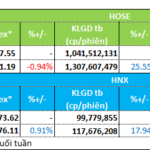

Market liquidity surged compared to the previous session, with the order-matching volume of the VN-Index reaching over 1.63 billion shares, equivalent to a value of more than 50.5 trillion VND. The HNX-Index recorded over 168.71 million shares, valued at over 4.1 trillion VND.

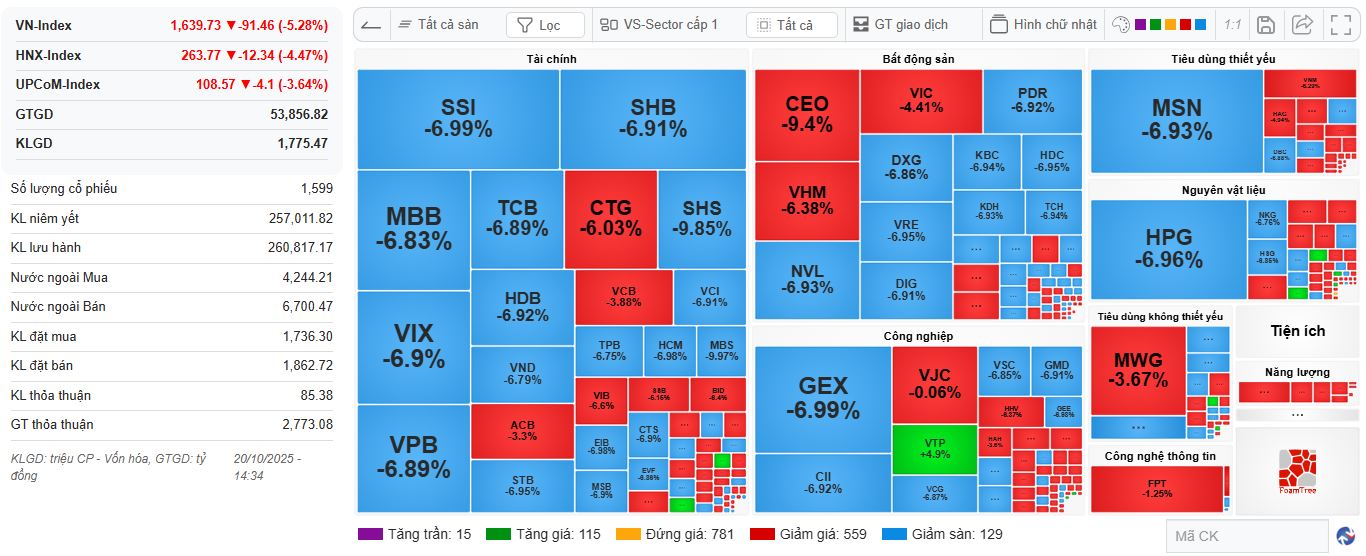

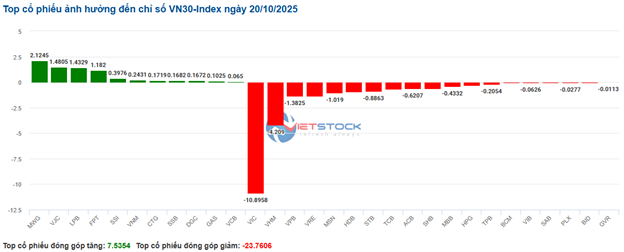

The VN-Index opened the afternoon session under continued selling pressure, causing the index to plummet despite buyers re-emerging toward the end. However, they couldn’t reverse the trend, and the VN-Index closed in the red, ending on a rather pessimistic note. Among the most negatively influential stocks were VIC, VHM, VCB, and TCB, which collectively dragged the index down by over 24.8 points. Conversely, VTP, VAB, CTR, and LGC managed to stay in the green, though their contributions to the overall index were negligible.

