“Why are house prices so high and keep rising?” – Prime Minister Pham Minh Chinh’s question at the recent meeting of the National Steering Committee on Housing Policy and Real Estate Market reflects the burning issue of the housing market in major cities like Hanoi and Ho Chi Minh City. Over the past three years, apartment prices in Hanoi have surged, putting significant pressure on buyers, especially those in the middle-income bracket.

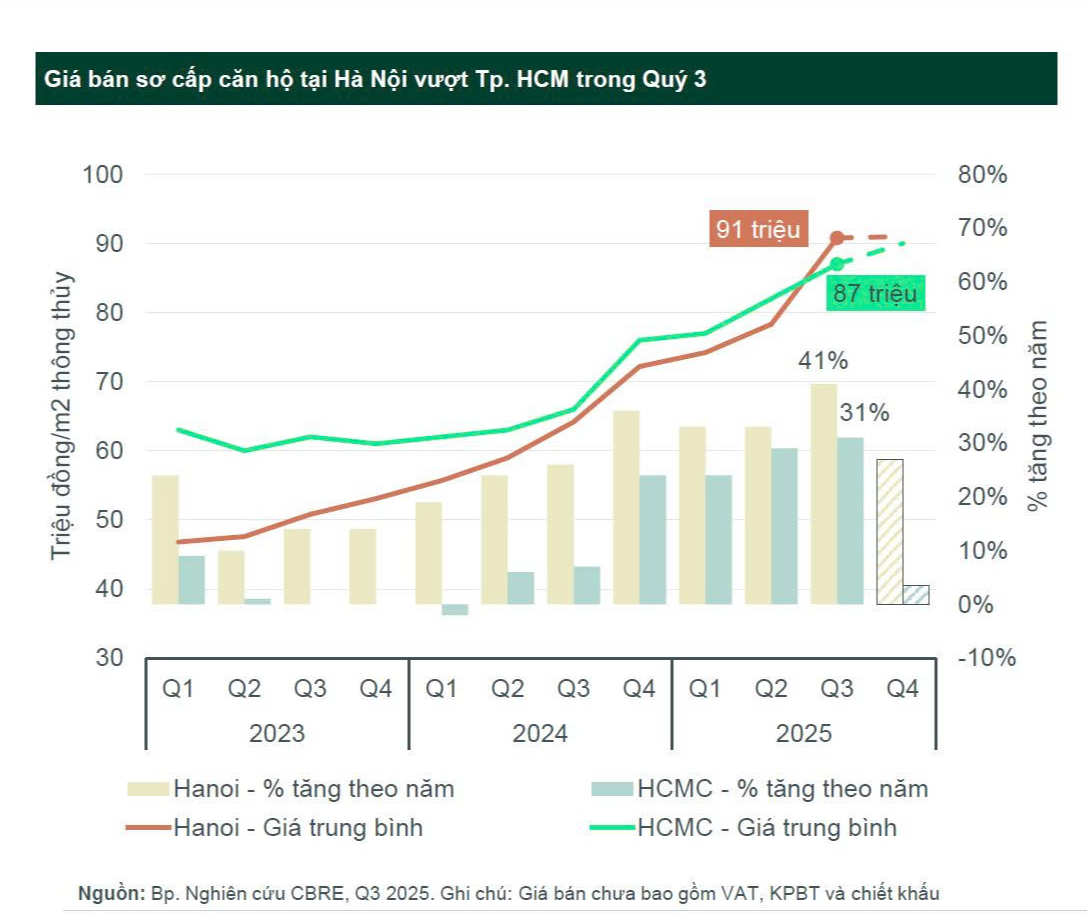

Notably, in Q3/2025, according to Ms. Nguyen Hoai An, Senior Director at CBRE Hanoi, the supply of high-end apartments in the two major cities dominated the market, with selling prices starting from 120 million VND/m². This pushed the overall market prices up by 31–41% in just one year.

To gain a clearer perspective on Hanoi’s apartment market, we sat down with Ms. Nguyen Hoai An for an insightful discussion.

Ms. An, how would you assess Hanoi’s apartment market in Q3/2025?

