|

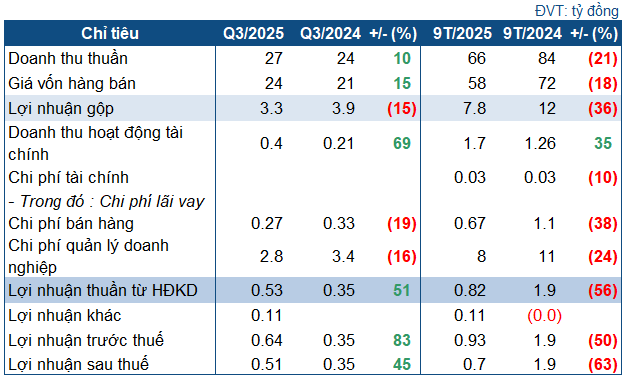

UPH’s Q3/2025 Business Targets

Source: VietstockFinance

|

Specifically, UPH’s Q3 net revenue reached VND 27 billion, a 10% increase year-over-year. However, the cost of goods sold rose by 15%, eroding gross profit by 15% to approximately VND 3.3 billion.

On the brighter side, operating expenses were better managed. Selling expenses decreased by 19% to VND 270 million, and administrative expenses dropped by 16% to VND 2.8 billion. Financial revenue also saw a significant improvement, surging by 69% to VND 352 million.

Additionally, UPH recorded other profits of over VND 109 million (none recorded in the same period last year) due to data adjustments with the Ho Chi Minh City Tax Department. Ultimately, the company’s post-tax profit reached VND 509 million, 45% higher than the same period last year.

Nevertheless, the cumulative results for the first nine months of the year were less promising. UPH’s net revenue stood at VND 66 billion, a 21% decline year-over-year, with post-tax profit at a mere VND 687 million, down sharply by 63%. With these figures, the company has only achieved 46% of its revenue target and 33% of its pre-tax profit goal set by the 2025 Annual General Meeting.

As of the end of Q3, UPH’s total assets amounted to VND 373 billion, a slight 3.6% decrease from the beginning of the year. Cash and cash equivalents stood at nearly VND 66 billion, also slightly reduced.

Inventory remained relatively stable at VND 197 billion, accounting for 53% of total assets. Construction in progress increased slightly to VND 23 billion, primarily for the Tan Phu Trung Industrial Park project.

On the liabilities side, total debt decreased by 6% to VND 217 billion, mostly short-term. Notably, the company maintains a debt-free financial structure. Short-term customer advances remained high at approximately VND 184 billion (85% of short-term debt), largely from Tay Ninh Industrial Infrastructure Development JSC and An Phat Investment Trading Business JSC. The company still carries accumulated losses of nearly VND 7.2 billion.

– 14:58 20/10/2025

F88 Surges Ahead in Q3, Achieving 90% of 2025 Annual Profit Target

On October 20th, F88 Investment Joint Stock Company announced its remarkable Q3-2025 business results, boasting a pre-tax profit of VND 282 billion, doubling the figure from the same period last year.

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.

F88 Surges Ahead in Q3, Achieving 90% of 2025 Annual Profit Target

F88 Investment Corporation (F88) has unveiled remarkable Q3/2025 financial results, reporting pre-tax profits of VND 282 billion, doubling the figure from the same period last year. In the first nine months of 2025, F88’s cumulative profit reached VND 603 billion, a 2.5-fold increase year-on-year.