| Top 10 Stocks Impacting VN-Index on October 20, 2025 (Points-Based) |

Similarly, the HNX-Index experienced a gloomy session, with significant negative impacts from stocks like SHS (-9.85%), MBS (-9.97%), HUT (-9.83%), and CEO (-9.72%).

| Top 10 Stocks Impacting HNX-Index on October 20, 2025 (Points-Based) |

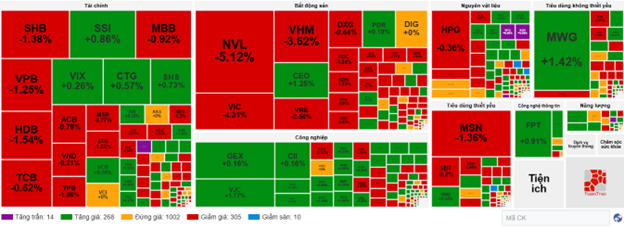

By the close, red dominated all sectors. The financial sector saw the sharpest decline at 5.87%, primarily driven by SSI (-6.99%), SHB (-6.91%), VPB (-6.89%), and TCB (-6.89%). The real estate sector followed with a 5.58% drop. Notably, VIC fell by 6.9%, and VHM by 4.46%, while CEO, NVL, PDR, and DXG hit their lower limits.

Foreign investors continued their net selling, offloading over 2.058 trillion VND on the HOSE, focusing on MSN (652.44 billion VND), CTG (269.1 billion VND), STB (221.51 billion VND), and SSI (175.28 billion VND). On the HNX, they net sold over 96 billion VND, targeting SHS (126.33 billion VND), IDC (65.97 billion VND), HLC (7.76 billion VND), and NRC (2.64 billion VND).

| Foreign Net Buying/Selling Trends |

At 14:35, the VN-Index dropped nearly 100 points.

After 14:00, selling pressure intensified, with nearly 100 stocks hitting their lower limits by 14:30. The market recorded nearly 700 stocks in the red.

Large-cap stocks weighed heavily on the market. The top 10 decliners, including VIC, VHM, HPG, VPL, and banking stocks like VCB, TCB, BID, VPB, and CTG, collectively dragged the index down by 45 points.

By 14:30, the VN-Index had fallen by over 90 points to 1,640 points.

|

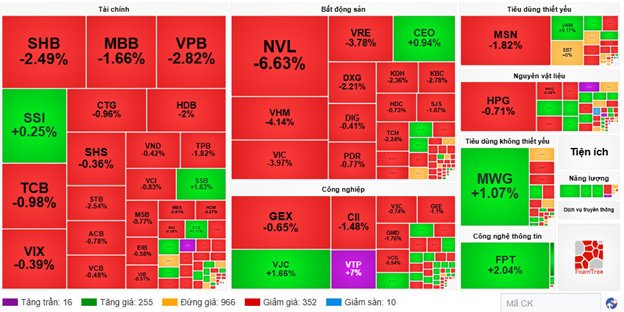

Morning Session: VN-Index Retreats to 1,710 Points

Selling pressure from Vingroup stocks weighed on the market. By mid-session, the VN-Index fell over 20 points (-1.19%) to 1,710.67 points, while the HNX-Index rose 0.35% to 277.09 points. Market breadth favored sellers, with 362 decliners and 271 advancers.

Among the top 10 stocks influencing the VN-Index, VIC and VHM had the most negative impact, collectively dragging the index down by over 11 points. Conversely, HVN and FPT contributed positively, adding 1.6 points to the index.

| Top 10 Stocks Impacting VN-Index Morning Session, October 20, 2025 (Points-Based) |

Sector divergence persisted. Real estate was the worst performer, declining 3.22%, led by VIC, VHM, and other stocks like BCM (-1.37%), KDH (-2.36%), KBC (-2.78%), NVL (-6.63%), TAL (-3%), DXG (-2.21%), and TCH (-2.24%).

