As of the close of October 19th, major enterprises listed the buying price of SJC gold bars at 149.5 million VND per tael and the selling price at 151 million VND per tael, remaining stable compared to the morning.

Over the past two days, the price of gold bars has decreased by approximately 2 million VND.

Similarly, the buying and selling prices of 99.99% gold rings and jewelry remained stable at around 148 – 150.3 million VND per tael.

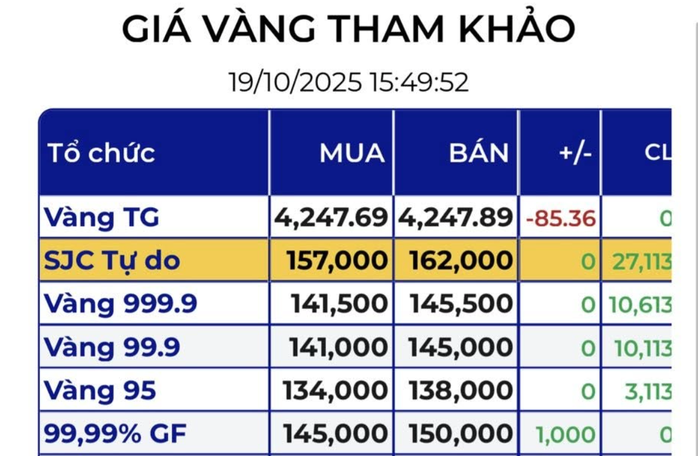

However, an unexpected development occurred in the free market, where gold prices continued to plummet. Currently, some small gold shops list the buying price of SJC gold bars at 157 million VND per tael and the selling price at 162 million VND per tael, a further decrease of 4 million VND per tael compared to yesterday.

In just two days, small shops have lowered the price of SJC gold bars by a total of 15 million VND and widened the buying-selling price gap to up to 5 million VND per tael.

According to reports from *Báo Người Lao Động*, many people purchased gold on online marketplaces at around 177 million VND per tael for SJC gold bars and approximately 165 million VND per tael for 99.99% plain gold rings over the weekend. If sold at this time, each tael of gold would result in a significant loss.

Domestic gold prices have plummeted due to the influence of global prices and market expectations of the State Bank’s recent measures to cool down gold prices – most notably, the study of a pilot gold trading platform in Vietnam.

In the international market, gold prices closed the week at $4,252 per ounce – equivalent to approximately 135 million VND per tael.

SJC gold bar prices in the free market have dropped by millions of dong, while prices of 99.99% plain gold rings vary significantly between gold shops, with each shop setting its own price.

Regarding gold market management, in the latest document, the State Bank’s Zone 2 branch has requested relevant authorities such as the Ho Chi Minh City Inspectorate, Ho Chi Minh City Police, and Ho Chi Minh City Tax Department to strengthen inspection and examination according to their management functions in this area to ensure market discipline and order, especially during times of market volatility and potential risks associated with speculation, price manipulation, and profiteering.

According to the State Bank’s Zone 2 branch, the main reason for the surge in gold prices stems from the continuous rise in global gold prices; the psychological expectation of further gold price increases in a context of low interest rates and limited gold supply… leading people to rush into buying gold. At the same time, it cannot be ruled out that some enterprises and individuals may take advantage of market fluctuations to speculate and manipulate prices, resulting in abnormal fluctuations…

Why Don’t Vietcombank and Techcombank Produce Their Own Gold Bars? The Case for Outsourcing Production

Gold prices surge as SJC gold bars hit VND 153 million, prompting Vietcombank and Techcombank to seek gold bar manufacturing partnerships.