Imbalance in the Market

The Q3/2025 comprehensive report on Vietnam’s real estate market by the Vietnam Real Estate Market Research Institute (VARS IRE) highlights that residential real estate remains the core segment, attracting significant attention. In Q3/2025, the market saw approximately 34,686 new products, a 5% decrease compared to the previous quarter. The housing supply continues to improve, diversifying across regions, expanding from urban cores to satellite areas and secondary cities with abundant land and reasonable costs. The Northern region contributed 49% of the new housing supply in Q3/2025, a 4% decrease from the previous quarter but still leading nationwide. The Southern region contributed 27%, maintaining a positive growth trend.

The Southern region contributed 27% of the new housing supply in Q3/2025.

Ms. Phạm Thị Miền, Vice Director of VARS IRE, noted that the supply-demand mismatch persists, particularly in major cities like Hanoi and Ho Chi Minh City, where housing demand is high. Most new projects launched have prices exceeding 100 million VND/m².

Specifically, prices for villas, townhouses, and row houses range from 50 to 400 million VND/m², with most projects increasing prices by 5-10% compared to previous launches. Commercial apartment prices vary widely, averaging 78 million VND/m² for new projects, with over 30% priced above 100 million VND/m².

In Hanoi, the average primary apartment price reached 95 million VND/m², with over 43% of new supply priced above 120 million VND/m². In Ho Chi Minh City, the average primary price was 91 million VND/m².

Meanwhile, JLL Vietnam reported 739 successful transactions in Q3/2025, a sixfold increase from the first quarter. The landed housing segment saw 54 units sold, nearly double Q1/2025. Primary luxury apartment prices averaged 5,076 USD/m², down 0.6% from the previous quarter but up 1.6% year-on-year. Primary landed housing prices reached 16,842 USD/m², a 3% annual increase.

Ms. Trang Lê, CEO of JLL Vietnam, stated, “The price increases in both primary and secondary markets, despite being high, reflect strong buyer and investor confidence in the long-term profitability of Ho Chi Minh City’s residential real estate.”

Challenges for Genuine Buyers

Similarly, Ms. Phạm Ngọc Thiên Thanh, Director of Research and Consulting at CBRE Ho Chi Minh City, noted that after a prolonged slowdown, the low-rise real estate market in Ho Chi Minh City is gradually recovering.

Q3/2025 recorded over 170 successful transactions, a 100% increase from the previous quarter, primarily in the West, such as Bình Tân and Bình Chánh, where land availability and prices are more favorable. However, Ms. Thanh warned that high price levels and shrinking mid-range supply are making it difficult for genuine buyers.

After a prolonged slowdown, the low-rise real estate market in Ho Chi Minh City is gradually recovering.

According to Knight Frank’s report, in Q3/2025, primary apartment prices in Ho Chi Minh City averaged 3,752 USD/m², an 8.8% annual increase. Notably, this rise is due to 90% of existing projects maintaining stable prices to compete with new projects in neighboring areas.

Regarding supply, Q3/2025 saw 1,800 new apartments and 2,600 unsold units, totaling 4,400 primary units. New supply primarily came from luxury (57%) and mid-range (43%) segments. Thủ Đức accounted for 80% of new supply (The Privé, Elysian), followed by the West (Trellia Cove) and South (Khải Hoàn Prime). The North recorded no new projects in three years.

Market demand in Q3/2025 remained steady, with 2,200 units sold, a 49% absorption rate. New launches saw strong demand, with 1,650 units sold due to limited supply and extended payment plans. Around 500 unsold units were absorbed, partly due to limited prime locations and urgent payment requirements.

In Q4/2025, the market expects approximately 4,500 new units, mainly from existing projects. Demand for new launches remains stable, pushing primary prices to nearly 4,000 USD/m².

Hue Garment Sets 9-Month Profit Record, Yet Faces Hefty Penalty from Tax Authority

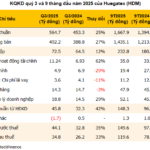

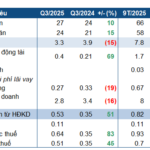

Fueled by rising yarn prices and lower input costs, Hue Textile Joint Stock Company (Huegatex, UPCoM: HDM) reported a net profit of VND 120 billion in the first nine months of 2025, surpassing its full-year 2024 profit of VND 109 billion. However, during the same period, the company was fined and required to pay nearly VND 1 billion in back taxes by the Hue Tax Department.

“Sky-High Prices, Sold-Out Properties: A Real Estate Market Recovery or Looming Risk?”

The influx of “cheap” capital and the prevailing mindset of asset accumulation are reigniting the real estate market, with absorption rates soaring to 77% in Q3/2025. Yet, beneath the vibrant transaction landscape lie concerns over persistently high price levels, supply-demand imbalances, and the escalating risks of real estate credit if timely regulatory measures fail to materialize.

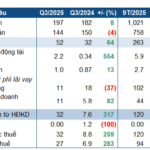

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.