The financial sector also faced pressure from large-cap adjustments, with VPB, MBB, SHB, HDB, TPB, and STB all down over 1%. However, buying interest remained in SSB (+1.63%), LPB (+1.41%), CTS (+1.11%), NVB (+7.95%), and VAB, which hit its upper limit.

Meanwhile, the communication services sector led with a 7% gain, driven by VGI (+8.88%), FOX (+1.78%), VNZ (+2%), SGT (+1.49%), FOC (+2.17%), and CTR, which also hit its upper limit.

Source: VietstockFinance

|

Foreign investors continued net selling, offloading nearly 1.2 trillion VND across all three exchanges, focusing on GEX and STB with over 110 billion VND each. VRE led net buying with 72.12 billion VND.

| Top 10 Foreign Net Bought/Sold Stocks, Morning Session, October 20, 2025 |

10:30: Blue-Chip Selling Pressure, Mixed Index Performance

Cautious trading kept indices near reference levels. By 10:30, the VN-Index fell over 16 points to around 1,715 points, while the HNX-Index dropped 2.2 points to 278 points.

Stocks like VIC, VHM, VPB, and VRE negatively impacted the VN30-Index, subtracting 10.89, 4.21, 1.38, and 1.35 points, respectively. Conversely, MWG, VJC, LPB, and FPT helped the VN30 retain over 6.2 points.

Source: VietstockFinance

|

The materials sector maintained its recovery despite divergence, with notable gains in KSV (+9.96%), DGC (+0.43%), DCM (+1.63%), HT1 (+3.4%), and DPM (+0.86%). Large-caps like HPG (-0.18%), GVR (-0.18%), and MSR (-1.03%) tempered the sector’s overall rise.

Meanwhile, the real estate sector faced headwinds, with most stocks in the red. VIC fell 4.02%, VHM 3.53%, VRE 2.44%, and NVL 4.82%. Only a few, like PDR (+0.38%), CEO (+1.57%), and SIP (+0.56%), saw slight recoveries.

Sellers dominated, with 305 decliners versus 268 advancers.

Source: VietstockFinance

|

Market Open: Real Estate Struggles Early, VN-Index Fluctuates

At 9:30, the VN-Index fell over 15 points to around 1,716 points, while the HNX-Index traded sideways near 276 points.

Despite green across most sectors, the market opened slightly lower due to weak performances in real estate and essentials. Notable early decliners included NVL (-6.93%), VIC (-3.04%), VHM (-1.29%), VRE (-2.2%), MCH (-2.32%), MSN (-0.23%), SAB (-0.11%), and SBT (-0.79%).

Large-caps like VJC, VPB, STB, and HDB weighed on the market, collectively pulling it down by nearly 4.1 points. Conversely, MWG, LPB, HPG, and CTG led the gainers, adding over 6 points.

– 15:20 20/10/2025

Vietstock Daily 21/10/2025: Panic Selling Surges, Short-Term Risks Escalate

The VN-Index plummeted sharply, marked by a long red candle accompanied by a surge in trading volume and a significantly higher number of declining stocks compared to advancing ones, reflecting overwhelming selling pressure across the board. The index breached the 1,700-point threshold, slicing through the Middle Bollinger Band and poised to retest the August 2025 lows (ranging between 1,605–1,630 points). Further compounding concerns, the MACD indicator triggered a sell signal as it crossed below the Signal line, signaling heightened short-term risks.

Technical Analysis Afternoon Session 20/10: Re-testing Critical Support Levels

The VN-Index underwent a significant correction, retesting the critical support zone of 1,700-1,711 points. The Middle line of the Bollinger Bands, positioned closely to this area, is anticipated to provide robust support. Meanwhile, the HNX-Index experienced a modest rebound, continuing its short-term sideways consolidation phase.

Capital Flows Return to Real Estate Stocks

The market continues to show robust liquidity, with significant increases on both the HOSE and HNX exchanges. Real estate stocks have once again emerged as the focal point of investment flows over the past week.