Amidst Vietnam’s financial sector undergoing a robust restructuring phase, marked by digitization pressures, cost-cutting, and efficiency enhancement, EVF has released its Q3 2025 financial report. Notably, the Cost-to-Income Ratio (CIR) stands at an impressive 9.85%, a rarity in the industry.

The Financial Sector Embraces the Efficiency Game

In an increasingly competitive financial market, institutions face a triple threat: rising capital costs, operational expenses, and mounting bad debt pressures. Efficiency optimization is no longer optional—it’s imperative for survival.

Major banks are accelerating automation, AI, and big data integration. For finance companies, where operations are often more complex and costly, digital transformation is a tougher challenge. EVF, though not a market leader, is charting a distinct path forward.

CIR: A Small Metric with Big Implications

The Cost-to-Income Ratio (CIR) is a critical indicator, especially in finance, where operational costs are a persistent challenge. A lower CIR means higher profit retention per unit of revenue. While many Vietnamese banks and finance companies maintain CIRs between 30–40%, EVF‘s 9.85% is a standout achievement.

Optimizing Systems, Not Just Cutting Costs

EVF has embraced comprehensive digitization across operations: credit assessment, disbursement, debt recovery, customer service, reporting, and internal management. Instead of expanding physical branches, EVF invests in customer data analytics, automated management systems, and paperless processes. This transformation is not about extreme cost-cutting but about redefining operational models.

Growth Fuels Efficiency

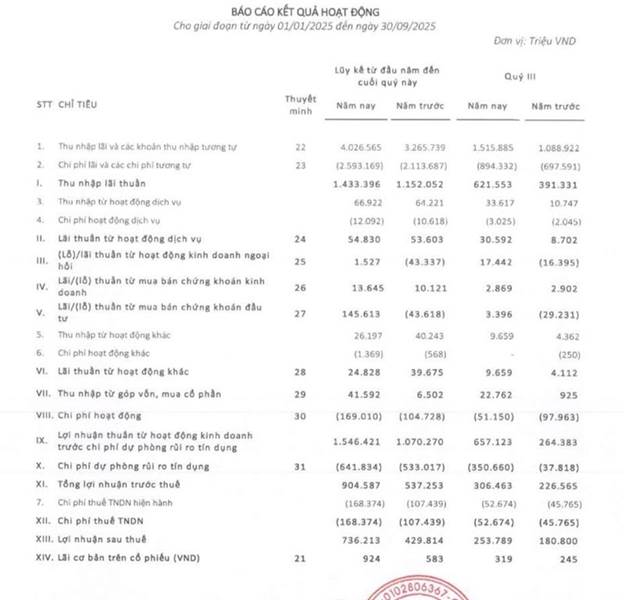

According to the Q3 2025 financial report, EVF‘s performance highlights:

In Q3/2025, EVF effectively managed operational costs, signaling positive momentum for the final stretch.

|

As of September 2025, EVF‘s credit balance reached VND 51,335 billion, a 9.73% increase from the start of 2025. Net interest income surged by 39% to VND 1,515 billion. The net interest margin (NIM) remained stable at 3.28%, outperforming many consumer finance companies.

Investment gains contributed significantly to pre-tax profits, with net securities investment income reaching VND 145.6 billion in 9M2025, compared to a loss of VND 43.6 billion in the same period last year. Equity investment income in Q3 2025 hit VND 41.59 billion, a sixfold increase from Q3 2024.

Total assets as of September 30, 2025, stood at VND 71,622 billion, a 20.2% increase (VND 12,023 billion) from the beginning of 2025. This growth was driven by increased customer loans (from VND 46,803 billion to VND 51,355 billion), interbank deposits and loans (from VND 4,892 billion to VND 10,168 billion), and trading/investment securities (from VND 2,616 billion to VND 3,754 billion), reflecting EVF‘s expanded operations and profitability.

Liabilities as of September 30, 2025, totaled VND 61,917 billion, a 22.4% increase (VND 11,326 billion) from the start of 2025. Notable increases include issued securities (from VND 18,556 billion to VND 28,047 billion, up 51%) and interbank deposits/loans (from VND 11,734 billion to VND 13,959 billion). Equity reached VND 9,705 billion, a 7.7% increase (VND 698 billion), primarily from retained earnings.

Setting a New Benchmark Quietly

EVF may not be the largest or most publicized finance company, but its sub-10% CIR, coupled with profit, credit, and asset growth, demonstrates a stable and efficient digital financial model. In an industry under pressure to redefine itself, EVF‘s approach offers a sustainable blueprint, especially in the fierce race for efficiency and technology.

Earlier, EVF rebranded by adding “Tổng hợp” to comply with the Law on Credit Institutions and adopted a new logo featuring its stock code “EVF,” replacing “EVNFinance.” In late September 2025, EVF relocated its headquarters to the 6th and 7th floors of Thaisquare Caliria, 11A Cát Linh, Ô Chợ Dừa Ward, Hanoi.

Services

– 16:33 20/10/2025

Deputy Prime Minister Assigns Five Key Tasks to the Financial and Banking Sector

On the evening of October 18, 2025, the grand opening ceremony of the Sóng Festival 2025: “One Touch – A Million Beliefs” took place at the Hanoi University of Science and Technology Stadium. This spectacular event was jointly organized by Tiền Phong Newspaper and the National Payment Corporation of Vietnam (NAPAS), under the content guidance of the State Bank of Vietnam.

Striving for an Average GDP Growth Rate of 10% Annually During 2026-2030

Prime Minister Pham Minh Chinh has signed and issued Directive No. 31, outlining the framework for the Socio-Economic Development Plan for the 2026-2030 period. The directive emphasizes that the key performance indicators of this five-year plan must be feasible, clear, aligned with current realities, and closely tied to the overarching 10-year strategy spanning 2021-2030.