Insights from South Korea and Taiwan’s ETF Market Development

At the conference titled “The Role of the Fund Industry in Stock Market Development and Attracting Indirect Investment Capital into Vietnam,” held on the morning of October 17th, representatives from foreign funds shared valuable insights to foster the growth of the fund industry, with a particular focus on ETFs.

Conference on “The Role of the Fund Industry in Stock Market Development and Attracting Indirect Investment Capital into Vietnam” held on October 17th, 2025

|

Mr. Huyn Dong Sik, Chairman of KIM Vietnam Asset Management, presented a discussion on South Korea’s ETF market and offered recommendations for Vietnam, emphasizing the importance of product diversification and the development of Gold ETFs.

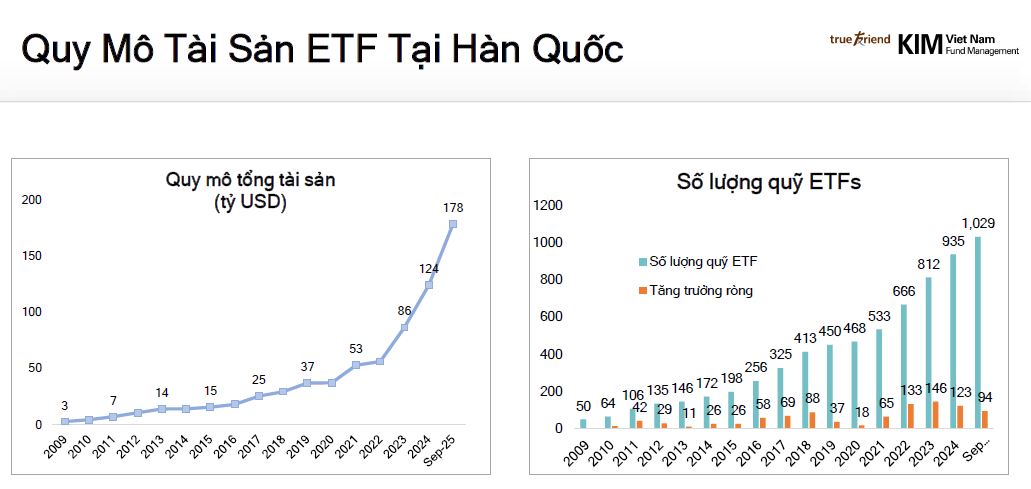

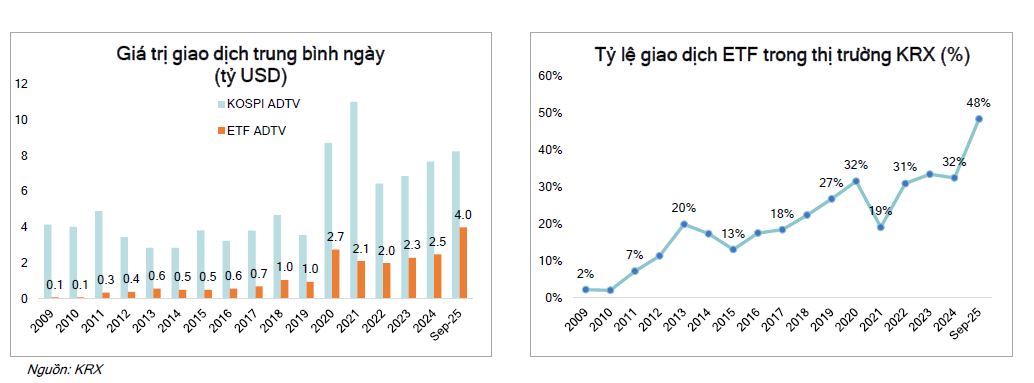

Regarding South Korea’s market, Mr. Huyn Dong Sik noted that it is currently one of the world’s top five ETF markets. South Korea’s ETF market began in 2002 with four ETFs valued at $250 million. Since 2010, the market has expanded significantly, introducing various ETFs investing in domestic equities, including leveraged ETFs, sector-specific ETFs, commodity ETFs, and international market ETFs.

As of September 2025, South Korea’s ETF market boasts a total Assets Under Management (AUM) of $180 billion, with over 1,000 ETF products.

ETF trading volumes account for 40% to 50% of the market’s total trading value. The investor base comprises over 50% individual and foreign investors (approximately 30% individual and 20% foreign). Participation from personal pension accounts, corporate retirement plans, and investment trust accounts has driven the growth of individual investors. Additionally, low costs and diverse ETF options have strongly attracted foreign investment capital.

|

|

|

According to South Korea’s experience, two key factors drive ETF market development.

