|

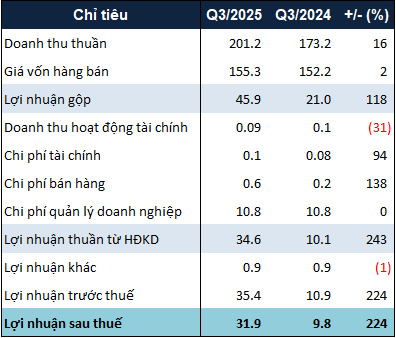

TrieuAn’s Q3/2025 Business Results. Unit: Billion VND

Source: Q3/2025 Financial Report

|

The primary driver behind the profit growth was a 16% increase in net revenue, reaching over 201 billion VND, while the cost of goods sold rose only slightly by 2%. As a result, TrieuAn’s gross profit nearly doubled to 46 billion VND, 2.2 times higher than the same period last year.

Regarding expenses, financial costs and selling expenses surged by 94% and 2.4 times, respectively, but accounted for a small portion of total expenses. The largest expense, management costs, remained stable at nearly 11 billion VND.

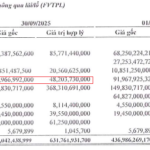

On the balance sheet, TrieuAn’s total assets as of September 30, 2025, surpassed 1 trillion VND, a 5% increase from the end of June. The most significant growth was in short-term receivables, which rose by 42% to over 202 billion VND, primarily due to a surge in short-term prepayments to Amec Holdings from nearly 32 billion VND to over 74 billion VND.

The value of long-term work-in-progress assets for the TA eco-tourism and resort project plummeted from over 2.6 billion VND to 244 million VND in just three months.

Meanwhile, TrieuAn’s total liabilities increased by 6% to nearly 356 billion VND. Notably, the outstanding loan from Ho Chi Minh City State Financial Investment Company (HFIC) skyrocketed from nearly 8 billion VND to over 44 billion VND, a 5.6-fold increase, due to a new long-term loan of over 38 billion VND in Q3.

– 09:43 21/10/2025

KienlongBank Surges Ahead with Strategic Milestones, Shattering 30-Year Profit Records and Leading Market Momentum

KienlongBank (Kien Long Commercial Joint Stock Bank; UPCoM: KLB) has recently unveiled its Q3 2025 business results, reporting a consolidated pre-tax profit of VND 616 billion. Key performance indicators, including total assets, mobilized capital, and outstanding loans, have all surged significantly, nearing annual targets. This impressive growth underscores the bank’s robust management capabilities and clear strategic direction.

National Securities Eyes 10 Million More SAM Shares Despite Nearly 50% Paper Loss

Amidst a 15% decline in SAM shares over the past month, National Securities Corporation (NSI) plans to invest over 70 billion VND to acquire an additional 10 million shares of SAM Holdings (HOSE: SAM), increasing its ownership stake to 4.31%. As of the end of September 2025, this investment in SAM is currently reflecting a loss of nearly half its value.

Vietnam’s Largest Auto Distributor Reports Q3 Profit Surging 59x Year-on-Year, Stock Hits Daily Limit Up

In the first nine months of the year, the company achieved a remarkable net revenue of 20,547 billion VND, marking a 27% increase compared to the same period in 2024. The parent company’s post-tax profit soared to 450 billion VND, an astounding 8.7-fold growth year-over-year.