Technical Signals of VN-Index

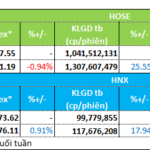

During the morning trading session on October 20, 2025, the VN-Index experienced a significant adjustment, testing the support zone of 1,700-1,711 points.

The Middle line of the Bollinger Bands is trending upward, approaching the 1,700-1,711 point range, indicating a high likelihood of holding firm.

However, investors should monitor the MACD indicator, as the gap between the MACD and signal lines is narrowing rapidly.

Technical Signals of HNX-Index

In the morning session on October 20, 2025, the HNX-Index saw a slight rebound, continuing its short-term sideways movement.

Trading volume consistently exceeds the 20-day average, and the MACD indicator has generated a buy signal, improving the short-term outlook.

DDV – DAP – VINACHEM Corporation

In the morning session on October 20, 2025, DDV shares continued to rise, forming a Three White Soldiers candlestick pattern. Trading volume is projected to surpass the 20-day average, indicating active investor participation.

Additionally, the MACD indicator is forming higher highs and higher lows, while DDV share prices have surpassed the August 2025 peak (34,100-35,500 range). If positive technical signals persist and prices remain above this range, the medium-term uptrend will be further reinforced.

NTL – Tu Liem Urban Development Corporation

During the morning session on October 20, 2025, NTL shares extended their rally for the third consecutive session, accompanied by above-average 20-day trading volume, reflecting investor optimism.

The share price remains close to the Upper Band of the Bollinger Bands, while the MACD indicator continues to rise, crossing above the zero line after generating a buy signal. This suggests that the recovery prospects remain intact.

The August 2025 peak (22,000-22,500 range) will serve as a potential short-term resistance level for NTL. A breakout above this range would further solidify the medium-term uptrend.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:03 October 20, 2025

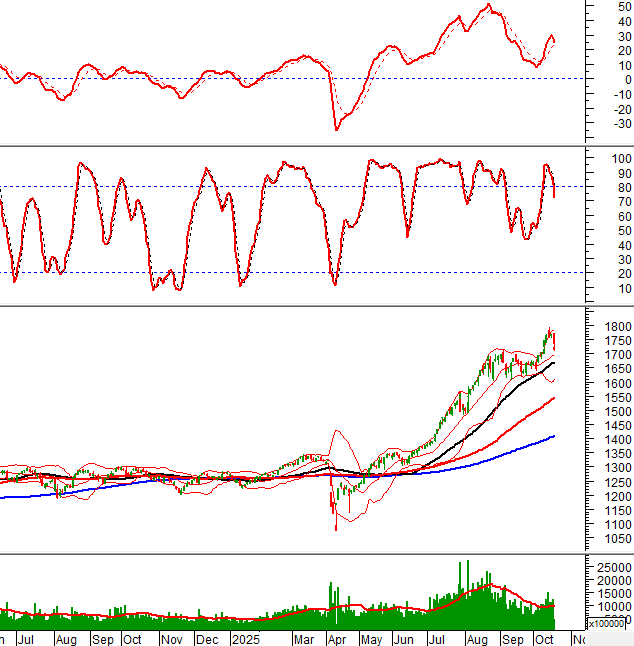

Stock Market Outlook for the Week of October 19: Investors’ Joy Over Upgrade Short-Lived as New Concerns Emerge

The VN-Index’s sharp decline at the end of the week erased all weekly gains, chipping away at investors’ portfolios.

Insider Selling Surge: Executives’ Relatives Offload Shares in Corporate Rush

Mr. Tran Ngoc Dan’s brother-in-law, Chairman of the Board of Directors at City Auto Joint Stock Company, sold 217,145 shares of CTF. Ms. Huynh Hoang Hoai Han, Acting Chief Accountant at Chuong Duong Joint Stock Company, sold 218,000 shares of CDC, reducing her ownership to 0% of the company’s charter capital.

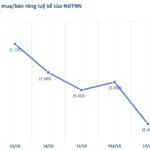

Foreign Blockades Unleash Massive Sell-Off: VN-Index Correction Sparks 5.2 Trillion VND Sell-Off – Which Stocks Are in the Crosshairs?

Foreign investors continued their net selling pressure, offloading thousands of billions worth of assets in each session. The sole exception was Thursday, October 16th, when foreign investors unexpectedly turned net buyers.