth showed nearly 330 gainers and over 330 decliners. However, strong support from blue-chip stocks helped the VN-Index rise to around 1,650 points.

The top 10 contributors to the VN-Index added nearly 14 points, featuring diverse sectors: VIC (real estate), VCB, BID, LPB (banking), TCX (securities), HVN, VJC (aviation), and VNM (consumer goods).

On the downside, MSN, VPL, and NVL weighed on the index, though their declines were not overly severe.

The influence of large-cap stocks was evident in the VN30 group, with 22 out of 30 stocks rising, pushing the VN30-Index up by over 26 points.

Despite the presence of many influential stocks, banking and securities shares performed poorly. Red dominated the financial sector, with VIX, VND, SHB, and VCI falling 2-5%.

The real estate sector remained negative, with NVL, TCH, DXG, and DXS hitting their lower limits. Red spread across this sector, maintaining pressure on the index alongside the financial sector, preventing a breakout.

Trading activity was vibrant, with a value of over 22.6 trillion VND by 10:40 AM.

Market heatmap as of 10:40 AM. Source: VietstockFinance

|

Opening: Early session tug-of-war

Following yesterday’s sharp decline, market sentiment remains uncertain.

The market opened on 21/10 with both the VN-Index and HNX-Index in the green. Leading large-cap stocks supported this rise, with positive momentum in financial, essential consumer, and information technology sectors. Real estate stocks, however, remained in the red.

NVL started the session negatively, quickly hitting its lower limit at the open.

Early market breadth was balanced, with 260 gainers and nearly 260 decliners, reflecting investor indecision.

During the opening phase, VIC rejoined the rally, contributing nearly 3 points to the VN-Index. Newcomer TCX from TCBS Securities debuted on HOSE, rising nearly 5% and entering the top 10 contributors to the VN-Index.

– 11:55 21/10/2025

Market Pulse October 20: Capital Flight from Financial and Real Estate Sectors Sends VN-Index Plummeting Nearly 95 Points

At the close of trading, the VN-Index plummeted 94.76 points (-5.47%), settling at 1,636.43 points, while the HNX-Index dropped 13.09 points (-4.74%), closing at 263.02 points. Market breadth was overwhelmingly negative, with 686 decliners (including 150 at the lower limit) versus just 140 advancers. Similarly, all constituents of the VN30 basket ended the session in the red.

Vietstock Daily 21/10/2025: Panic Selling Surges, Short-Term Risks Escalate

The VN-Index plummeted sharply, marked by a long red candle accompanied by a surge in trading volume and a significantly higher number of declining stocks compared to advancing ones, reflecting overwhelming selling pressure across the board. The index breached the 1,700-point threshold, slicing through the Middle Bollinger Band and poised to retest the August 2025 lows (ranging between 1,605–1,630 points). Further compounding concerns, the MACD indicator triggered a sell signal as it crossed below the Signal line, signaling heightened short-term risks.

Technical Analysis Afternoon Session 20/10: Re-testing Critical Support Levels

The VN-Index underwent a significant correction, retesting the critical support zone of 1,700-1,711 points. The Middle line of the Bollinger Bands, positioned closely to this area, is anticipated to provide robust support. Meanwhile, the HNX-Index experienced a modest rebound, continuing its short-term sideways consolidation phase.

Stock Market Outlook for the Week of October 19: Investors’ Joy Over Upgrade Short-Lived as New Concerns Emerge

The VN-Index’s sharp decline at the end of the week erased all weekly gains, chipping away at investors’ portfolios.