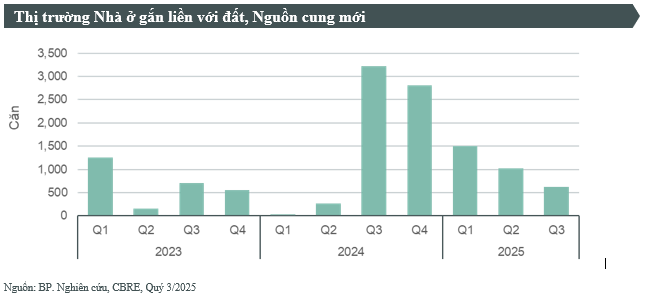

According to CBRE’s Q3 report on the landed property market, new supply reached over 620 units, a nearly 40% decrease compared to Q2 and over 80% compared to the same period in 2024. This modest launch is primarily due to the absence of significant supply from mega-urban projects as seen in previous quarters. Most of the launched projects are existing ones progressing to their next phases, while the majority of units in the quarter came from a new urban area project in Van Giang, bordering Hanoi.

Avison Young Vietnam’s report also indicates that in Q3/2025, the existing supply of villas and townhouses in Hanoi continued to appear mainly in the eastern and northeastern areas. These regions have ample land reserves, manageable development costs, and benefit significantly from ongoing infrastructure improvements. However, the number of new project launches remains limited due to complex legal procedures and rising investment costs, preventing a significant breakthrough in market volume.

Ms. Nguyen Hoai An, Senior Director of CBRE Hanoi, stated that most of the new supply in the quarter was concentrated in projects located far from the city center, leading to an average primary market price of approximately VND 186 million per square meter of land (excluding VAT, KPBT, and discounts), 19% lower than the previous quarter and 21% lower than the same period last year. Meanwhile, secondary market prices for landed properties continued their upward trend from previous quarters, reaching VND 198 million per square meter of land, a 4% increase from the previous quarter.

Total transaction volume in the landed property market during Q3/2025 reached nearly 640 units, surpassing the new supply in the same period. This demonstrates the persistent real demand for land and housing products among buyers.

Avison Young Vietnam also believes that demand remains stable, primarily from middle- to upper-class buyers with genuine housing needs and long-term investors. Hanoi’s push for key infrastructure projects, especially the planned construction of the Nam Thang Long – Tran Hung Dao and Van Cao – Hoa Lac metro lines by the end of 2025, enhances the appeal of suburban areas. As a result, demand persists, particularly in well-planned urban areas with transparent legal frameworks and long-term price appreciation potential.

For Q4/2025, Ms. Nguyen Hoai An forecasts that Hanoi’s landed property market may see an increase in supply, with new launches expected to exceed 1,000 units. Several projects have already begun reservation activities, signaling more vibrant sales in the final quarter.

The total supply of landed properties in Hanoi for 2025 is projected to surpass 4,400 units, second only to the record-high supply years of 2022 and 2024, driven by mega-urban project launches.

Up-Close Look at Two Residential Land Plots Allocated by Hanoi to Hacinco for Social Housing Development

Hanoi has recently allocated two prime plots of land adjacent to the Ring Road 3 to Hacinco (Hanoi Construction Investment Company No. 2) for the development of a social housing project in the new urban area of Dai Kim (Dinh Cong Ward). This move comes in response to the growing shortage of affordable housing options in the city.

Industrial Real Estate Firm Reports 70% Drop in Q3/2025 Profits, Stock Plummets to Daily Limit

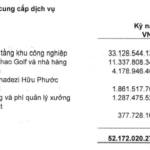

The primary cause stems from the company’s core revenue pillar—industrial zone infrastructure leasing—plummeting by 76%, now standing at a mere 33 billion.

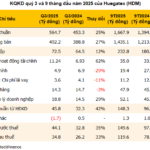

Hue Garment Sets 9-Month Profit Record, Yet Faces Hefty Penalty from Tax Authority

Fueled by rising yarn prices and lower input costs, Hue Textile Joint Stock Company (Huegatex, UPCoM: HDM) reported a net profit of VND 120 billion in the first nine months of 2025, surpassing its full-year 2024 profit of VND 109 billion. However, during the same period, the company was fined and required to pay nearly VND 1 billion in back taxes by the Hue Tax Department.