Lately, the most discussed topic has been the soaring prices. In Q3, projects priced at 120 million VND/m² and above accounted for 20% of the new supply, totaling over 10,300 units. Meanwhile, the supply of units priced below 60 million VND/m² was almost non-existent.

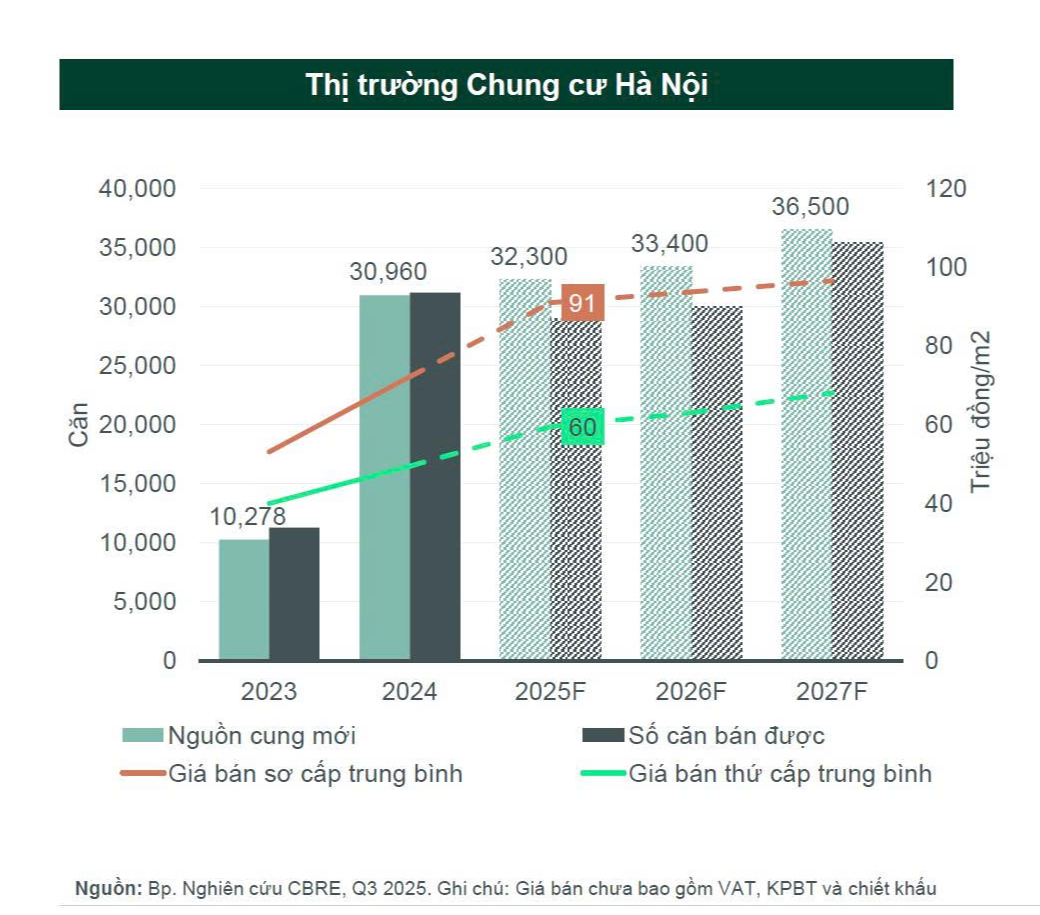

High-priced projects continuously entering the market pushed the average primary selling price up by 16% quarterly and 41% year-on-year. Notably, historically, Hanoi’s average primary prices were lower than Ho Chi Minh City’s. However, by Q3/2025, Hanoi’s average primary price reached 91 million VND/m², surpassing Ho Chi Minh City.

In the secondary market, apartment prices rose by 19% annually, averaging 58 million VND/m². This growth rate, though slower than in 2024, outpaced the first two quarters of this year.

CBRE observed many new projects launching with great market reception. Sales and booking rates in 2025 were robust, particularly for units priced around 100 million VND/m², attracting significant buyer interest.

What about current liquidity, Ms. An?

According to CBRE data, Hanoi’s market liquidity remains strong. In Q3/2025, new supply exceeded 10,000 units, while over 11,000 units were sold.