First, streamlining the regulatory process. Continuous product growth is supported by regulatory bodies accelerating product development procedures.

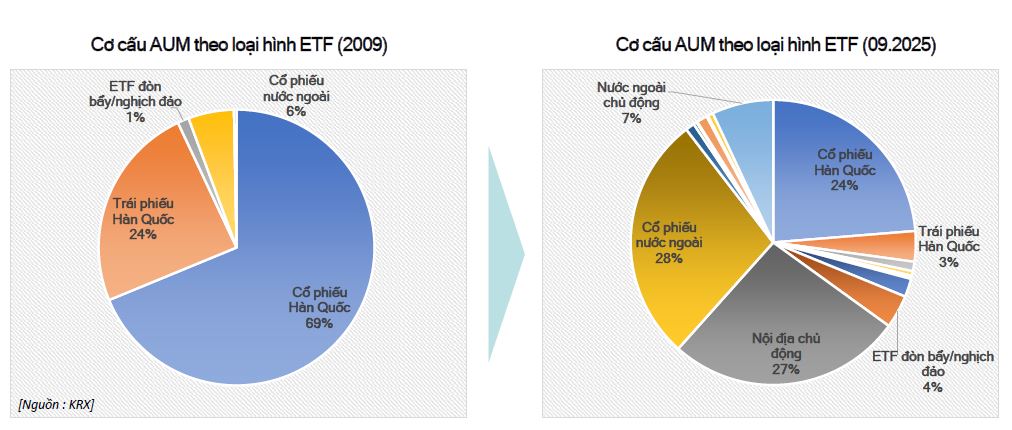

Second, product diversification and innovation. Diversification and the introduction of new products are other critical drivers. In 2009, the market had only three basic ETF types (domestic equities, domestic bonds, and foreign equities), but now offers 13 to 14 listed types.

At the conference, Mr. Albert Kwang-Chin Ting, Chairman of Phu Hung Fund Management (PHFM), presented on the theme “Vietnam’s Golden Opportunity.” His presentation focused on applying international experiences, particularly from Taiwan, to develop ETFs and the fund management industry in Vietnam.

Mr. Albert Kwang-Chin Ting emphasized that Vietnam is well-positioned to attract capital shifting from slower-growing economies in the region.

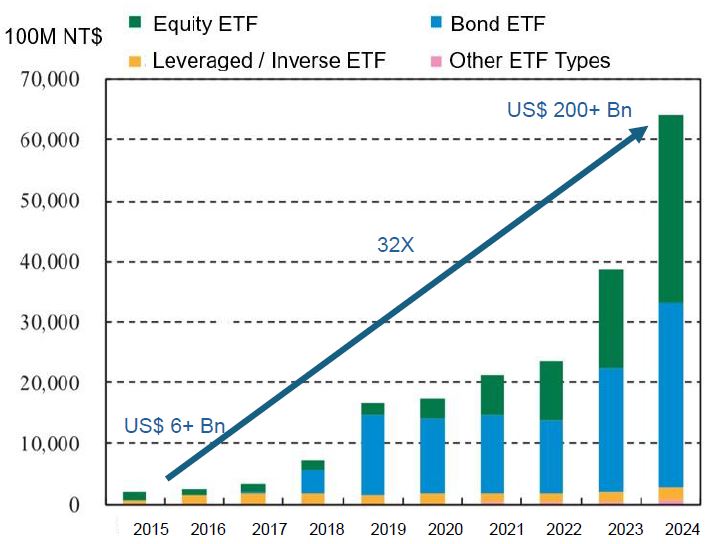

The PHFM leader highlighted ETFs’ role in increasing market capitalization and enhancing the fund management industry. In just a decade, the Taiwan Stock Exchange’s ETF AUM grew 32-fold, from $6 billion in 2015 to over $200 billion in 2024.

This growth also led to a 60-fold increase in investors, from 240,000 in 2015 to 14.3 million in 2024.

|

Taiwan’s ETF Market Scale

Source: PHFM

|

Taiwan’s success stems from policies facilitating ETF development.

To simplify index creation, the Taiwan Stock Exchange established a wholly-owned subsidiary, Taiwan Index Plus (TIP).

To expand the market, Taiwan broadened distribution channels. A key strategy for attracting individual investors is leveraging commercial banks. Commercial banks have a wider reach and better networks than securities or fund management companies. In Taiwan, trust laws allow bank customers to open securities/fund investment accounts and start investing on the same day at a branch.

The market is also boosted through linkages with the insurance sector. Life insurance companies use fund management expertise to offer complex policies directly linked to funds and ETFs, channeling capital into fund management.

