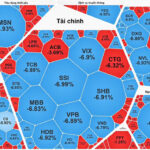

Vietnam’s stock market has experienced turbulent trading sessions, with red dominating the board. Selling pressure spread from large-cap stocks to other sectors, causing the VN-Index to plunge.

The VN-Index closed the October 20 session at 1,636.43 points, a staggering loss of nearly 95 points, marking a record decline in absolute terms. The 5.47% drop in the VN-Index resulted in a market capitalization evaporation of over 410 trillion VND on the HoSE, leaving it at 7.1 quadrillion VND.

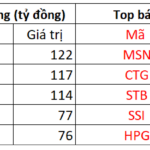

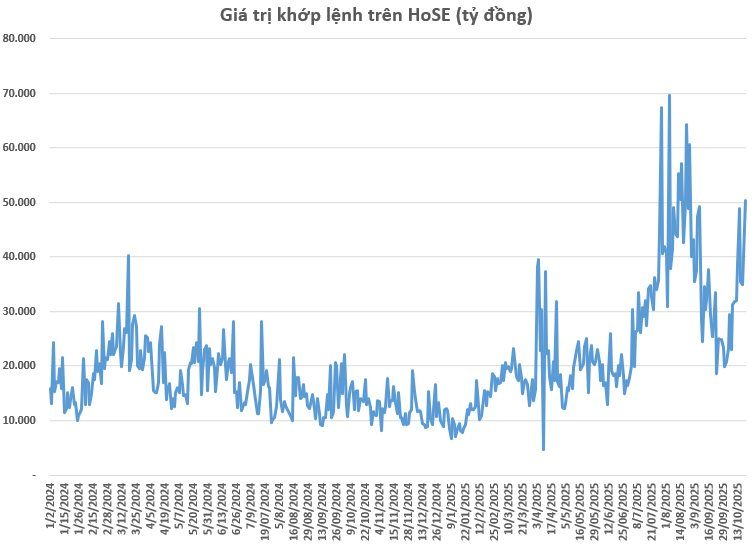

Amid this backdrop, trading volume surged dramatically, with order-matching value on the HoSE reaching nearly 50.3 trillion VND (~1.9 billion USD), a 26% increase from the previous session and the highest in two months.

The VN-Index has plummeted by a total of 130 points from its peak over two consecutive sessions, erasing nearly all gains made in the past month. This has fostered a cautious sentiment among individual investors.

However, from a long-term perspective, the situation is not as dire as market sentiment suggests. The stock market had experienced a significant uptrend prior to this, making a healthy correction entirely normal within an upward cycle.

In any market wave, prices never rise in a straight line; there are always pauses to reassess the strength of capital flows. Strong fluctuations often serve as a “cleansing” mechanism, filtering out weak speculative positions, balancing supply and demand, and reducing short-term profit-taking pressure.

Such adjustments pave the way for a more sustainable price foundation, setting the stage for new accumulation and subsequent growth. Historically, after significant but macro-unchanging fluctuations, markets tend to stabilize and find new equilibrium.

Corrections Present Long-Term Stock Accumulation Opportunities

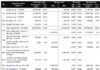

SSI Research’s recent strategic report suggests that a strong correction in the near future could offer long-term stock accumulation opportunities.

This outlook is supported by: (1) expectations of double-digit GDP growth over the next 5–10 years, driven by comprehensive institutional reforms and private sector development, (2) robust profit growth prospects of over 14% annually in 2025–2026, (3) market upgrade potential attracting international capital, and (4) supportive monetary policies maintaining a favorable interest rate environment for the stock market.

Regarding market upgrades, experts believe Vietnam’s equity market will increasingly attract foreign capital. Petri Deryng, head of the billion-dollar Pyn Elite Fund, notes that FTSE Russell’s decision will draw more institutional investors to Vietnam’s stock market and potentially boost retail investor optimism. FTSE-tracking funds will adjust by increasing Vietnamese stock allocations in 2026.

“FTSE’s decision is a significant milestone for Vietnam, reflecting the government’s recent efforts to achieve upgrades. We believe MSCI will also elevate Vietnam to emerging market status in the coming years. Additionally, achieving an investment-grade rating for government bonds will be crucial for financing major public projects,” Deryng emphasized.

Pyn Elite Fund is renowned for its optimism about Vietnam’s stock market. In mid-July, when the VN-Index was around 1,500, Deryng predicted it could reach 1,800 by year-end. Historically, he has forecast the VN-Index hitting 2,500 points long-term.

Market Plunge: Stocks Tumble Nearly 95 Points, Leaving Investors Stunned

The stock market plummeted dramatically in the final minutes of the session, marking the steepest decline in history, with 150 stocks hitting their lower limit.