We see no signs of instability in market liquidity.

Why are prices high but liquidity remains strong? Is investment demand driving the market, fueled by cheap credit and developers’ sales policies?

While primary prices are high, several factors are at play.

First, buyers of off-plan properties often have investment in mind. If they needed immediate occupancy, they’d opt for ready-to-move-in homes. Buying a property that will only be completed in 2-3 years means they’re investing in a future asset alongside the developer.

High price growth is also supported by low interest rates, which maintain market liquidity.

Second, when analyzing price growth, we should compare it with other asset classes. For instance, domestic gold prices surged 65% in the past year, influencing real estate trends. While not a direct cause, it provides a balanced perspective on price dynamics.

Developers’ sales policies, such as loan support and interest-free periods until handover, also enhance liquidity.

However, the positive investment sentiment in real estate, especially in Hanoi’s apartment segment, is notable. Buyers see apartments as both a business opportunity and a stable asset, making it a trusted investment.

What’s the biggest challenge facing the market?

The biggest challenge is the high prices in both primary and secondary markets. Primary prices exceed 90 million VND/m², while secondary prices continue to grow by double digits in 2025.

This poses a significant barrier for buyers. Despite strong liquidity, it’s unclear how much of this demand comes from genuine homebuyers. This is the market’s current challenge.

Supply-wise, Hanoi’s supply is growing, which could help stabilize prices. However, faster infrastructure development could further boost supply. Many infrastructure projects are underway, which is positive.

Completed infrastructure projects will significantly improve connectivity, enhancing real estate value.

Increased supply could help stabilize prices.

Regarding capital and credit, interest rates are reasonable, facilitating buyer access to credit. Developers also offer supportive policies for primary market buyers.

The main risk remains the rapid price growth we’re witnessing.

How effective have the government’s efforts to control housing prices been?

The government has taken several measures to regulate the market, including credit control, affordable commercial housing, and land transaction centers.

Land transaction centers enhance transparency, especially in the primary market. Credit control, likely through banks, could cap loans for multiple properties, which is a feasible short-term measure.

However, distinguishing between speculation and genuine investment is crucial. Policies should target speculative behavior during market overheating.

For affordable commercial housing, integrating it with existing social housing policies would be more effective, avoiding market distortions.

What’s your outlook for the 2026 housing market?

Hanoi’s 2025 supply is expected to reach 32,000 units, with over 30,000 units annually in subsequent years.

Supply is expected to exceed 30,000 units annually in 2025-2026.

With ample supply, buyers will have more options, fostering competition and potentially more flexible pricing to ensure liquidity.

Thank you for your insights, Ms. An!

SGO Group Launches Low-Rise Project in Phúc Thọ, Hanoi, Following T&T and Sunshine Group

On October 18th, SGO Group’s investment ecosystem (comprising Hai Phat Investment & Real Estate Business JSC – Hai Phat Land, SGO Investment & Real Estate Business JSC – SGO Land, and SGO Construction General Contractor JSC – SGO Construction) officially launched the groundbreaking ceremony for the Dong Ca Low-Rise Housing Area project – SGO La Porta Phuc Tho.

Thousands Frustrated as Week-Long Efforts Fail to Submit Social Housing Applications Online

Struggling to secure a NOXH online application for Rice Long Châu, a determined couple took turns requesting leave from work, meticulously planning shifts to ensure one of them could submit their application. Despite their relentless efforts, success remained elusive. The developer’s daily cap of 70 online submissions has left thousands of hopeful applicants in limbo, unable to finalize their registration.

Potential 5-Year Ban on Land Auctions for Defaulting Bidders; Proposal to Increase Deposit to 50%

The Ministry of Justice has proposed stringent penalties for individuals who default on land auction deposits, including a ban on participation in future auctions for a period ranging from 6 months to 5 years. Additionally, defaulters will be required to fully compensate for any damages incurred as a result of their actions.

Expert Strategies to Stabilize the Real Estate Market

In addition to construction costs, land expenses play a significant role in determining both the cost and selling price of apartments, alongside profit expectations. When cost considerations are effectively addressed, the market can introduce more affordable products, meeting the substantial demand of urban residents.