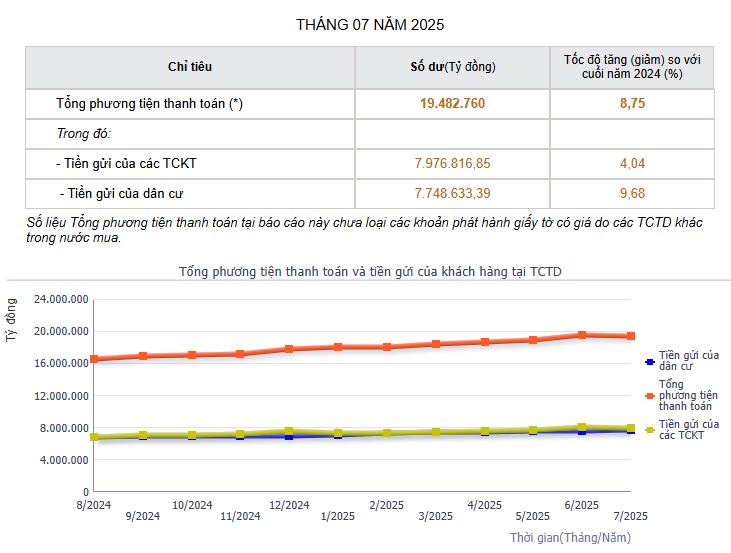

Source: State Bank of Vietnam (SBV)

|

In July alone, resident deposits surged by over VND 54 trillion.

Meanwhile, deposits from economic organizations reached VND 7,980 trillion, a decrease of approximately VND 128 trillion compared to the previous month, equivalent to a 1% decline. However, compared to the beginning of the year, deposits from this group still increased by more than 4%.

Thus, after the first seven months of 2025, the total deposits from individuals and economic organizations in the banking system exceeded VND 15,700 trillion.

According to a report by MBS, by the end of July, the average 12-month interest rate for private joint-stock commercial banks increased slightly by 2 basis points compared to the previous month, reaching 4.89% per annum, and decreased by 16 basis points compared to the beginning of the year. Meanwhile, the interest rate for state-owned commercial banks remained stable at 4.7% per annum.

The deposit interest rate remained stable despite accelerated credit growth, thanks to the system’s ample liquidity, supporting banks in maintaining low interest rates to promote economic growth.

At the Government Party Congress for the 2025-2030 term on October 13, Governor of the State Bank of Vietnam Nguyen Thi Hong stated that amidst rising international interest rates, the SBV has endeavored to maintain policy interest rates for an extended period, increasing them when necessary to stabilize the exchange rate, and then reducing and stabilizing them. To date, the lending interest rate has decreased by approximately 2% per annum compared to the end of 2022 as the economy began to recover.

The exchange rate and foreign exchange market remained fundamentally stable due to the synchronized combination of monetary regulation tools and solutions. The foreign exchange market operated smoothly, with legal foreign currency demands being fully and promptly met, especially for importing goods and raw materials to serve domestic production as the economy recovered and grew, particularly in the final year of the term.

When businesses and individuals faced difficulties, the banking system implemented a series of credit and interest rate policy solutions to provide support.

– 10:33 October 21, 2025

BIDV CEO: All Banks Aiming for Credit Growth

BIDV’s CEO, Mr. Le Ngoc Lam, asserts that Vietnam’s current interest rate landscape is highly competitive compared to regional and global standards. This favorable environment, coupled with the State Bank’s unrestricted credit limits, presents an opportune moment for businesses to ramp up their investments.

Stable Interest Rates Amidst Positive Market Developments

Market factors and interest rate management have consistently demonstrated positive signals, playing a pivotal role in maintaining the current interest rate stability.