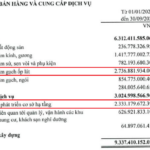

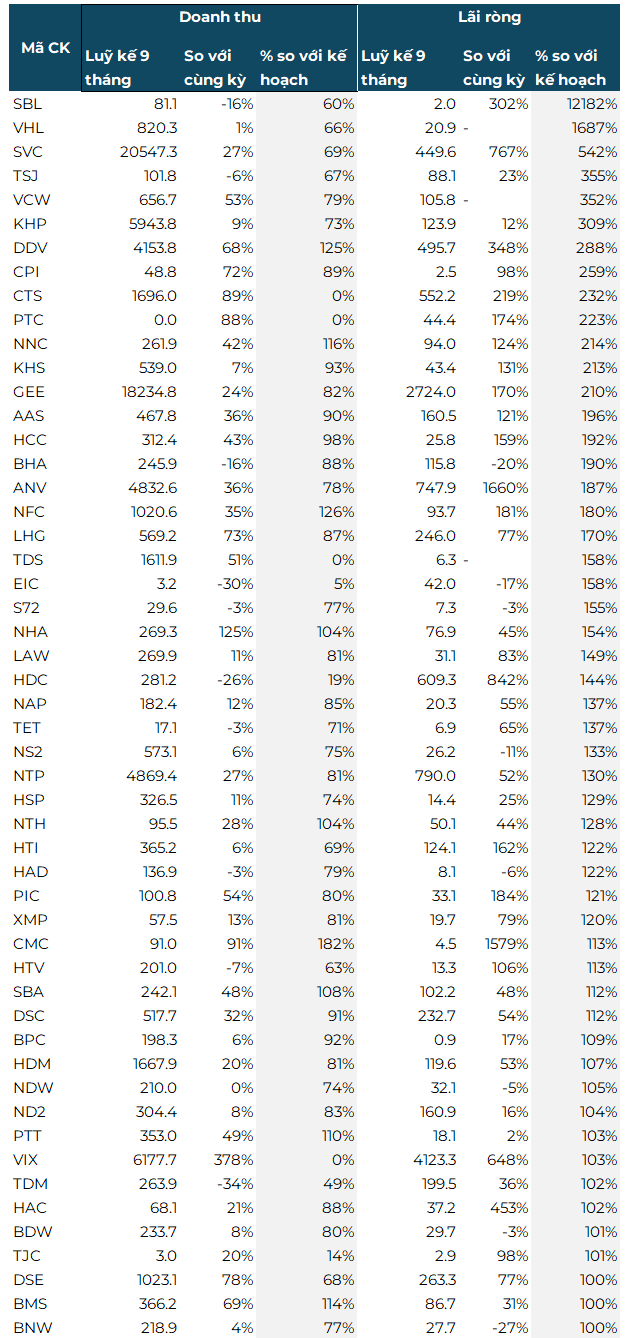

According to data from 148 companies that have released their Q3 financial results or estimates, a remarkable 52 firms have already surpassed their 2025 profit targets within just nine months.

Companies Exceeding Targets

Source: VietstockFinance. Unit: Billion VND

|

Leading the pack is Saigon Beer – Bac Lieu JSC (UPCoM: SBL), which has exceeded its annual profit target by over 100 times. The brewery reported a staggering 837% surge in Q3 net profit to 2.2 billion VND. In the first nine months, SBL achieved a cumulative profit of nearly 2 billion VND, far surpassing its modest full-year target of just 16 million VND.

In second place is Viglacera Ha Long JSC (HNX: VHL), with a 16-fold profit exceeding its target, reaching nearly 21 billion VND in the first nine months.

Meanwhile, Vietnam’s leading automobile distributor, Savico, achieved a breakthrough with a Q3 net profit of 364 billion VND in 2025, soaring by nearly 5,800% year-on-year. This marks the company’s highest quarterly profit in its history, surpassing the 2022 record of 333 billion VND and nearly quadrupling the 2024 full-year profit of 100 billion VND.

This impressive result is primarily attributed to a financial income of nearly 669 billion VND, up by over 3,200% year-on-year, including 537 billion VND from the transfer of capital in a real estate project.

In the first nine months of 2025, Savico generated revenue of over 20,547 billion VND, a 27% increase, and a net profit of nearly 450 billion VND, up by 767% year-on-year, exceeding its annual profit target by 120% despite achieving only 69% of its revenue goal.

Song Da Water Investment JSC (Viwasupco, UPCoM: VCW) also experienced a remarkable turnaround, posting a Q3 net profit of 34 billion VND in 2025, compared to a loss of 33 billion VND in the same period last year.

This marks the second consecutive profitable quarter for Viwasupco after seven consecutive quarters of losses from Q3 2023 to Q1 2025. In the first nine months, the company achieved a net profit of 106 billion VND, a significant improvement from a loss of nearly 55 billion VND in the same period last year, and exceeding its annual profit target by nearly three times.

DAP – VINACHEM (UPCoM: DDV), a fertilizer producer, exploded in Q3 2025 with a record profit of 221 billion VND, driven by a surge in revenue and selling prices of its main product, DAP. After nine months, the company reported net revenue of nearly 4.2 trillion VND, up by 68%, and after-tax profit of 496 billion VND, 4.5 times higher than the same period last year, exceeding its revenue target by 25% and pre-tax profit goal by 188%.

Gelex Electric (GEE) also delivered impressive results, with a nine-month after-tax profit of 2,845 billion VND, up by 166% year-on-year, surpassing its full-year 2025 target of 2,819 billion VND.

– 08:15 21/10/2025

Viglacera’s Q3 Profits Plummet 55% Amid Severe Storm Impact

Viglacera’s net profit in Q3 plummeted by over half due to adverse weather conditions and rising production costs. However, the nine-month results remain positive, with profits surging nearly 50%, driven by improved performance in industrial zone infrastructure leasing and construction materials segments compared to the same period last year.

Q3/2025 Financial Report Deadline on October 17: Surge in Last-Minute Disclosures as Companies Rush to Announce Record Growth

Nam Việt (ANV) reported a remarkable Q3 pre-tax profit of VND 343 billion, surging 826% year-over-year, while its 9-month profit soared to VND 857 billion, a staggering 1,225% increase. Similarly, DAP Vinachem (DDV) posted a Q3 pre-tax profit of VND 276 billion, up 985%, and its 9-month profit reached VND 620 billion, marking a 348% growth.

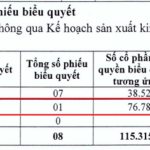

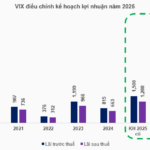

Why Are Top Businesses Boldly Scaling Up Their 2025 Plans?

The stock market’s remarkable surge and the exceptional first-half financial results have prompted numerous brokerage firms to significantly elevate their 2025 targets. Additionally, companies across various sectors are revising their projections upward, fueled by unexpected revenue streams, leading to a widespread shift in business objectives.

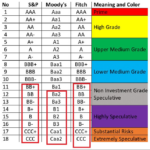

Why Vietnam’s Corporate Credit Ratings Hit a Global Ceiling

Recently, concerns have arisen regarding the classification of several major Vietnamese enterprises as “junk” or “non-investment grade” by international credit rating agencies. However, a deeper understanding of how global credit rating systems operate reveals that such ratings are not inherently negative and do not equate to labeling these businesses as “junk.”