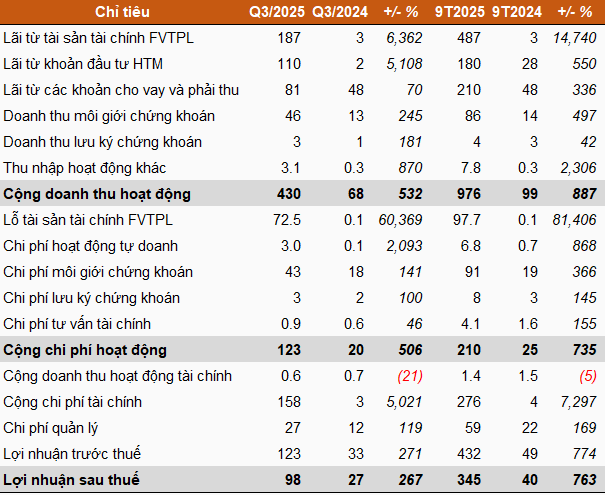

During the period, LPBS recorded a profit of nearly VND 187 billion from financial assets measured at fair value through profit or loss (FVTPL), a 65-fold increase year-over-year. This included a gain of nearly VND 124 billion from asset sales, primarily listed stocks and bonds, along with a revaluation surplus of over VND 63 billion. After deducting FVTPL financial asset losses and proprietary trading expenses, the company’s net profit reached over VND 115 billion, a 42-fold increase year-over-year.

Beyond proprietary trading, lending activities significantly contributed to Q3’s positive results, generating revenue of over VND 81 billion, a 70% increase.

Another key segment, brokerage services, saw operational growth with revenue exceeding VND 46 billion and expenses nearing VND 43 billion, up 3.4 times and 2.4 times year-over-year, respectively. However, the profit of nearly VND 4 billion did not significantly differ from the previous year’s loss of over VND 4 billion.

In contrast, financial activities incurred a loss of VND 157 billion, compared to a loss of just over VND 2 billion in the same period last year. This was primarily due to a substantial increase in debt scale to fund business operations, leading to higher interest expenses.

With Q3 results, LPBS raised its pre-tax profit for the first nine months to over VND 432 billion, an 8.7-fold increase year-over-year, achieving 86% of its annual target. Ultimately, the company’s net profit exceeded VND 345 billion, an 8.6-fold increase.

|

Q3 and 9M 2025 Business Results of LPBS

Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, LPBS’s total assets reached nearly VND 18.3 trillion, a 3.6-fold increase since the beginning of the year, setting a new record.

Key changes included FVTPL financial assets rising from over VND 612 billion to more than VND 6.4 trillion, driven by increased investments in listed stocks, bonds, and new deposit certificates. Held-to-maturity (HTM) investments grew from VND 270 billion to nearly VND 7.1 trillion, all in term deposits under one year. Outstanding loans increased from nearly VND 2.7 trillion to over VND 3.4 trillion, primarily margin lending.

On the funding side, the company borrowed nearly VND 13.7 trillion, a 25-fold increase year-over-year. It significantly raised debt with LPBank and Vietcombank, while also borrowing from Agribank, VietinBank, and ABBank. These loans, at interest rates of 3.4–7.5% annually, aimed to supplement working capital.

Operations were also funded by shareholder equity of nearly VND 3.9 trillion. This figure will rise to nearly VND 12.7 trillion in the upcoming Q4 financial report, a 3.3-fold increase, following the successful issuance of 878 million shares to existing shareholders on October 15.

At an offering price of VND 10,000 per share, LPBS raised nearly VND 8.8 trillion, allocating 60% to invest in bond market securities and deposit certificates, 30% to margin lending, and 10% to underwriting and other activities. Capital deployment is planned from 2025 to 2026.

– 20:00 20/10/2025

Vietcap Securities Doubles Q3 Net Profit on Strong Brokerage and Lending Performance

Vietcap Securities Corporation (HOSE: VCI) has released its Q3/2025 financial report, revealing a remarkable net profit of over 420 billion VND, doubling the figure from the same period last year. This impressive growth is primarily driven by robust brokerage and lending activities. Consequently, the company’s cumulative profit for the first nine months of the year has surged to nearly 900 billion VND, marking a 30% increase year-on-year.

MSH Shares Unsold: FPTS Fails to Offload 1.19 Million Stocks

From August 18 to September 16, 2025, FPTS refrained from selling any of the 1.19 million MSH shares it had previously registered, citing unfavorable market prices as the reason.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.