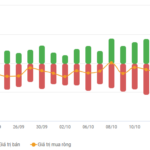

The Vietnamese stock market had a disappointing start to the week on October 20th. Selling pressure intensified in the afternoon session, with red and light blue dominating as 655 stocks declined, including 148 that hit the lower limit. The Ho Chi Minh City Stock Exchange (HOSE) recorded 108 stocks dropping to their maximum allowable decline.

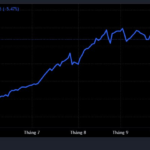

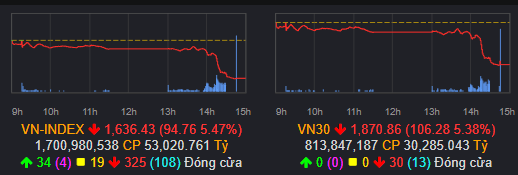

The VN-Index closed at 1,636 points, marking a record drop of 94.76 points (-5.47%). Heavy selling in large-cap stocks caused the VN30 to lose over 106 points. Liquidity surged, with trading volume on HOSE exceeding 1.7 billion units, corresponding to a value of over 53 trillion VND.

The sharp decline wiped out more than 412.3 trillion VND (~ 16 billion USD) in market capitalization on HOSE, 19.5 trillion VND on HNX, and 29.65 trillion VND on UPCOM; collectively, the total market capitalization decreased by 442 trillion VND. As of October 20th, HOSE’s market capitalization stood at just over 7.1 million billion VND. The nearly 5.5% drop made Vietnamese stocks one of the world’s worst-performing markets on the first day of the week.

This steep decline occurred after the market had enjoyed a positive period, particularly following its upgrade to secondary emerging market status. The absence of foreign capital inflows further weakened market support. Foreign investors net-sold nearly 2 trillion VND on HOSE during the session.

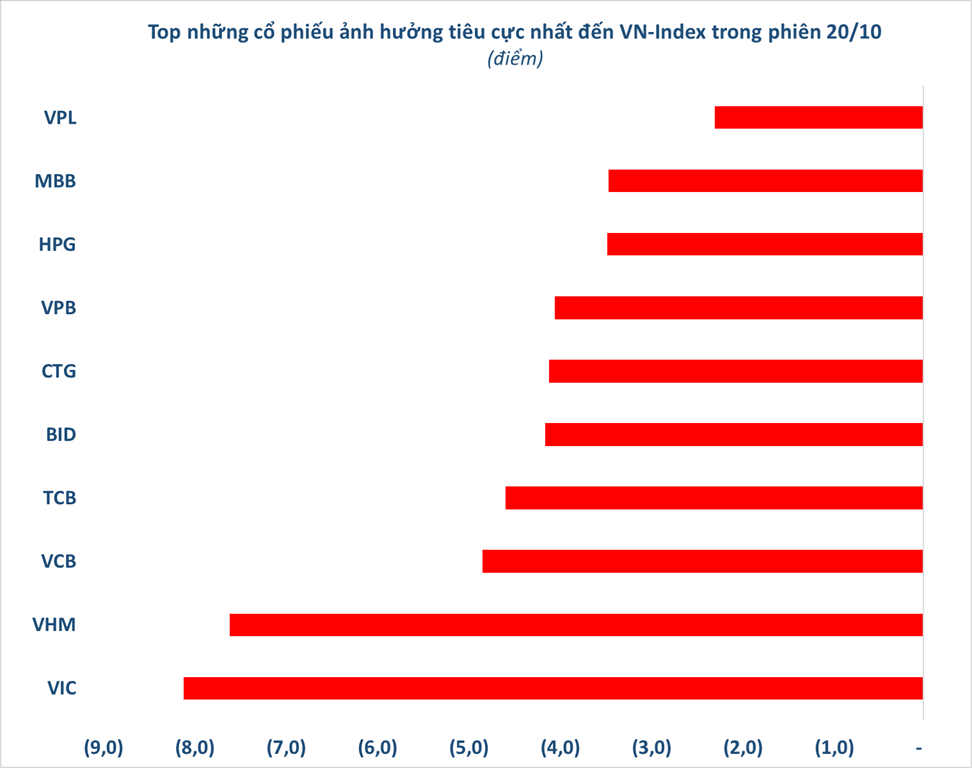

In terms of contribution, the Vingroup duo, VIC and VHM, both fell over 4%, collectively erasing 15.7 points from the VN-Index. VIC dropped 4.5% to 194,900 VND/share, while VHM declined 6.9% to 108,000 VND/share.

Leading bank stocks like VCB, TCB, BID, and CTG also became major drags on the VN-Index. By the close, VCB fell 4%, TCB hit the lower limit, and BID and CTG both dropped over 6%. HPG and VPL also ended the session at their lower limits, further pressuring the main index. The widespread decline in the market’s largest-cap stocks highlighted the session’s negativity. Many investors joked that any stock not hitting its lower limit was fortunate, given that hundreds of stocks plummeted to their daily limits.

On the flip side, a few stocks like VTP, VAB, and CTR showed faint signs of green, but their gains were insignificant compared to the broader market’s steep decline.

Prior to today’s sharp fall, the market had experienced a positive streak, fueled by the upgrade to secondary emerging market status. High investor expectations for this pivotal decision attracted capital inflows, pushing the VN-Index to new highs. The VN-Index set a record above 1,766 points, while the VN30 surpassed 2,000 points for the first time. Such elevated prices naturally triggered profit-taking, putting short-term pressure on the market.

Additionally, during the market’s euphoric phase, many investors used margin lending to boost purchasing power. Consequently, even a slight decline in one stock could trigger widespread selling across other portfolio holdings.

Several experts have expressed caution about the market. According to SHS Securities, current prices are not ideal for investors to increase positions or chase purchases. Instead, they should carefully evaluate existing positions based on reasonable valuations and third-quarter earnings reports.

“The 1,700-point range is not an attractive entry point for many stocks, especially those that have seen sharp price increases this year,” SHS analysts advised.

Mr. Dinh Viet Bach, a Securities Analyst at Pinetree, believes the probability of a correction this week is high, as the market needs to retest support levels to build upward momentum. The first support level could be around 1,700 points. If the VN-Index breaks below this, it may retreat to the next support level at the 10-week moving average, around 1,670 points.

Market Outlook: Heightened Correction Pressures in Stocks for the Week of October 13–17, 2025

The VN-Index tumbled in the final session of the week, capping a week of correction with a decline of over 16 points compared to the previous week. Amidst a sharply polarized market, the weakening of leading stocks coupled with persistent net selling pressure from foreign investors continued to exert significant strain on investor sentiment.

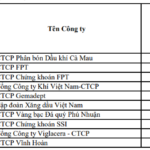

Daily Stock Purchase: Astonishing Returns from FPT Holdings by Chairman Truong Gia Binh

Investing in FPT Corporation by purchasing one share daily resulted in an 80% loss after two years, requiring an additional five years to break even. However, since 2014, the investment value has consistently risen, delivering a remarkable return of nearly 1,500% to date.