Additionally, ETFs thrive among individual investors through education, particularly promoting fixed monthly investments (Systematic Investment Plans – SIPs). Investor education is crucial for enhancing financial literacy, enabling effective savings management decisions.

Physical Gold ETF Development Experience

At the conference, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, announced ongoing revisions to Circular 98 on fund operations. These changes aim to diversify fund types, including ETFs and bond funds, while tightening distribution channels and enhancing online fund certificate distribution transparency.

Regulators are also exploring a new fund type: Gold ETFs. Developing gold derivatives and ETFs will reduce physical gold demand, mitigating risks to the foreign exchange balance.

KIM representatives shared their experience in developing physical gold ETFs and expressed willingness to cooperate with Vietnam. KIM manages South Korea’s largest physical gold ETF, with an AUM of $1.5 billion.

As a late entrant, KIM overcame limitations of other gold ETFs (which trade futures) by focusing on physical gold, despite the complexity of managing this product.

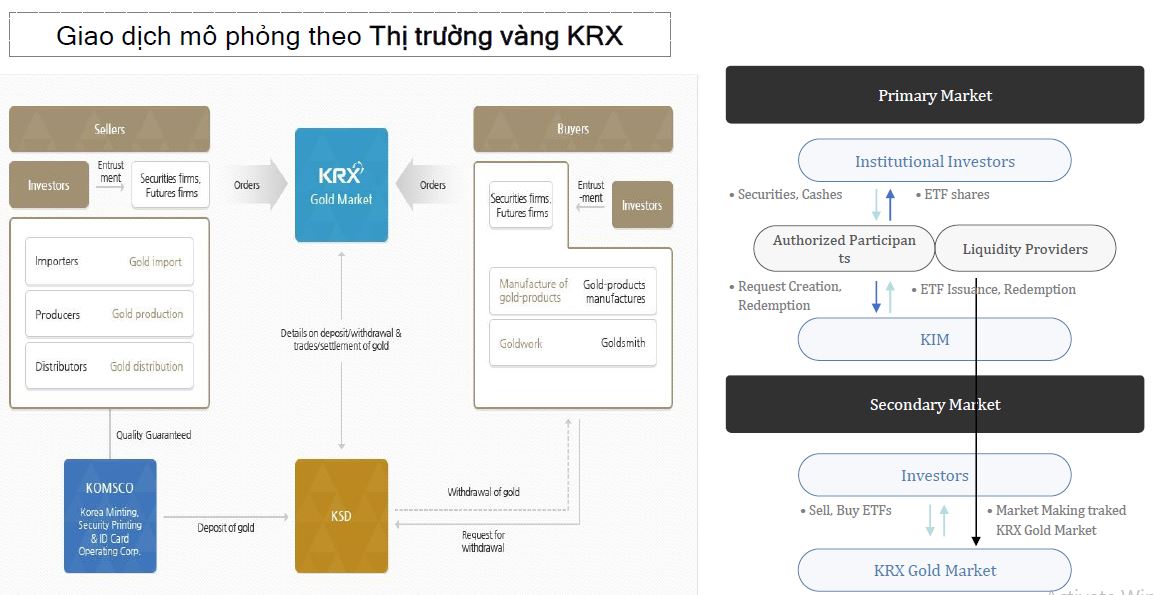

Mr. Huyn Dong Sik outlined essential infrastructure for launching gold ETFs.

Infrastructure requirements include a centralized physical gold trading market, a custodian for gold storage, and a quality assurance entity. In South Korea, the central bank’s mint ensures gold quality, backed by public trust.

KIM’s leadership suggested an entity like the Korea Securities Depository (KSD) to centralize information storage for efficient ETF issuance.

Source: KIM

|

Regarding benchmark indices, using global indices can address price premiums in closed domestic markets compared to international prices. Tracking global prices makes ETFs cheaper than domestic gold, encouraging investors to shift from domestic gold to ETFs.

– 10:31 21/10/2025

Vietnam’s Prime Minister: Economy Demonstrates Resilience Against External Shocks, Leading Global Growth

At the opening session of the 10th Meeting of the 15th National Assembly, Prime Minister Pham Minh Chinh highlighted eight remarkable achievements in the implementation of the Socio-Economic Development Plan for 2025 and the five-year period 2021–2025. Notably, Vietnam’s economy has demonstrated robust resilience against external shocks, sustaining one of the highest growth rates globally. The country’s economic scale has surged, climbing five positions to rank 32nd worldwide.

Inauguration of the 10th Session, 15th National Assembly

This morning, October 20th, the 10th Session of the 15th National Assembly officially commenced with a solemn ceremony at the National Assembly House in Hanoi, the capital city. The session is scheduled to span 40 consecutive working days.