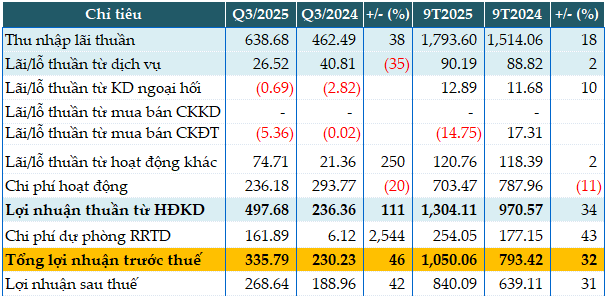

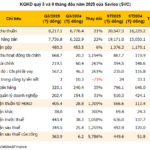

In Q3/2025, VietABank recorded a net interest income of nearly VND 639 billion, a 38% increase year-on-year. Notably, other operating activities yielded a profit of approximately VND 75 billion, 3.6 times higher than the same period last year.

Conversely, some business segments experienced declines, such as a 35% drop in service income and losses in foreign exchange and securities investment trading.

However, the bank reduced its operating expenses by 20% to just over VND 236 billion this quarter. As a result, net profit from business operations surged 2.1 times year-on-year, reaching nearly VND 498 billion.

During this period, VietABank set aside VND 162 billion for credit risk provisions, compared to only VND 6 billion in the same quarter last year. The bank attributed this increase to the growth in outstanding loans. Despite this, VietABank still reported a pre-tax profit of nearly VND 336 billion, up 46%.

For the first nine months of the year, VietABank achieved a pre-tax profit of over VND 1,050 billion, a 32% increase year-on-year.

Compared to the 2025 target of VND 1,306 billion in pre-tax profit, the bank has accomplished nearly 80% of its goal by the end of Q3.

|

VAB’s Q3 and 9-month 2025 business results. Unit: Billion VND

Source: VietstockFinance

|

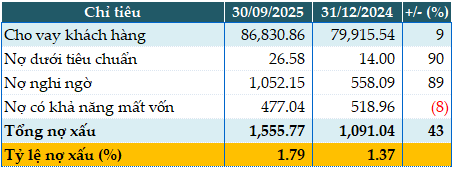

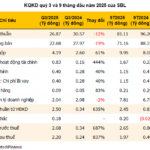

As of the end of Q3, VietABank’s total assets grew by 12% from the beginning of the year to VND 134,613 billion. Customer loans and deposits both increased by 9% to VND 86,830 billion and VND 97,984 billion, respectively.

Total non-performing loans as of September 30, 2025, rose by 43% from the start of the year to VND 1,556 billion. Consequently, the non-performing loan ratio increased from 1.37% at the beginning of the year to 1.79%.

|

VAB’s loan quality as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

In other developments, on October 17, 2025, the State Bank of Vietnam approved VietABank’s plan to increase its charter capital by up to VND 3,332 billion. This includes VND 200 billion through an Employee Stock Ownership Plan (ESOP) and VND 3,132 billion via a rights issue to existing shareholders. As a result, VietABank’s charter capital will rise from VND 8,164 billion to VND 11,496 billion.

– 13:43 20/10/2025

Q3 2025 Financial Report Update (October 20th): First Textile Firm Announces 35% Profit Surge, Real Estate Company Reports 65% Profit Decline

Seoul Metal reported a Q3 pre-tax profit of VND 24 billion, a 120% increase, while its 9-month figure reached VND 60 billion, up 74% year-on-year. In contrast, Sasco (SAS) posted a Q3 pre-tax profit of VND 133 billion, reflecting a 38% decline compared to the same period last year.

Record-Low Quarterly Profit for TDM as Financial Costs Surge Over 1,100%

Plummeting revenue, shrinking gross margins, and soaring financial expenses pushed Thu Dau Mot Water JSC (HOSE: TDM) into a quarter of record-low profits. However, a hefty dividend from Biwase, totaling hundreds of billions of dong, propelled TDM’s nine-month net profit up 36%, reaching nearly 200 billion dong.

Savico’s Q3 Profits Surge 5,800%, Stock Hits Consecutive Upper Limits

Savico (HOSE: SVC) reported record-breaking Q3/2025 profits, surpassing all previous years by a significant margin. This remarkable achievement was driven by a one-time financial gain of VND 537 billion from the divestment of a real estate project.